New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome to NewMexico GovNew 2022-2026

Understanding the New Mexico Form RPD 41379

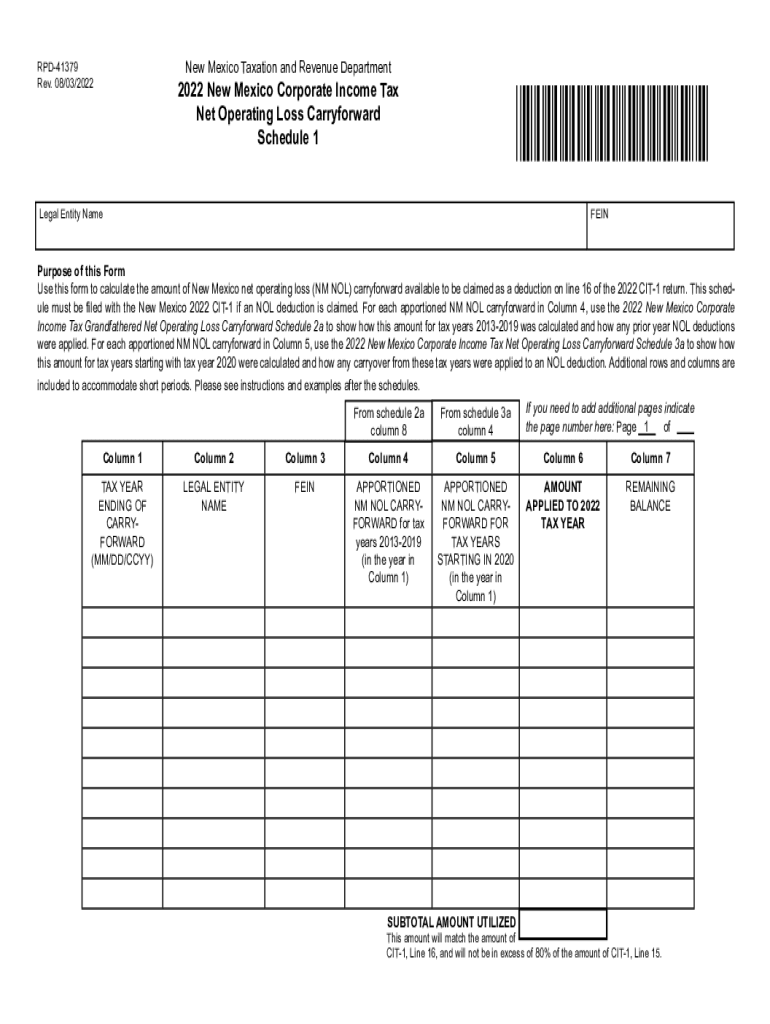

The New Mexico Form RPD 41379 is specifically designed for reporting net operating loss carryforwards for businesses operating within the state. This form is essential for entities that have incurred losses in previous tax years and wish to apply those losses against future income. By utilizing the RPD 41379, businesses can effectively manage their tax liabilities and optimize their financial performance. The form must be filled out accurately to ensure compliance with state tax regulations.

Steps to Complete the New Mexico Form RPD 41379

Completing the RPD 41379 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including previous tax returns and records of losses. Next, fill out the form by entering the required information, such as the amount of net operating loss and the tax year it pertains to. It is important to review the form for any errors before submission. Finally, submit the form either electronically or by mail, following the guidelines provided by the New Mexico Taxation and Revenue Department.

Key Elements of the New Mexico Form RPD 41379

The RPD 41379 includes several critical components that must be understood for proper completion. Key elements include:

- Taxpayer Information: This section requires basic information about the business, including the name, address, and taxpayer identification number.

- Net Operating Loss Amount: The form requires a detailed account of the total net operating loss available for carryforward.

- Tax Year Information: Indicate the tax years for which the losses were incurred, ensuring that the information aligns with previous filings.

- Signature and Date: The form must be signed by an authorized representative of the business, along with the date of submission.

Eligibility Criteria for Using Form RPD 41379

To utilize the RPD 41379, businesses must meet specific eligibility criteria set by the New Mexico Taxation and Revenue Department. Generally, only entities that have reported a net operating loss on their state income tax return can apply for carryforward. Additionally, businesses must ensure that they have maintained accurate records of their losses and have filed all required tax returns for previous years. Understanding these criteria is essential for effective tax planning and compliance.

Form Submission Methods for RPD 41379

The New Mexico Form RPD 41379 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses opt to file electronically through the New Mexico Taxation and Revenue Department's online portal, which can streamline the process.

- Mail Submission: The form can also be printed and mailed to the appropriate state tax office. Ensure that it is sent to the correct address to avoid delays.

- In-Person Submission: Businesses may choose to deliver the form in person at designated tax offices, allowing for immediate confirmation of receipt.

Legal Use of the New Mexico Form RPD 41379

The RPD 41379 is legally recognized for reporting net operating loss carryforwards in accordance with New Mexico state tax laws. Proper use of this form is crucial for ensuring that businesses can benefit from their losses in future tax years. Compliance with all legal requirements, including accurate reporting and timely submission, is necessary to avoid penalties and ensure that the carryforward is honored by the state. Understanding the legal implications of using the RPD 41379 can aid in effective tax strategy and planning.

Quick guide on how to complete new mexico form rpd 41369 nm net operating loss carryforward sctaxation ampamp revenue department welcome to newmexicogovnew

Effortlessly Prepare New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew with Ease

- Find New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Purge your concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and eSign New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico form rpd 41369 nm net operating loss carryforward sctaxation ampamp revenue department welcome to newmexicogovnew

Create this form in 5 minutes!

People also ask

-

What is rpd 41379 and how does it relate to airSlate SignNow?

RPD 41379 refers to a specific document format that airSlate SignNow can efficiently handle. By utilizing features specifically tailored for rpd 41379, businesses can streamline their eSignature processes and ensure compliance, enhancing their document management capabilities.

-

What are the pricing options for using rpd 41379 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs when working with rpd 41379 files. These plans are designed to be cost-effective, ensuring that businesses can efficiently manage their documents without breaking the bank.

-

What features does airSlate SignNow provide for rpd 41379?

When dealing with rpd 41379, airSlate SignNow provides features such as customizable templates, advanced document workflows, and secure eSigning capabilities. These features enable users to quickly send, manage, and securely sign their documents online.

-

How can airSlate SignNow improve my business workflow with rpd 41379?

By integrating airSlate SignNow into your business workflow, documents like rpd 41379 can be managed more efficiently. The platform automates the signing process, reduces turnaround times, and minimizes errors, thus enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for rpd 41379 documents?

Using airSlate SignNow for rpd 41379 documents offers numerous benefits, including enhanced security, compliance, and ease of use. This solution allows users to track the status of their documents in real-time and provides a user-friendly interface that simplifies the signing process.

-

Does airSlate SignNow integrate with other software for rpd 41379 management?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications to manage rpd 41379 documents. From CRM systems to cloud storage solutions, these integrations ensure a smooth flow of information and document management across platforms.

-

Is airSlate SignNow easy to use for managing rpd 41379 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it exceptionally easy to manage rpd 41379 documents. Users can quickly learn to navigate the interface and access essential features with minimal training.

Get more for New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew

Find out other New Mexico Form RPD 41369 NM Net Operating Loss Carryforward ScTaxation & Revenue Department Welcome To NewMexico govNew

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney