Revenue Ky GovForms62A500 WCommonwealth of Kentucky TANGIBLE PERSONAL T PROPERTY TAX 2021

What is the 2021 ky tax form?

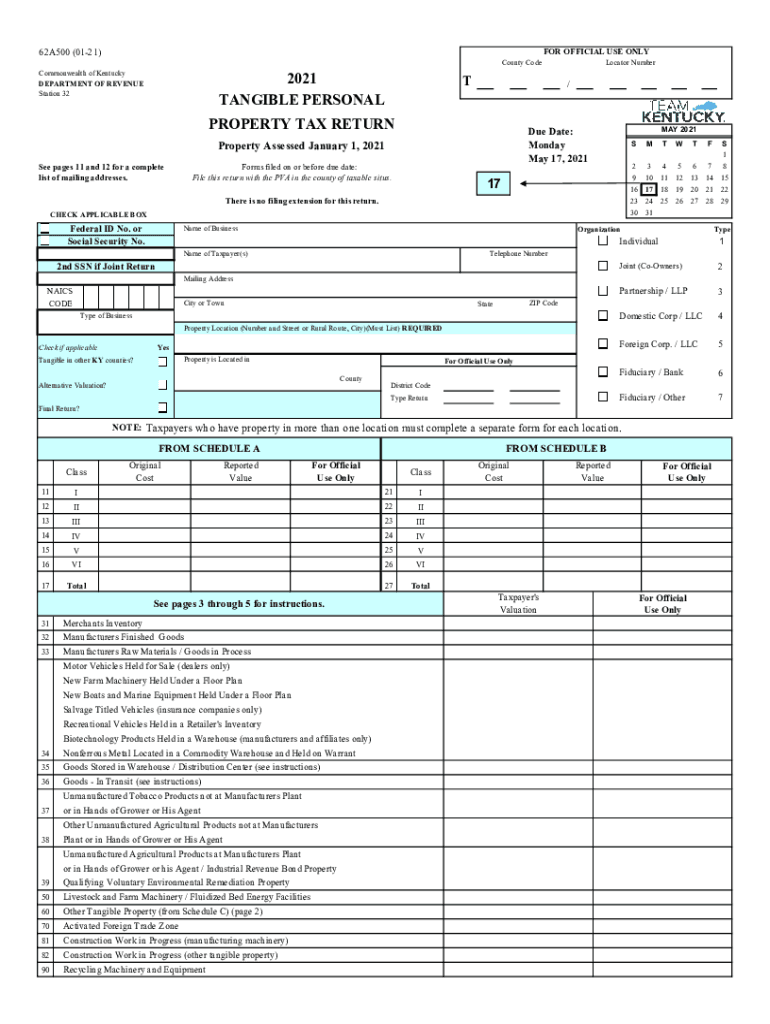

The 2021 ky tax form, specifically known as the 62A500, is the Commonwealth of Kentucky's Tangible Personal Property Tax form. This form is essential for individuals and businesses to report tangible personal property that is subject to taxation. Tangible personal property includes items such as machinery, equipment, and furniture that are not permanently affixed to real estate. Understanding this form is crucial for compliance with state tax regulations and ensuring accurate tax assessments.

Steps to complete the 2021 ky tax form

Completing the 2021 ky tax form involves several key steps:

- Gather necessary information: Collect details about your tangible personal property, including descriptions, purchase dates, and values.

- Access the form: Obtain the 62A500 form from the Kentucky Department of Revenue website or through authorized distribution channels.

- Fill out the form: Accurately enter the required information, ensuring that all property is listed and values are correctly assessed.

- Review the form: Double-check all entries for accuracy and completeness to avoid potential issues with your submission.

- Submit the form: File the completed form by the designated deadline, either online, by mail, or in person, as per the guidelines provided by the Kentucky Department of Revenue.

Filing Deadlines / Important Dates

For the 2021 ky tax form, it is important to be aware of the filing deadlines to avoid penalties. Typically, the deadline for submitting the 62A500 form is April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates ensures timely compliance with state tax regulations.

Legal use of the 2021 ky tax form

The 2021 ky tax form is legally binding when completed and submitted in accordance with Kentucky state laws. To ensure its legal validity, it must be filled out accurately and submitted by the required deadline. Additionally, the form must be signed by the taxpayer or an authorized representative. Compliance with these regulations is essential to avoid penalties and ensure that property is assessed correctly for tax purposes.

Required Documents

When completing the 2021 ky tax form, certain documents may be required to substantiate the information provided. These may include:

- Purchase invoices for tangible personal property.

- Previous tax returns related to property tax.

- Documentation of any exemptions or deductions claimed.

Having these documents ready can facilitate a smoother filing process and help ensure that all information is accurate and verifiable.

Who Issues the Form

The 2021 ky tax form, or 62A500, is issued by the Kentucky Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers in Kentucky. The department provides resources and guidance on how to complete the form correctly and the implications of tangible personal property taxation.

Quick guide on how to complete revenuekygovforms62a500 wcommonwealth of kentucky tangible personal t property tax

Finalize Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents quickly and without holdups. Manage Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX on any device via airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX with ease

- Locate Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX and click Retrieve Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or hide sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Complete button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuekygovforms62a500 wcommonwealth of kentucky tangible personal t property tax

Create this form in 5 minutes!

How to create an eSignature for the revenuekygovforms62a500 wcommonwealth of kentucky tangible personal t property tax

How to generate an e-signature for a PDF document in the online mode

How to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What is the 2021 ky tax form and why is it important?

The 2021 ky tax form is a crucial document for residents of Kentucky to report their income and calculate their tax obligations for the year. Filing this form accurately ensures compliance with state tax laws and helps avoid penalties. Additionally, it may determine your eligibility for state tax credits or refunds.

-

How can airSlate SignNow help with signing the 2021 ky tax form?

AirSlate SignNow offers an intuitive platform to electronically sign the 2021 ky tax form, making the process faster and more efficient. You can easily upload your document, sign it, and send it to the necessary parties from any device. This eliminates the hassle of printing and scanning, allowing for a seamless filing experience.

-

Are there any costs associated with using airSlate SignNow for the 2021 ky tax form?

AirSlate SignNow provides an affordable pricing model that allows users to sign documents like the 2021 ky tax form at a low cost. Depending on the plan, you may benefit from unlimited signing or additional features tailored for your business needs. It's a cost-effective solution compared to traditional signing methods.

-

What features does airSlate SignNow offer for managing the 2021 ky tax form?

AirSlate SignNow includes features such as templates, customizable fields, and reminders to streamline the signing process of the 2021 ky tax form. Additionally, you can track the status of documents in real-time and receive notifications when forms are signed or completed. These features enhance efficiency and organization.

-

Is it secure to use airSlate SignNow for the 2021 ky tax form?

Yes, airSlate SignNow prioritizes security and ensures that your 2021 ky tax form and other documents are protected with advanced encryption measures. All data is stored securely, and your transactions are compliant with industry standards. This guarantees peace of mind while managing sensitive tax information.

-

Can airSlate SignNow integrate with other software for the 2021 ky tax form?

Absolutely! AirSlate SignNow integrates seamlessly with various applications to enhance your workflow for handling the 2021 ky tax form. Whether it’s accounting software, cloud storage, or project management tools, these integrations allow for a more cohesive experience, minimizing the need to switch between different platforms.

-

What are the benefits of using airSlate SignNow for the 2021 ky tax form?

Using airSlate SignNow for the 2021 ky tax form provides numerous benefits such as increased efficiency, cost savings, and hassle-free signing. Users enjoy the ability to sign documents from anywhere, track progress in real-time, and maintain a secure archive of all signed forms. It simplifies the entire tax filing process.

Get more for Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX

- Quitclaim deed by two individuals to corporation connecticut form

- Warranty deed from two individuals to corporation connecticut form

- Ct corporation llc 497301008 form

- Ct notice 497301010 form

- Quitclaim deed from individual to corporation connecticut form

- Warranty deed from individual to corporation connecticut form

- Connecticut lis form

- Quitclaim deed from individual to llc connecticut form

Find out other Revenue ky govForms62A500 WCommonwealth Of Kentucky TANGIBLE PERSONAL T PROPERTY TAX

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors