Corporate Tax FormsRI Division of Taxation RI Gov 2022-2026

Understanding the Corporate Tax Form RI 1120S

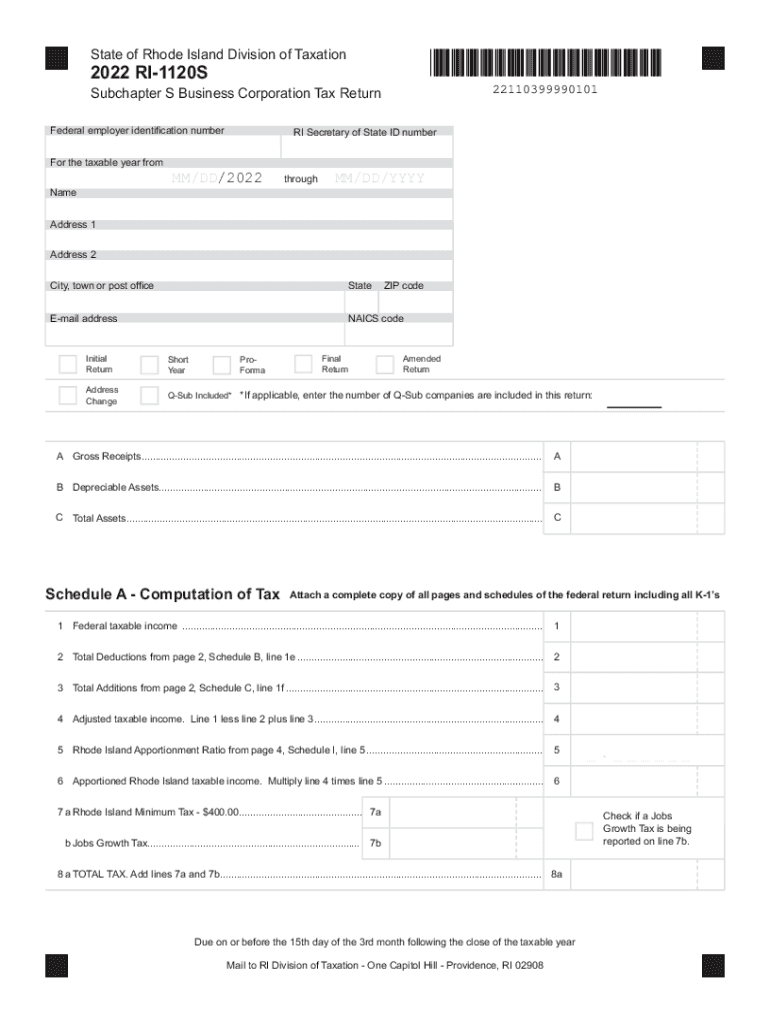

The Corporate Tax Form RI 1120S is essential for corporations in Rhode Island that elect to be taxed as S corporations. This form is used to report income, gains, losses, deductions, and credits, allowing corporations to pass their income directly to shareholders. By utilizing this form, businesses can avoid double taxation, which is a significant advantage for many small to mid-sized enterprises. The form must be filed annually to ensure compliance with state tax laws.

Steps to Complete the Corporate Tax Form RI 1120S

Completing the Corporate Tax Form RI 1120S involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and prior year tax returns. Next, fill out the form by providing detailed information about the corporation's income, deductions, and credits. It's crucial to ensure that all figures are accurate and reflect the corporation's financial status. After completing the form, review it thoroughly for any errors before submission.

Legal Use of the Corporate Tax Form RI 1120S

The Corporate Tax Form RI 1120S is legally recognized as a valid document for state tax purposes, provided it meets specific requirements. To ensure legal compliance, the form must be signed by an authorized officer of the corporation. Additionally, it must be submitted within the designated filing deadlines set by the Rhode Island Division of Taxation. Utilizing a reliable eSignature solution can help ensure that the form is executed properly and securely, meeting all legal standards.

Filing Deadlines for the Corporate Tax Form RI 1120S

Corporations must be aware of the filing deadlines for the Corporate Tax Form RI 1120S to avoid penalties. Typically, the form is due on the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Timely submission is crucial to maintain compliance and avoid late fees.

Required Documents for the Corporate Tax Form RI 1120S

When preparing to file the Corporate Tax Form RI 1120S, certain documents are required to support the information reported. These may include:

- Income statements detailing revenue and expenses

- Balance sheets showing assets, liabilities, and equity

- Prior year tax returns for reference

- Documentation for any deductions or credits claimed

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy.

Form Submission Methods for the Corporate Tax Form RI 1120S

The Corporate Tax Form RI 1120S can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the Rhode Island Division of Taxation's e-filing system

- Mailing a paper copy of the form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete corporate tax formsri division of taxation rigov

Effortlessly Complete Corporate Tax FormsRI Division Of Taxation RI gov on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Corporate Tax FormsRI Division Of Taxation RI gov on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Corporate Tax FormsRI Division Of Taxation RI gov with Ease

- Locate Corporate Tax FormsRI Division Of Taxation RI gov and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Corporate Tax FormsRI Division Of Taxation RI gov and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporate tax formsri division of taxation rigov

Create this form in 5 minutes!

How to create an eSignature for the corporate tax formsri division of taxation rigov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1120S form and who needs to file it?

The RI 1120S form is a tax return specifically for S corporations in Rhode Island. If your business is registered as an S corporation in the state, you are required to file this form annually, detailing your income, deductions, and credits.

-

How can airSlate SignNow help with filing the RI 1120S?

airSlate SignNow simplifies the process of preparing and submitting your RI 1120S form by allowing you to easily collect signatures and securely send documents. With its user-friendly interface, you can ensure that your tax documents are executed properly and on time.

-

Are there any costs associated with using airSlate SignNow for RI 1120S filing?

airSlate SignNow offers various pricing plans to accommodate different business needs. The cost will depend on the features you choose, but many businesses find it to be a cost-effective solution for handling their RI 1120S and other document signing needs.

-

What features does airSlate SignNow offer for document management related to RI 1120S?

With airSlate SignNow, you can access features like customizable templates, document tracking, and in-app reminders, which aid in managing your RI 1120S forms. These features streamline the preparation process, ensuring nothing is overlooked.

-

Can I integrate airSlate SignNow with other tools for RI 1120S preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting software and tools that can help with RI 1120S preparation. This connectivity ensures your documents are consistent and that your workflows are more efficient.

-

Is it easy to get started with airSlate SignNow for RI 1120S forms?

Absolutely! Getting started with airSlate SignNow is straightforward. You can sign up, create or import your RI 1120S documents, and begin sending them for signatures in just a few clicks, making the process quick and efficient.

-

What are the benefits of using airSlate SignNow for my RI 1120S filing?

Using airSlate SignNow for your RI 1120S filing offers numerous benefits, including reduced paperwork, enhanced security, and quicker turnaround times for document signing. It helps ensure compliance with state regulations while saving you time.

Get more for Corporate Tax FormsRI Division Of Taxation RI gov

- Legal last will and testament form for divorced person not remarried with no children pennsylvania

- Legal last will and testament form for divorced person not remarried with minor children pennsylvania

- Legal last will and testament form for divorced person not remarried with adult and minor children pennsylvania

- Mutual wills package with last wills and testaments for married couple with adult children pennsylvania form

- Mutual wills package with last wills and testaments for married couple with no children pennsylvania form

- Mutual wills package with last wills and testaments for married couple with minor children pennsylvania form

- Pennsylvania married form

- Legal last will and testament form for a married person with no children pennsylvania

Find out other Corporate Tax FormsRI Division Of Taxation RI gov

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast