Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank 2022

What is the 2022 KY DoR 62A500 Form?

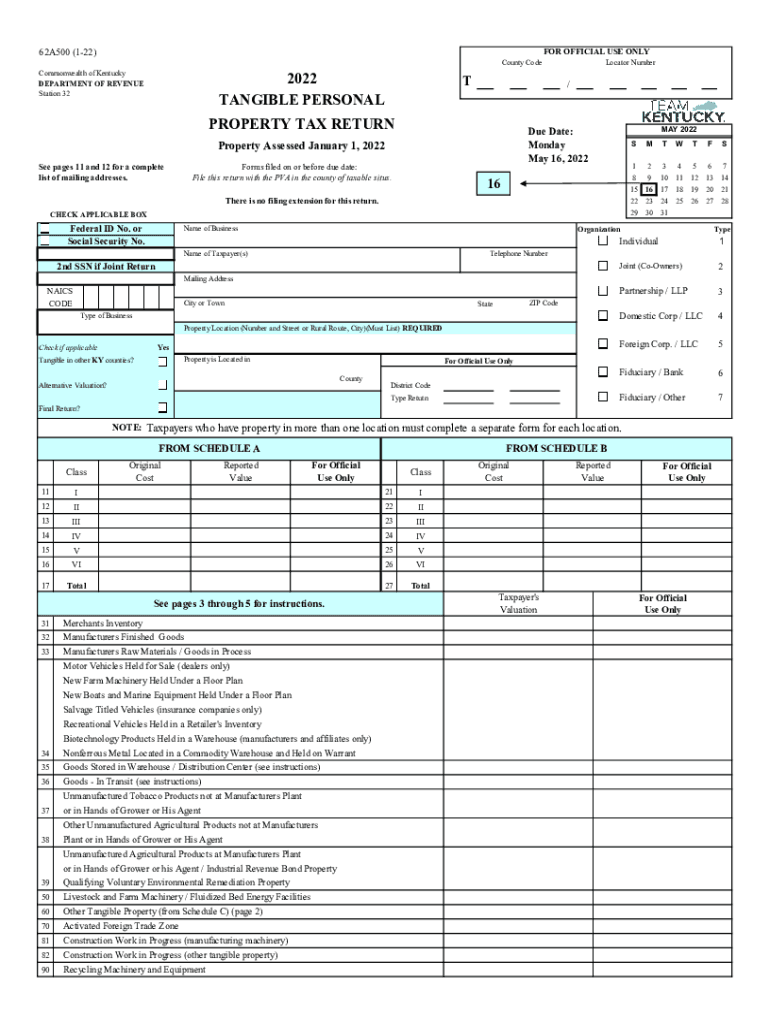

The 2022 KY DoR 62A500 form, commonly referred to as the Kentucky property tax return, is a crucial document for property owners in Kentucky. This form is used to report property values to the Kentucky Department of Revenue (DoR). It is essential for determining the property tax owed based on the assessed value of real estate properties. Proper completion of the 62A500 form ensures that property owners meet their tax obligations and helps maintain accurate records for state tax purposes.

Steps to Complete the 2022 KY DoR 62A500 Form

Completing the 2022 KY DoR 62A500 form involves several key steps that ensure accuracy and compliance. Here is a straightforward process:

- Gather necessary documents, including previous tax returns and property assessment notices.

- Access the 2022 KY DoR 62A500 form online or obtain a printable version.

- Fill in personal information, including your name, address, and property details.

- Provide the assessed value of your property as indicated by the local property valuation administrator.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the 2022 KY DoR 62A500 Form

The 2022 KY DoR 62A500 form is legally binding when completed and submitted correctly. It is essential for property owners to understand that the information provided must be truthful and accurate. Submitting false information can lead to penalties or legal repercussions. The form must be filed in accordance with state regulations to ensure compliance with Kentucky tax laws.

Filing Deadlines for the 2022 KY DoR 62A500 Form

Timely submission of the 2022 KY DoR 62A500 form is crucial to avoid penalties. The filing deadline typically aligns with the annual property tax cycle. Property owners should be aware of specific dates set by the Kentucky Department of Revenue, generally falling on April 15 for most property tax returns. It is advisable to check for any updates or changes to these deadlines annually.

Form Submission Methods for the 2022 KY DoR 62A500 Form

Property owners have several options for submitting the 2022 KY DoR 62A500 form. These methods include:

- Online submission through the Kentucky Department of Revenue’s website.

- Mailing a printed version of the form to the designated address.

- In-person submission at local revenue offices, which may provide assistance if needed.

Key Elements of the 2022 KY DoR 62A500 Form

Understanding the key elements of the 2022 KY DoR 62A500 form is vital for accurate completion. Important sections include:

- Property identification details, including parcel number and address.

- Owner information, such as name and contact details.

- Assessment information, including the total assessed value of the property.

- Signature line for the property owner, confirming the accuracy of the information provided.

Quick guide on how to complete 2022 form ky dor 62a500 p fill online printable fillable blank

Prepare Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank effortlessly on any device

Digital document management has become trendy among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank on any device using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

The easiest way to edit and eSign Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank seamlessly

- Find Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to secure your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and eSign Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form ky dor 62a500 p fill online printable fillable blank

Create this form in 5 minutes!

People also ask

-

What is the 2022 ky tax form and why is it important?

The 2022 ky tax form is essential for Kentucky residents to accurately report their income and any tax liabilities to the state. By filing this form, individuals and businesses ensure compliance with state tax laws and avoid penalties.

-

How can airSlate SignNow help with the 2022 ky tax form?

airSlate SignNow provides an efficient way to eSign and send your 2022 ky tax form securely. With our platform, you can eliminate paperwork hassles, track signing statuses, and streamline the submission process to ensure timely filing.

-

Is there a cost to use airSlate SignNow for my 2022 ky tax form?

airSlate SignNow offers various pricing plans, catering to different business sizes and needs. Depending on your requirements, you can choose a package that suits your budget while ensuring you have all the necessary tools to manage your 2022 ky tax form.

-

Can I integrate airSlate SignNow with accounting software for my 2022 ky tax form?

Yes, airSlate SignNow seamlessly integrates with multiple accounting software solutions, enabling users to easily manage their 2022 ky tax form alongside their financial documents. This integration helps streamline your workflow and maintains consistency across your financial records.

-

What are the benefits of using airSlate SignNow for my 2022 ky tax form?

Using airSlate SignNow for your 2022 ky tax form offers numerous benefits, including enhanced security, ease of use, and faster turnaround times. Our digital signing solution reduces the time spent on document management and ensures that your important forms are handled efficiently.

-

How does eSigning the 2022 ky tax form work with airSlate SignNow?

eSigning your 2022 ky tax form with airSlate SignNow is simple and intuitive. You upload your document, add signers, and then send the form for signature; once signed, the document is automatically stored securely in your account for record-keeping.

-

Is airSlate SignNow compliant with legal standards for the 2022 ky tax form?

Absolutely! airSlate SignNow complies with all legal requirements for electronic signatures, making it a reliable choice for your 2022 ky tax form. Our solution meets both federal and state regulations, ensuring your documents are valid and enforceable.

Get more for Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank

- Warranty deed from individual to a trust oregon form

- Oregon warranty form

- Oregon deed trust 497323556 form

- Warranty deed from husband to himself and wife oregon form

- Quitclaim deed from husband to himself and wife oregon form

- Quitclaim deed from husband and wife to husband and wife oregon form

- Oregon husband wife form

- Revocation of postnuptial property agreement oregon oregon form

Find out other Form KY DoR 62A500 P Fill Online, Printable, Fillable, Blank

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe