TC 20S Utah S Corporation Tax Return Forms & Publications 2021

What is the TC 20S Utah S Corporation Tax Return?

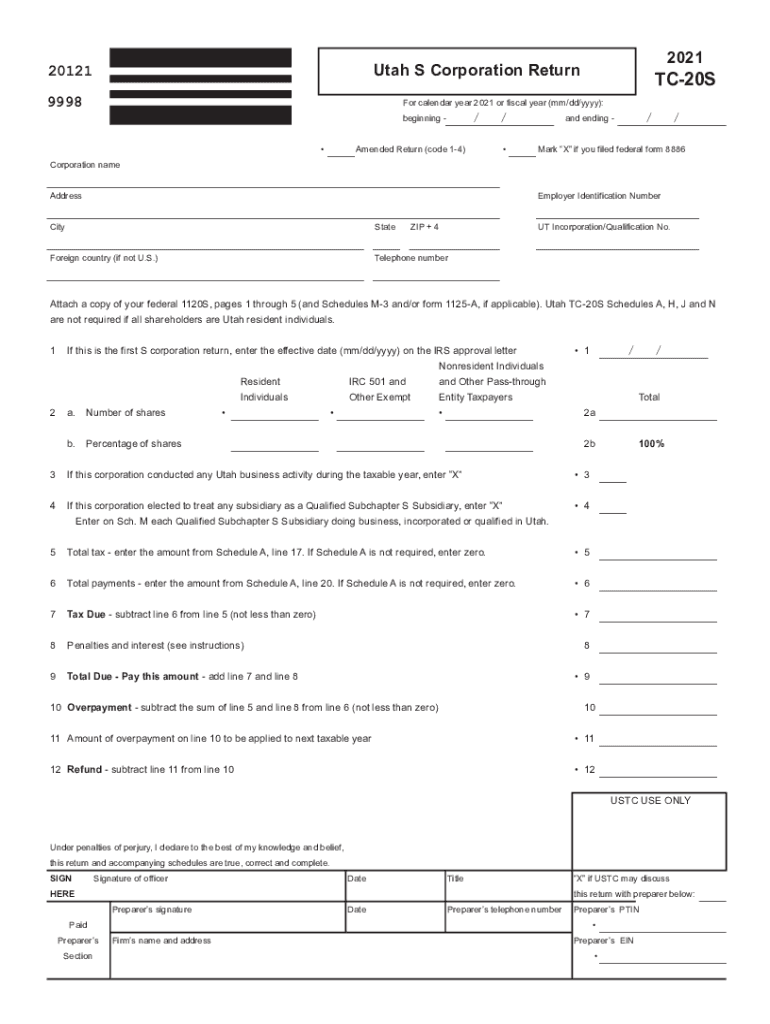

The TC 20S form is a tax return specifically designed for S corporations operating in Utah. This form allows S corporations to report their income, deductions, and credits to the state tax authority. Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. Understanding the TC 20S is essential for compliance with Utah tax regulations, ensuring that S corporations fulfill their obligations while taking advantage of available tax benefits.

Steps to Complete the TC 20S Form

Completing the TC 20S form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and prior tax returns. Next, fill out the form by providing information about the corporation's income, deductions, and credits. It is crucial to report all income accurately and to claim any deductions for which the corporation qualifies. After completing the form, review it thoroughly for errors before submission. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines for the TC 20S Form

The filing deadlines for the TC 20S form are typically aligned with federal tax deadlines. Generally, S corporations must file their TC 20S by the fifteenth day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties and interest on unpaid taxes.

Legal Use of the TC 20S Form

The TC 20S form must be filled out and submitted in accordance with Utah state law. This includes ensuring that all information provided is accurate and complete. The form serves as an official document for tax purposes, and any discrepancies can lead to audits or penalties. It is essential for S corporations to maintain proper records and documentation to support the information reported on the TC 20S, ensuring compliance with legal requirements.

Required Documents for the TC 20S Form

When preparing to file the TC 20S form, certain documents are required to support the information provided. These include financial statements, such as profit and loss statements and balance sheets, as well as any supporting documentation for deductions and credits claimed. Corporations should also have prior year tax returns available for reference. Having these documents organized and readily accessible can streamline the filing process and help ensure accuracy.

Examples of Using the TC 20S Form

The TC 20S form is utilized by various S corporations across different industries. For instance, a small business in the retail sector may use the form to report its sales revenue and operational expenses. Similarly, a consulting firm would report its income from client services and any applicable deductions. Each corporation's specific circumstances will dictate how the TC 20S is completed, making it a versatile tool for tax reporting within Utah.

Penalties for Non-Compliance with the TC 20S Form

Failure to file the TC 20S form on time or submitting inaccurate information can result in significant penalties. The Utah State Tax Commission may impose fines for late filings, which can accumulate over time. Additionally, inaccuracies can lead to audits, further complicating the corporation's tax situation. It is crucial for S corporations to understand their responsibilities regarding the TC 20S to avoid these potential penalties and ensure compliance with state tax laws.

Quick guide on how to complete 2021 tc 20s utah s corporation tax return forms ampamp publications

Effortlessly prepare TC 20S Utah S Corporation Tax Return Forms & Publications on any device

Online document management has gained popularity among businesses and individuals. It offers a seamless eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents promptly without delays. Handle TC 20S Utah S Corporation Tax Return Forms & Publications on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign TC 20S Utah S Corporation Tax Return Forms & Publications with ease

- Locate TC 20S Utah S Corporation Tax Return Forms & Publications and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign TC 20S Utah S Corporation Tax Return Forms & Publications while ensuring clear communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 tc 20s utah s corporation tax return forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the 2021 tc 20s utah s corporation tax return forms ampamp publications

The best way to make an e-signature for your PDF online

The best way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What are utah tc 20s and how do they work with airSlate SignNow?

Utah tc 20s are specific document templates used in various industries, including real estate and legal. With airSlate SignNow, you can easily edit, send, and eSign these documents, ensuring a seamless workflow. Utilizing utah tc 20s in your business processes helps improve efficiency and document accuracy.

-

How does airSlate SignNow support utah tc 20s in terms of compliance?

airSlate SignNow prioritizes compliance, especially with documents like utah tc 20s, which often require strict adherence to regulations. Our platform offers audit trails, encryption, and secure storage to ensure your documents meet legal requirements. This makes it easier for your business to stay compliant while managing utah tc 20s.

-

What features make airSlate SignNow ideal for utilizing utah tc 20s?

airSlate SignNow provides a range of features tailored for utah tc 20s, such as customizable templates, easy eSignature integrations, and mobile access. These tools enhance collaboration among team members and clients, streamlining the document management process. With airSlate SignNow, handling utah tc 20s becomes more efficient and user-friendly.

-

Is airSlate SignNow cost-effective for businesses using utah tc 20s?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents, including utah tc 20s. Our competitive pricing plans ensure that businesses of all sizes can access powerful features without breaking the bank. Investing in airSlate SignNow can lead to signNow savings in time and resources over traditional document handling methods.

-

Can I integrate airSlate SignNow with other tools while working with utah tc 20s?

Absolutely! airSlate SignNow offers various integrations with popular tools and platforms, making it easier to manage utah tc 20s alongside your existing workflows. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure a smooth experience when handling your documents.

-

What are the benefits of using airSlate SignNow for utah tc 20s?

Using airSlate SignNow for utah tc 20s offers several benefits, including faster turnaround times, enhanced document security, and improved collaboration. The platform simplifies the sending and signing process, which can lead to quicker deal closures. Moreover, the ability to track document status helps you stay organized and informed.

-

How can I customize my utah tc 20s with airSlate SignNow?

airSlate SignNow allows you to fully customize your utah tc 20s to fit your business needs. You can add fields, adjust text, and incorporate branding elements to ensure each document meets your standards. Customization options not only enhance the appearance of your documents but also improve user experience.

Get more for TC 20S Utah S Corporation Tax Return Forms & Publications

- Mississippi eminent domain 497314310 form

- Resolution authorizing filing of eminent domain action mississippi form

- Mississippi eminent domain 497314312 form

- Complaint mississippi 497314313 form

- Personnel policies manual town of pelahatchie mississippi form

- Employment agreement between sole proprietorship and an employee mississippi form

- Mississippi agreement 497314316 form

- Assignment and instruction to apply escrowed funds mississippi form

Find out other TC 20S Utah S Corporation Tax Return Forms & Publications

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word