TC 20S Utah S Corporation Tax Return Forms & Publications 2023

Understanding the Utah TC20S Form

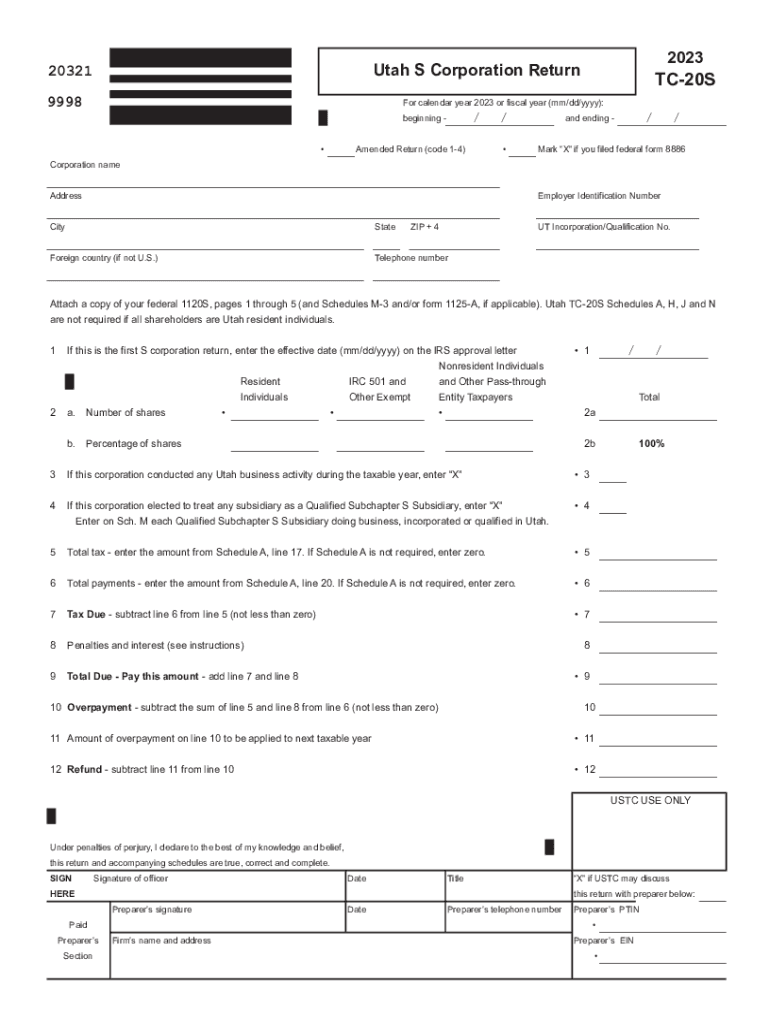

The Utah TC20S form is used for filing the S Corporation Tax Return in the state of Utah. This form is essential for S corporations to report their income, deductions, and credits to the Utah State Tax Commission. The TC20S form allows S corporations to pass their income through to shareholders, who then report it on their personal tax returns. This structure helps avoid double taxation, making it a popular choice for many businesses in Utah.

Steps to Complete the Utah TC20S Form

Filling out the Utah TC20S form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Begin with the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report the total income and deductions on the appropriate lines of the form.

- Calculate the tax liability based on the net income reported.

- Complete any additional schedules required, such as those for credits or special deductions.

- Review the form for accuracy before submission.

Required Documents for the Utah TC20S Form

When preparing to file the Utah TC20S form, it is important to have specific documents on hand:

- Financial statements, including balance sheets and income statements.

- Records of all income received and expenses incurred during the tax year.

- Previous year’s tax return for reference.

- Any relevant documentation for tax credits or deductions being claimed.

Filing Deadlines for the Utah TC20S Form

Understanding the filing deadlines is crucial to avoid penalties. The Utah TC20S form is typically due on the fifteenth day of the fourth month following the end of the tax year. For most corporations operating on a calendar year, this means the form must be filed by April 15. Extensions may be available, but it is important to file the extension request on time to avoid late fees.

Form Submission Methods for the Utah TC20S

The Utah TC20S form can be submitted in several ways to accommodate different preferences:

- Online submission through the Utah State Tax Commission's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person delivery at designated tax office locations, if preferred.

Key Elements of the Utah TC20S Form

Several key elements are essential when completing the Utah TC20S form:

- Identification of the corporation, including name and EIN.

- Accurate reporting of total income and allowable deductions.

- Calculation of the tax owed based on net income.

- Details of any credits claimed that may reduce tax liability.

Legal Use of the Utah TC20S Form

The Utah TC20S form is legally required for S corporations operating in Utah. Proper completion and timely submission ensure compliance with state tax laws. Failure to file this form can result in penalties and interest on unpaid taxes. It is crucial for corporations to understand their obligations under Utah tax law to maintain good standing and avoid legal issues.

Quick guide on how to complete tc 20s utah s corporation tax return forms ampamp publications

Complete TC 20S Utah S Corporation Tax Return Forms & Publications effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle TC 20S Utah S Corporation Tax Return Forms & Publications on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign TC 20S Utah S Corporation Tax Return Forms & Publications with ease

- Find TC 20S Utah S Corporation Tax Return Forms & Publications and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign TC 20S Utah S Corporation Tax Return Forms & Publications and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 20s utah s corporation tax return forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the tc 20s utah s corporation tax return forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utah TC20S form and why is it important?

The Utah TC20S form is a crucial document for businesses operating in Utah, as it facilitates the reporting of vehicle sales tax. Understanding this form ensures compliance with state regulations and can signNowly affect your tax reporting. By utilizing the airSlate SignNow solution, you can efficiently manage and eSign your Utah TC20S forms to streamline your business processes.

-

How can I complete the Utah TC20S form with airSlate SignNow?

To complete the Utah TC20S form using airSlate SignNow, simply upload your form and use our user-friendly tools to fill it out. Our electronic signature features allow for quick and secure signing, ensuring that your document is ready for submission in no time. This simplifies the process and promotes efficiency in handling your tax documents.

-

Is there a cost associated with using airSlate SignNow for the Utah TC20S form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, including competitive options for handling the Utah TC20S form. We provide a cost-effective solution that enhances productivity while ensuring compliance. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Utah TC20S form?

airSlate SignNow offers a range of features including templates, electronic signatures, and document tracking specifically for the Utah TC20S form. These features make it easier to fill, sign, and manage your tax documents efficiently. Additionally, our platform allows for seamless collaboration among team members, enhancing overall workflow.

-

Can I integrate airSlate SignNow with other tools for handling the Utah TC20S form?

Absolutely! airSlate SignNow integrates with various software applications to enhance your experience when managing the Utah TC20S form. Whether you use CRM systems or document management tools, our platform can easily connect to streamline your processes. This integration minimizes errors and boosts productivity.

-

What benefits does airSlate SignNow provide for completing the Utah TC20S form?

Using airSlate SignNow for the Utah TC20S form offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our easy-to-use interface allows for quick navigation, while electronic signatures ensure your documents are legally binding. Adopting this solution promotes a smoother experience for your business transactions.

-

Is airSlate SignNow secure for handling the Utah TC20S form?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to safeguard your sensitive information while handling the Utah TC20S form. You can confidently manage your documents knowing they are protected against unauthorized access and data bsignNowes.

Get more for TC 20S Utah S Corporation Tax Return Forms & Publications

Find out other TC 20S Utah S Corporation Tax Return Forms & Publications

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA