1350 STATE of SOUTH CAROLINA SC W 4 DEPARTMENT of REVENUE SOUTH 2022-2026

What is the 1350 STATE OF SOUTH CAROLINA SC W-4 DEPARTMENT OF REVENUE SOUTH

The 1350 STATE OF SOUTH CAROLINA SC W-4 is a tax form used by employees in South Carolina to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted, helping to prevent underpayment or overpayment of state taxes. It is particularly important for new employees or those who wish to adjust their withholding status due to changes in personal circumstances, such as marriage or the birth of a child.

How to use the 1350 STATE OF SOUTH CAROLINA SC W-4 DEPARTMENT OF REVENUE SOUTH

To use the 1350 STATE OF SOUTH CAROLINA SC W-4, individuals must first fill out the form accurately. This includes providing personal information such as name, address, and Social Security number. Employees should also indicate their filing status and the number of allowances they are claiming. Once completed, the form should be submitted to the employer, who will use it to calculate the appropriate withholding amount from the employee's paycheck.

Steps to complete the 1350 STATE OF SOUTH CAROLINA SC W-4 DEPARTMENT OF REVENUE SOUTH

Completing the 1350 STATE OF SOUTH CAROLINA SC W-4 involves several steps:

- Obtain the form from the South Carolina Department of Revenue website or through your employer.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status (single, married, etc.) and the number of allowances you wish to claim.

- Sign and date the form to certify the information is correct.

- Submit the completed form to your employer for processing.

Legal use of the 1350 STATE OF SOUTH CAROLINA SC W-4 DEPARTMENT OF REVENUE SOUTH

The 1350 STATE OF SOUTH CAROLINA SC W-4 is legally recognized as a valid document for determining state tax withholding. Employers are required by law to withhold state income tax based on the information provided in this form. Failure to submit a completed W-4 may result in the employer withholding the maximum tax rate, which could lead to higher tax payments than necessary.

Key elements of the 1350 STATE OF SOUTH CAROLINA SC W-4 DEPARTMENT OF REVENUE SOUTH

Key elements of the 1350 STATE OF SOUTH CAROLINA SC W-4 include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount.

- Signature: The employee's signature confirms the accuracy of the information provided.

Eligibility Criteria

Eligibility to complete the 1350 STATE OF SOUTH CAROLINA SC W-4 includes any employee working in South Carolina who is subject to state income tax withholding. This includes full-time, part-time, and seasonal employees. It is important for individuals to ensure that they meet the criteria for the allowances they claim to avoid potential tax issues.

Quick guide on how to complete 1350 state of south carolina sc w 4 department of revenue south

Complete 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources required to draft, alter, and electronically sign your documents rapidly without interruptions. Manage 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH on any device through airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH with ease

- Find 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1350 state of south carolina sc w 4 department of revenue south

Create this form in 5 minutes!

People also ask

-

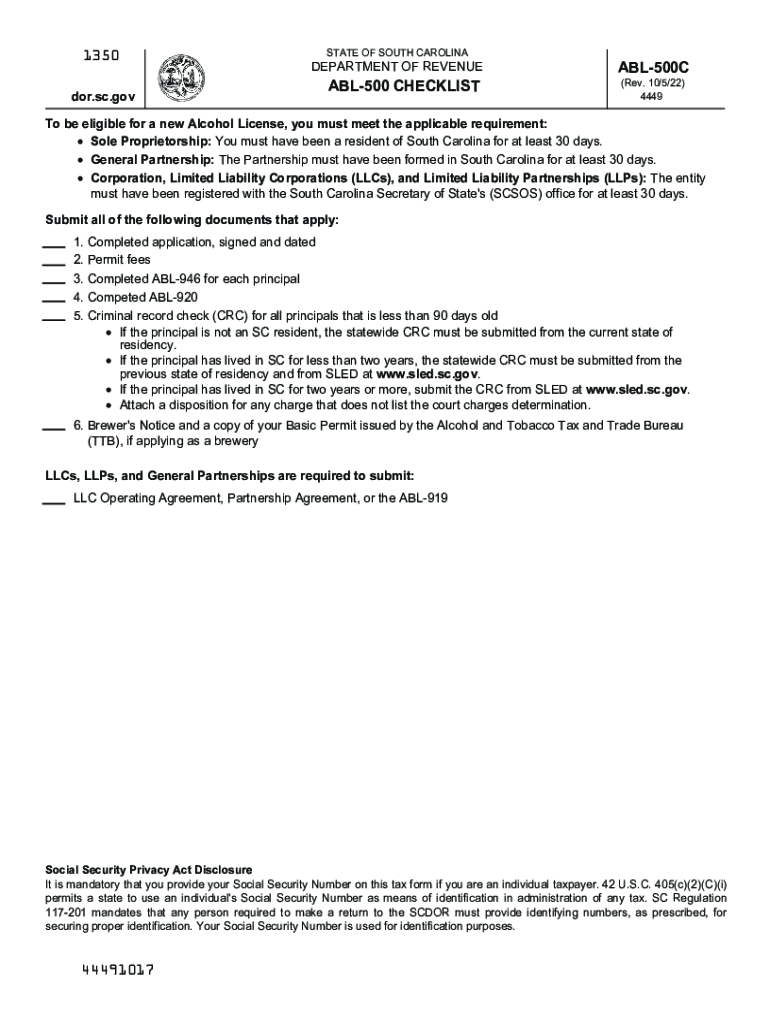

What is the process for how South Carolina ABL renewal?

The process for how South Carolina ABL renewal typically involves submitting the required documentation and fees to the appropriate state office. It is essential to check for any specific requirements related to your business type. Completing this process ensures that your business remains compliant and avoids potential penalties.

-

How can airSlate SignNow assist with the South Carolina ABL renewal process?

airSlate SignNow can streamline the South Carolina ABL renewal process by allowing you to electronically sign and send necessary documents securely. Utilizing our eSignature feature can enhance efficiency and reduce the time spent on paperwork, ensuring a hassle-free renewal experience.

-

What are the benefits of using airSlate SignNow for South Carolina ABL renewal?

Using airSlate SignNow for South Carolina ABL renewal offers numerous benefits, including improved document management and enhanced security for sensitive information. Our platform simplifies the signing process, helping you complete your renewal quickly, while also providing a cost-effective solution for businesses.

-

Is there a fee associated with airSlate SignNow for South Carolina ABL renewal?

Yes, there is a fee for using airSlate SignNow, which varies based on the chosen subscription plan. The pricing is competitive and designed to fit different business needs, making it a cost-effective choice for facilitating the South Carolina ABL renewal process.

-

What features does airSlate SignNow offer that aid in South Carolina ABL renewal?

airSlate SignNow offers features like customizable templates, advanced security options, and real-time tracking of documents. These features are particularly beneficial for ensuring that your South Carolina ABL renewal paperwork is handled professionally and efficiently.

-

How does airSlate SignNow integrate with other tools during the South Carolina ABL renewal process?

airSlate SignNow easily integrates with various business applications, allowing you to import data directly into your documents for South Carolina ABL renewal. This integration enhances productivity and ensures that all relevant information is seamlessly synchronized, minimizing errors.

-

Can I track the progress of my South Carolina ABL renewal with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your South Carolina ABL renewal documents. This transparency ensures you stay informed every step of the way, reducing anxiety about the application process.

Get more for 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH

- Warranty deed from individual to corporation oregon form

- Transfer on death deed from an individual ownergrantor to four individual beneficiaries oregon form

- Oregon filing form

- Notice completion oregon form

- Oregon quitclaim deed 497323636 form

- Warranty deed from individual to llc oregon form

- Oregon notice completion form

- Intent foreclose form

Find out other 1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUE SOUTH

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer