66 102 2018

Understanding the 66 102 Form

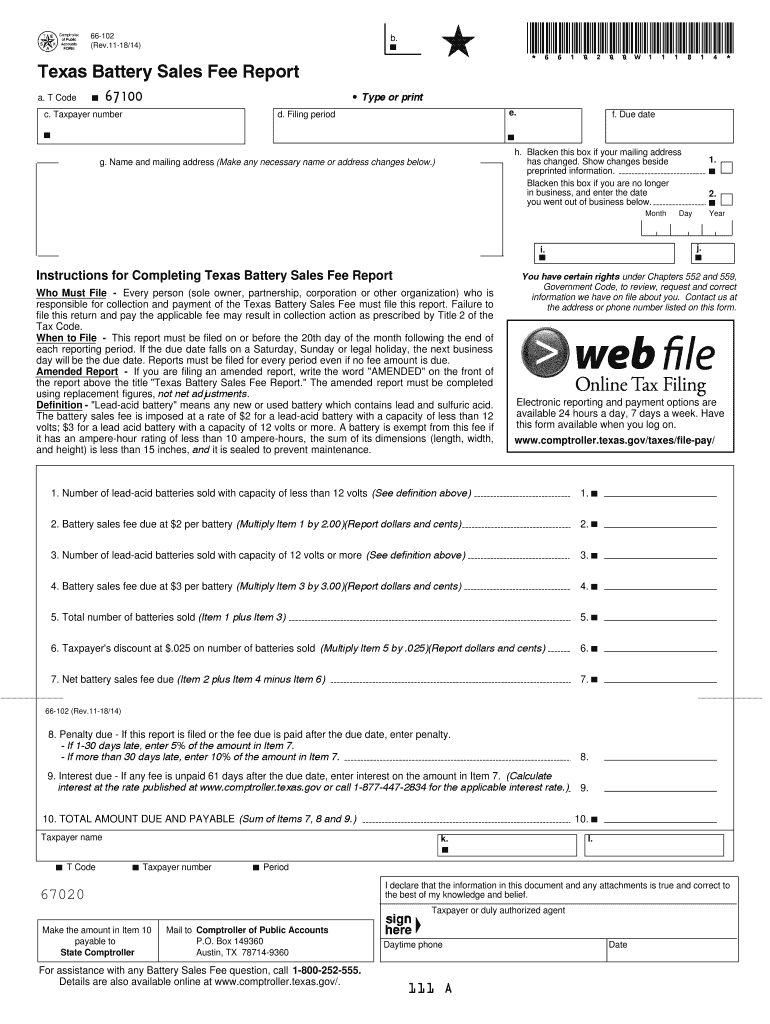

The 66 102 form, also known as the Texas battery sales fee report, is a crucial document for businesses involved in selling batteries in Texas. This form is designed to report the battery core charge collected from customers and ensure compliance with state regulations. Understanding the purpose of this form is essential for accurate reporting and avoiding potential penalties.

Steps to Complete the 66 102 Form

Completing the 66 102 form involves several key steps:

- Gather all necessary sales records related to battery sales and core charges.

- Fill out the form with accurate information, including the total number of batteries sold and the corresponding core charges.

- Calculate the total fee owed based on the number of batteries sold.

- Review the completed form for accuracy before submission.

Ensuring that all information is correct will help prevent delays in processing and potential fines.

Legal Use of the 66 102 Form

The 66 102 form must be used in accordance with Texas state law. It is essential for businesses to understand the legal implications of this form, as improper use or failure to submit it can result in penalties. Compliance with the Texas battery sales fee regulations helps maintain transparency and accountability in business practices.

Required Documents for Submission

When submitting the 66 102 form, businesses should have the following documents ready:

- Sales records for all batteries sold during the reporting period.

- Documentation of core charges collected from customers.

- Any previous forms submitted, if applicable, for reference.

Having these documents on hand will facilitate a smoother submission process and ensure all required information is included.

Form Submission Methods

The 66 102 form can be submitted through various methods, including:

- Online submission via the Texas Comptroller's website.

- Mailing a paper version of the form to the appropriate state office.

- In-person submission at designated state offices.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Penalties for Non-Compliance

Failure to submit the 66 102 form or inaccuracies in reporting can lead to significant penalties. Businesses may face fines or additional fees if they do not comply with the Texas battery sales fee regulations. It is crucial for businesses to understand these potential consequences to avoid financial repercussions.

Quick guide on how to complete texas battery sales fee 2018 2019 form

Your assistance manual for preparing your 66 102

If you're interested in learning how to generate and send your 66 102, here are some brief guidelines to simplify your tax submission process.

To begin, simply register your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that allows you to modify, generate, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revert to change responses when necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and convenient sharing options.

Complete the steps below to finalize your 66 102 in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Select Get form to access your 66 102 in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-binding eSignature (if applicable).

- Examine your document and correct any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it onto your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can lead to return mistakes and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct texas battery sales fee 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How much will be the fee to fill out the XAT form?

The XAT Registration fee is Rs. 1700(late fee Rs. 2000). This is had increased from last year.If you want to apply for XLRI programmes then pay additional Rs.300 (late fee Rs. 500)The last date for registration is 30th Nov 2018. The exam is on 6th Jan 2019.All the best

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the texas battery sales fee 2018 2019 form

How to create an eSignature for your Texas Battery Sales Fee 2018 2019 Form online

How to make an electronic signature for the Texas Battery Sales Fee 2018 2019 Form in Chrome

How to create an eSignature for putting it on the Texas Battery Sales Fee 2018 2019 Form in Gmail

How to generate an eSignature for the Texas Battery Sales Fee 2018 2019 Form from your smartphone

How to make an eSignature for the Texas Battery Sales Fee 2018 2019 Form on iOS

How to generate an eSignature for the Texas Battery Sales Fee 2018 2019 Form on Android OS

People also ask

-

What is the texas battery core charge?

The texas battery core charge is a fee that is applied when purchasing a new battery. This charge is meant to encourage the recycling of old batteries, which are valuable for their materials. When you return your old battery, you can receive a refund of the core charge.

-

How is the texas battery core charge calculated?

The texas battery core charge typically varies based on the type and size of the battery you are purchasing. It is often a flat fee added to the cost of the new battery, designed to promote recycling and responsible disposal. Always check with your retailer for the exact charge associated with your specific battery purchase.

-

Are there any benefits to paying the texas battery core charge?

Yes, by paying the texas battery core charge, you contribute to environmental sustainability efforts. The charge encourages users to return their used batteries for recycling, minimizing waste and allowing for the reuse of precious materials. This not only benefits the environment but can result in lower costs for new batteries in the long run.

-

Can I get a refund for the texas battery core charge?

Yes, you can receive a refund for the texas battery core charge when you return your old battery to the retailer. Keep your receipt as proof of purchase to ensure you easily claim your refund. This process supports both eco-friendly practices and your wallet.

-

How does the texas battery core charge relate to battery recycling?

The texas battery core charge plays a critical role in battery recycling by incentivizing consumers to return used batteries. This recycling process helps recover valuable materials like lead, which can then be used to manufacture new batteries. Understanding this linkage helps consumers appreciate the importance of responsible battery disposal.

-

Where can I find more information about the texas battery core charge?

To find detailed information about the texas battery core charge, check with your local battery retailers or manufacturers. Many provide resources on their websites that outline the core charge policy as well as recycling options. Local government websites may also offer guidelines on battery disposal and recycling.

-

Do all batteries have a texas battery core charge?

Not all battery types have a texas battery core charge; typically, it applies to lead-acid batteries. Retailers may have specific policies regarding which batteries incur this fee. Always ask your retailer about the core charge before making a purchase to avoid any surprises.

Get more for 66 102

Find out other 66 102

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free