New State Law Changes Filing Requirements for Tangible 2023

Understanding the New State Law Changes for Tangible Property Tax Filing

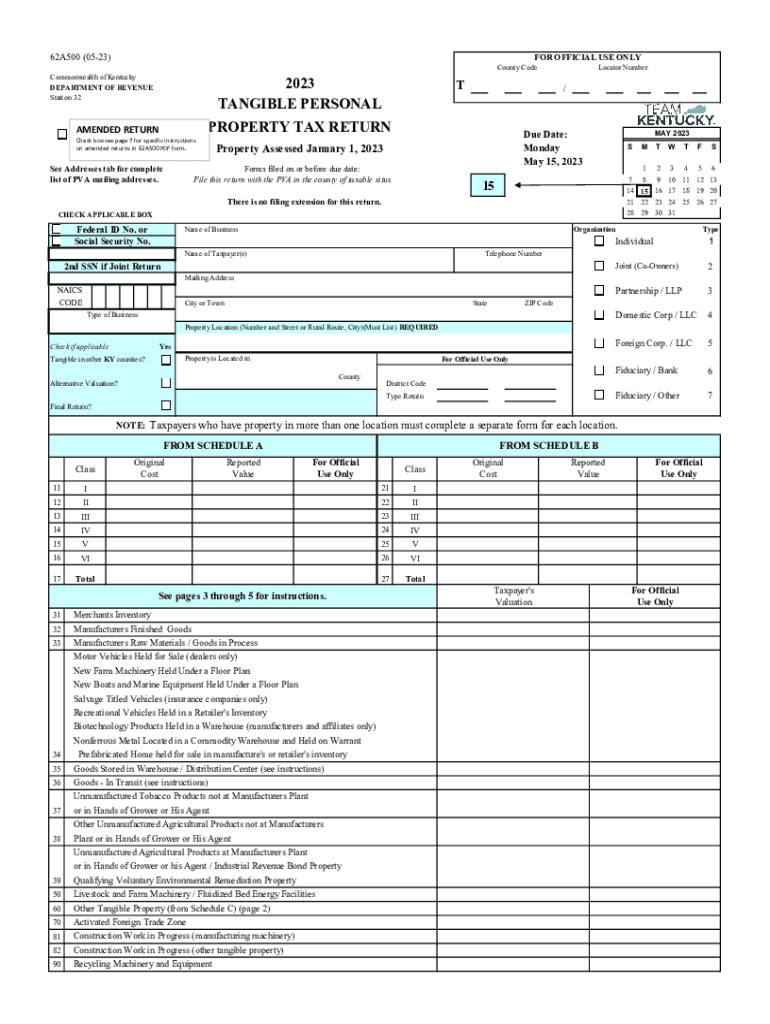

The recent changes in state law regarding tangible property tax filing requirements aim to streamline the process for taxpayers in Kentucky. These changes include updated definitions of tangible property and modified filing procedures. Taxpayers must familiarize themselves with these new regulations to ensure compliance and avoid potential penalties. The law now specifies what constitutes tangible property, which can affect how property is assessed and taxed.

Steps to Complete the New State Law Changes Filing Requirements

To successfully file under the new state law changes, taxpayers should follow these steps:

- Gather all necessary documentation related to tangible property ownership, including purchase receipts and previous tax returns.

- Review the updated definitions of tangible property to determine what items must be reported.

- Complete the appropriate forms, ensuring all information is accurate and up to date.

- Submit the completed forms by the specified deadline to avoid penalties.

Required Documents for Filing Tangible Property Tax

When filing for tangible property tax, taxpayers need to prepare several documents to support their claims. Key documents include:

- Proof of ownership, such as purchase agreements or title documents.

- Previous year’s tax returns, which can provide a reference for current filings.

- Any relevant financial statements that detail the value of the tangible property.

Form Submission Methods for Tangible Property Tax

Taxpayers have several options for submitting their tangible property tax forms. These methods include:

- Online submission through the state’s tax portal, which is often the quickest option.

- Mailing the completed forms to the appropriate tax office, ensuring they are sent well before the deadline.

- In-person submission at local tax offices, which may provide immediate assistance if questions arise.

Penalties for Non-Compliance with Tangible Property Tax Filing

Failure to comply with the new filing requirements can result in significant penalties. Taxpayers may face:

- Fines based on the assessed value of the tangible property.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action for continued non-compliance, leading to further financial repercussions.

Eligibility Criteria for Tangible Property Tax Filing

To be eligible for tangible property tax filing, individuals and businesses must meet specific criteria. These include:

- Ownership of tangible property as defined by state law.

- Meeting the filing deadlines established by the state.

- Providing accurate and complete information on the tax forms.

Quick guide on how to complete new state law changes filing requirements for tangible

Complete New State Law Changes Filing Requirements For Tangible effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and smoothly. Manage New State Law Changes Filing Requirements For Tangible on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient method to modify and eSign New State Law Changes Filing Requirements For Tangible with ease

- Locate New State Law Changes Filing Requirements For Tangible and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools provided by airSlate SignNow designed for that purpose.

- Generate your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to finalize your modifications.

- Choose your preferred method for sending your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you select. Modify and eSign New State Law Changes Filing Requirements For Tangible and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new state law changes filing requirements for tangible

Create this form in 5 minutes!

How to create an eSignature for the new state law changes filing requirements for tangible

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 62a500 feature in airSlate SignNow?

The 62a500 feature in airSlate SignNow offers a seamless document signing experience for users. It allows businesses to create, send, and track documents effortlessly, ensuring efficient workflows and enhanced productivity.

-

How does pricing work for the 62a500 service?

airSlate SignNow offers competitive pricing for the 62a500 service, suitable for businesses of all sizes. You can choose from various plans that cater to your needs, allowing you to scale as your business grows while enjoying cost-effective rates.

-

What are the key benefits of using airSlate SignNow 62a500?

Using airSlate SignNow’s 62a500 feature empowers your business with enhanced document management capabilities. It streamlines the eSignature process, reduces turnaround time, and increases compliance with legally binding signatures.

-

Does airSlate SignNow 62a500 integrate with other tools?

Yes, the 62a500 feature in airSlate SignNow integrates seamlessly with various popular business applications. This allows you to connect your existing tools and improve your workflow efficiency without the need for complicated setups.

-

Is the 62a500 feature secure for handling sensitive documents?

Absolutely! The 62a500 feature in airSlate SignNow is designed with advanced security measures to protect your sensitive documents. It includes encryption, secure data storage, and compliance with industry standards to ensure your information remains safe.

-

Can I customize templates using the 62a500 service?

Yes, airSlate SignNow’s 62a500 service allows users to create and customize templates easily. This enables businesses to tailor documents according to their specific needs, streamlining the creation process and ensuring consistency.

-

How can 62a500 improve my team's productivity?

The 62a500 feature signNowly improves your team's productivity by simplifying document workflows. With quick eSigning and easy sharing options, your team can focus on more important tasks instead of getting bogged down by paperwork.

Get more for New State Law Changes Filing Requirements For Tangible

- Personnel security action form

- Us coast guard small arms range sheet form

- Form i 129 petition for a nonimmigrant worker 2011

- Form i 129 2014

- Form i90 2017 2019

- Www uscis i 90 2010 form

- Pdf icon click icon to download listed form auxiliary forms

- Than 24 hours national bureau of economic research nber form

Find out other New State Law Changes Filing Requirements For Tangible

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free