State of Rhode Island Division of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M 2021

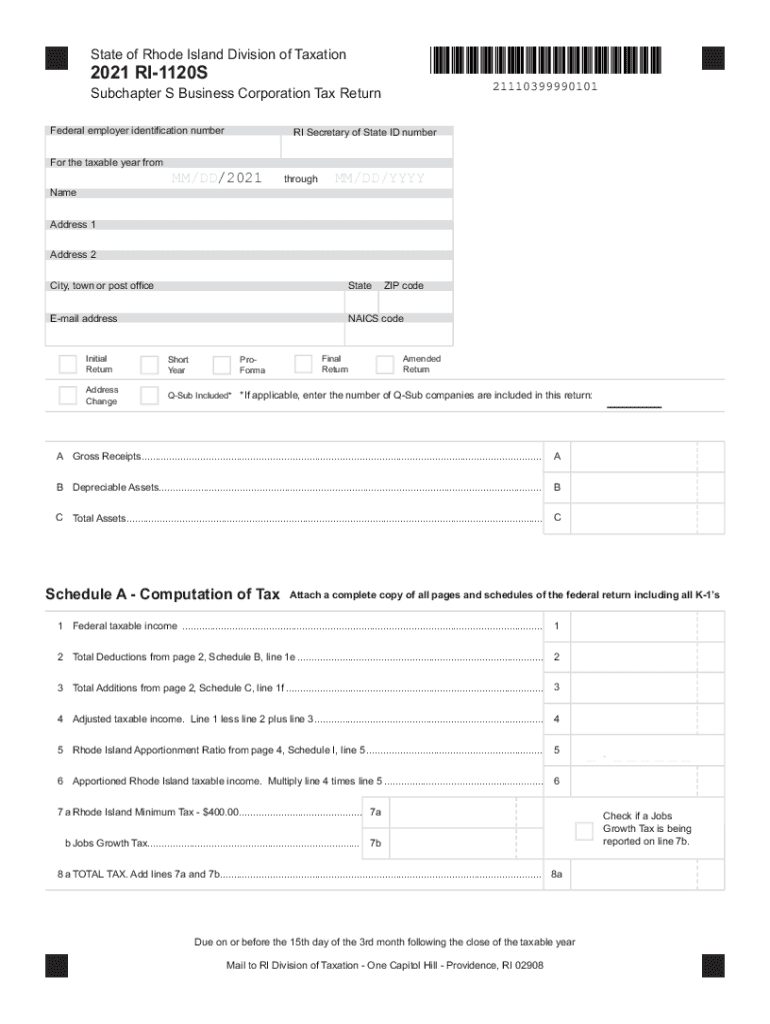

Understanding the RI 1120S Form

The RI 1120S form is a critical document for S corporations operating in Rhode Island. It is used to report income, deductions, and credits for the corporation. This form is essential for ensuring that your business complies with state tax regulations. Completing the RI 1120S accurately helps to avoid potential penalties and ensures that your business remains in good standing with the state tax authorities.

Steps to Complete the RI 1120S Form

Filling out the RI 1120S form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill in the corporation's identifying information, such as name, address, and federal identification number.

- Report total income and allowable deductions as per the guidelines provided by the state.

- Calculate the tax liability based on the net income reported.

- Review the completed form for accuracy before submission.

Legal Use of the RI 1120S Form

The RI 1120S form must be used in accordance with Rhode Island tax laws. To be legally valid, the form must be signed by an authorized officer of the corporation. This signature certifies that the information provided is accurate and complete. Compliance with the legal requirements ensures that the form is recognized by the Rhode Island Division of Taxation.

Filing Deadlines for the RI 1120S Form

It is important to be aware of the filing deadlines for the RI 1120S form to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by March 15. It is advisable to file the form on time to maintain compliance with state tax regulations.

Required Documents for Filing the RI 1120S Form

When preparing to file the RI 1120S form, certain documents are required:

- Financial statements, including profit and loss statements and balance sheets.

- Federal income tax return (Form 1120S) for the same tax year.

- Documentation for any credits or deductions claimed.

- Records of any distributions made to shareholders.

Penalties for Non-Compliance with the RI 1120S Form

Failure to file the RI 1120S form on time or submitting inaccurate information can result in penalties. These may include fines or interest on unpaid taxes. It is essential for corporations to ensure timely and accurate filing to avoid these consequences. Understanding the implications of non-compliance can help businesses maintain their standing and avoid financial setbacks.

Quick guide on how to complete state of rhode island division of taxationbusiness services rhode island nellie m gorbeabusiness services rhode island nellie m

Effortlessly Prepare State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M on Any Device

Digital document management has gained popularity among both businesses and individuals. It offers an optimal environmentally friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M on any system using airSlate SignNow applications for Android or iOS, and enhance any document-centric workflow today.

How to Alter and Electronically Sign State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M with Ease

- Find State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of rhode island division of taxationbusiness services rhode island nellie m gorbeabusiness services rhode island nellie m

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island division of taxationbusiness services rhode island nellie m gorbeabusiness services rhode island nellie m

The way to create an e-signature for your PDF file in the online mode

The way to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What is the purpose of the RI 1120S form?

The RI 1120S form is used by S corporations to report income, deductions, and credits to the state of Rhode Island. Filing this form is essential for maintaining compliance with state tax regulations and allows S corporations to pass income directly to shareholders.

-

How can airSlate SignNow help with filing the RI 1120S?

AirSlate SignNow streamlines the process of preparing and signing the RI 1120S form by allowing users to easily fill out, sign, and send documents electronically. This not only accelerates the filing process but also ensures that all necessary signatures are obtained efficiently.

-

What are the pricing options for airSlate SignNow when filing RI 1120S?

AirSlate SignNow offers several pricing plans tailored to fit different business needs. Each plan includes features that facilitate the eSigning process, including options for managing multiple RI 1120S forms without the hassle of paper documents, making it a cost-effective solution.

-

What features does airSlate SignNow offer for completing the RI 1120S?

AirSlate SignNow provides a variety of features to assist with the RI 1120S, including customizable templates, secure document storage, and real-time tracking of document status. These features enhance collaboration and provide transparency throughout the filing process.

-

Is there a trial period available for airSlate SignNow users concerned about RI 1120S filing?

Yes, airSlate SignNow offers a free trial period for new users to explore its functionalities before committing to a paid plan. This allows prospective customers to assess how the platform can simplify their RI 1120S filing processes without any initial investment.

-

Can I integrate airSlate SignNow with other accounting software when handling the RI 1120S?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software, allowing users to streamline their financial processes when dealing with the RI 1120S. This integration ensures that all financial data is synchronized, making the filing process much smoother.

-

What are the benefits of using airSlate SignNow for the RI 1120S?

Using airSlate SignNow for the RI 1120S simplifies the filing and signing process, reduces paperwork, and minimizes errors. Additionally, it enhances document security and accessibility, allowing users to manage their tax forms effortlessly from anywhere.

Get more for State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M

- Security appeal form

- Rebuttal memorandum supporting summary judgment motion mississippi form

- Memorandum in opposition to appellants motion for summary judgment mississippi form

- Memorandum order form

- Notice appeal sample form

- Answer defendant sample form

- Summary judgment motion mississippi form

- Afes section 125 flexible benefit plan expense form

Find out other State Of Rhode Island Division Of TaxationBusiness Services Rhode Island Nellie M GorbeaBusiness Services Rhode Island Nellie M

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document