Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report 2022-2026

Understanding the Texas Battery Sales Fee Report

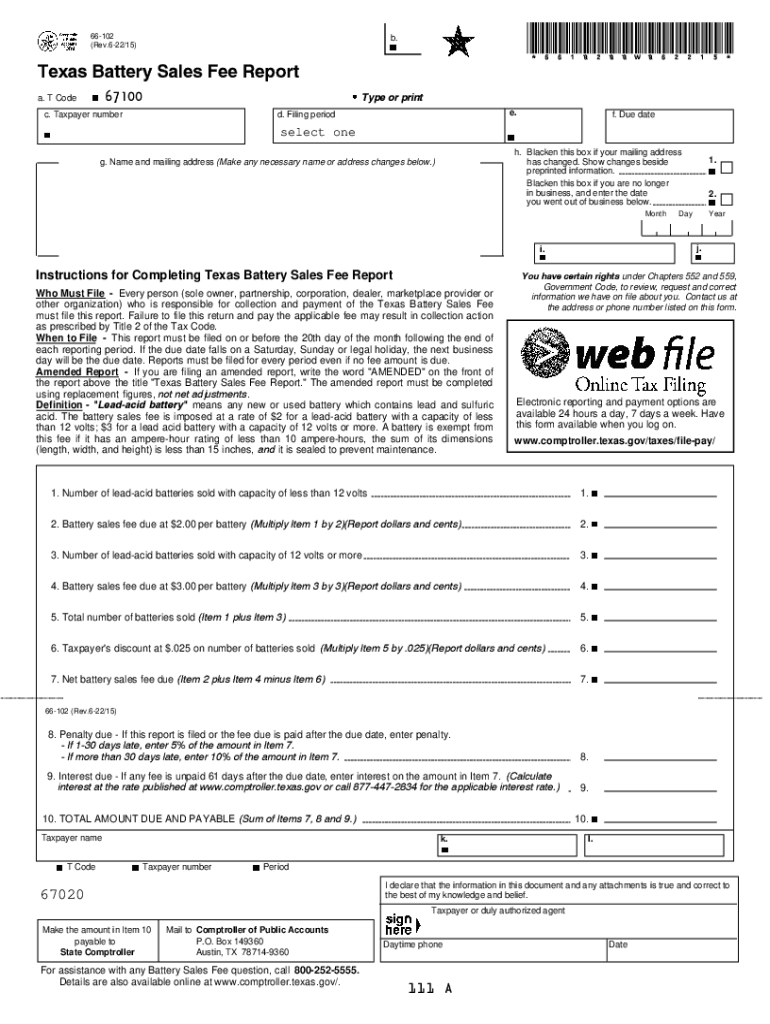

The Texas Battery Sales Fee Report, officially known as the 66-102 form, is a critical document for businesses involved in the sale of batteries in Texas. This form is used to report and remit the state-mandated battery sales fee, which is essential for compliance with Texas tax regulations. The fee applies to various types of batteries, including automotive and industrial batteries, and is designed to promote recycling and proper disposal of battery waste.

Steps to Complete the Texas Battery Sales Fee Report

Completing the Texas Battery Sales Fee Report involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect sales data for the reporting period, including the total number of batteries sold and the applicable fee rates.

- Fill out the form: Enter the required information in the appropriate sections of the 66-102 form, ensuring all figures are accurate.

- Calculate the total fee: Multiply the number of batteries sold by the applicable fee rate to determine the total amount due.

- Review for errors: Double-check all entries for accuracy to avoid potential penalties or compliance issues.

- Submit the form: Follow the designated submission method, whether online, by mail, or in person, to ensure timely processing.

Legal Use of the Texas Battery Sales Fee Report

The Texas Battery Sales Fee Report is legally binding when completed and submitted according to state regulations. It is essential for businesses to maintain compliance with Texas tax laws, as failure to submit the report or remit the appropriate fees can result in penalties. The report serves as a formal declaration of sales and fees owed, providing a transparent record for both the business and the state.

Filing Deadlines and Important Dates

Timely filing of the Texas Battery Sales Fee Report is crucial for compliance. Businesses must be aware of the specific deadlines for submission, which typically align with quarterly or annual reporting periods. Missing these deadlines can lead to penalties and interest on unpaid fees. It is advisable to check the Texas Comptroller's website for the most current filing dates and requirements.

Form Submission Methods

Businesses have several options for submitting the Texas Battery Sales Fee Report. The form can be submitted online through the Texas Comptroller's website, allowing for quick processing and confirmation. Alternatively, businesses can choose to mail the completed form to the designated address or deliver it in person at a local Comptroller office. Each method has its own processing times and requirements, so it is important to choose the one that best fits the business's needs.

Key Elements of the Texas Battery Sales Fee Report

Several key elements must be included in the Texas Battery Sales Fee Report to ensure it is complete and compliant:

- Business information: Include the business name, address, and taxpayer identification number.

- Sales data: Provide detailed information on the number and types of batteries sold during the reporting period.

- Fee calculation: Clearly outline how the total fee was calculated based on sales data.

- Signature and date: Ensure the form is signed and dated by an authorized representative of the business.

Examples of Using the Texas Battery Sales Fee Report

Businesses in various sectors utilize the Texas Battery Sales Fee Report to comply with state regulations. For example, an automotive retailer selling batteries must accurately report the number of batteries sold to avoid penalties. Similarly, industrial suppliers must track their battery sales to ensure proper fee remittance. By using the 66-102 form, these businesses contribute to environmental sustainability while fulfilling their legal obligations.

Quick guide on how to complete miscellaneous texas tax forms 66 102 texas battery sales fee report

Effortlessly prepare Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without any delays. Handle Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-centric workflow today.

The easiest way to modify and eSign Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report with ease

- Obtain Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that function by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct miscellaneous texas tax forms 66 102 texas battery sales fee report

Create this form in 5 minutes!

People also ask

-

What is the Texas battery sales fee report?

The Texas battery sales fee report outlines the fees associated with battery sales in Texas, ensuring compliance with state regulations. This report helps businesses understand their financial obligations and permits them to accurately track and report battery sales fees.

-

How can airSlate SignNow assist with the Texas battery sales fee report?

airSlate SignNow simplifies the process of creating and signing the Texas battery sales fee report by providing a user-friendly platform for document management. Users can easily generate, eSign, and share necessary reports to ensure compliance and maintain accurate records.

-

Is there a cost associated with using airSlate SignNow for the Texas battery sales fee report?

Yes, there may be costs associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. The platform provides various pricing plans to suit the needs of organizations seeking to manage their Texas battery sales fee report efficiently.

-

What features does airSlate SignNow offer for managing the Texas battery sales fee report?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows, making it easier to manage the Texas battery sales fee report. These features help streamline the reporting process and reduce manual errors.

-

Can I integrate airSlate SignNow with other tools for my Texas battery sales fee report?

Absolutely! airSlate SignNow provides integrations with various applications, enhancing the management of the Texas battery sales fee report. Whether you use CRM systems or accounting software, you can streamline your workflow and improve efficiency.

-

How secure is the information in my Texas battery sales fee report with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption technologies to protect sensitive information within your Texas battery sales fee report, ensuring that your data remains confidential and secure.

-

What benefits can I expect from using airSlate SignNow for the Texas battery sales fee report?

Using airSlate SignNow for the Texas battery sales fee report offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. By automating the signing process, businesses can focus on their core operations while ensuring all regulatory requirements are met.

Get more for Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report

- Landlord tenant lease co signer agreement oregon form

- Application for sublease oregon form

- Inventory and condition of leased premises for pre lease and post lease oregon form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out oregon form

- Property manager agreement oregon form

- Agreement for delayed or partial rent payments oregon form

- Tenants maintenance repair request form oregon

- Guaranty attachment to lease for guarantor or cosigner oregon form

Find out other Miscellaneous Texas Tax Forms 66 102 Texas Battery Sales Fee Report

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer