3 Total Additions from Page 2, Schedule C, Line 1d 2019

Understanding Total Additions from Schedule C

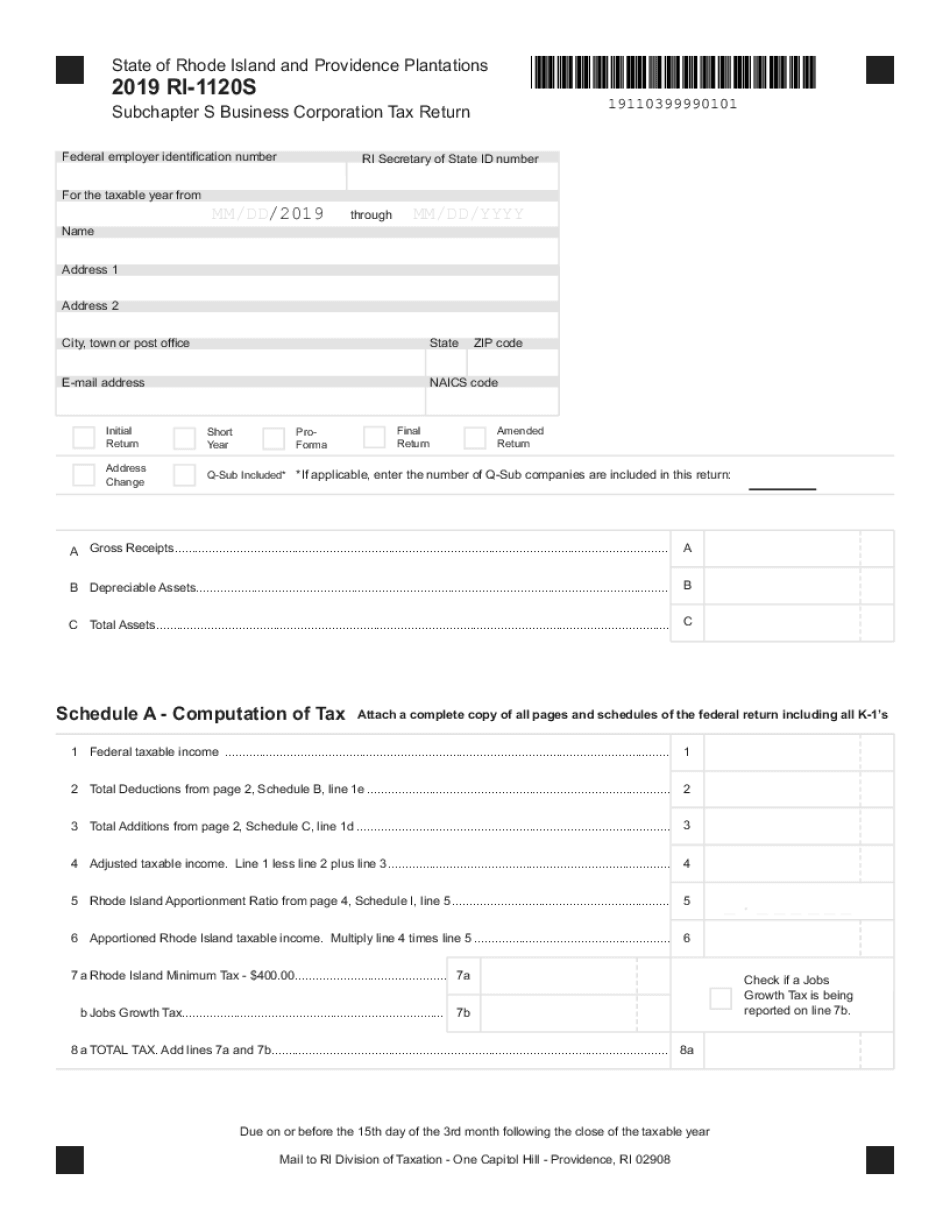

The 3 Total Additions from Page 2, Schedule C, Line 1d, represent specific income adjustments that a business must account for when filing the ri 1120S tax form. These additions typically include items such as interest income, dividend income, and other specific types of income that are not directly related to the core business operations. Understanding these additions is crucial for accurately reporting your business income and ensuring compliance with tax regulations.

Steps to Complete the Total Additions

To accurately complete the 3 Total Additions from Page 2, Schedule C, Line 1d, follow these steps:

- Gather all relevant income documentation, including bank statements and financial records.

- Identify and list all sources of income that qualify as total additions, such as interest and dividends.

- Calculate the total amount for each source and ensure that the figures are accurate.

- Enter the total amounts on the appropriate line of the ri 1120S form.

IRS Guidelines for Total Additions

The IRS provides specific guidelines regarding what constitutes total additions for the ri 1120S tax form. It is essential to refer to the latest IRS publications and instructions for Schedule C to ensure compliance with federal tax laws. The guidelines clarify which types of income must be included and how they should be reported, helping taxpayers avoid potential errors that could lead to audits or penalties.

Filing Deadlines for the ri 1120S

Filing deadlines for the ri 1120S tax form are critical to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is advisable to check for any updates or changes to deadlines that may occur due to legislative actions or IRS announcements.

Required Documents for Filing

When preparing to file the ri 1120S, several documents are necessary to ensure a complete and accurate submission. These documents include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources, including the 3 Total Additions.

- Previous year’s tax returns for reference.

- Any supporting documentation for deductions and credits claimed.

Penalties for Non-Compliance

Failure to accurately report the 3 Total Additions or to file the ri 1120S on time can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and interest may accrue on unpaid taxes. Additionally, non-compliance can lead to audits, which can further complicate a business's financial situation. It is essential to adhere to all filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete 3 total additions from page 2 schedule c line 1d

Effortlessly Prepare 3 Total Additions From Page 2, Schedule C, Line 1d on Any Device

Managing documents online has gained signNow traction with both organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it on the web. airSlate SignNow provides all the necessary tools for you to create, alter, and electronically sign your documents rapidly without any delays. Handle 3 Total Additions From Page 2, Schedule C, Line 1d across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Method to Edit and Electronically Sign 3 Total Additions From Page 2, Schedule C, Line 1d with Ease

- Find 3 Total Additions From Page 2, Schedule C, Line 1d and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 3 Total Additions From Page 2, Schedule C, Line 1d while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3 total additions from page 2 schedule c line 1d

Create this form in 5 minutes!

How to create an eSignature for the 3 total additions from page 2 schedule c line 1d

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the ri 1120s form and why is it important?

The ri 1120s form is a tax return specifically designed for S corporations in Rhode Island. It is essential for compliance with state tax regulations, ensuring that S corporations accurately report their income, deductions, and credits. Filing the ri 1120s can help businesses avoid penalties and maintain good standing with the state.

-

How can airSlate SignNow assist with the ri 1120s form?

airSlate SignNow provides a reliable platform for electronically signing and sending documents, including the ri 1120s form. With its easy-to-use interface, businesses can streamline the submission process, ensuring that their forms are filed quickly and securely. This efficiency can save time and reduce stress during tax season.

-

What pricing options are available for airSlate SignNow tailored to the ri 1120s filing?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options suitable for those managing the ri 1120s form. These plans provide flexible features for document management and eSigning, ensuring that you only pay for what you need. Check the website for the latest pricing information and any special offers.

-

What features does airSlate SignNow offer that are beneficial for handling the ri 1120s form?

airSlate SignNow offers features like customizable templates, collaborative signing, and secure document storage that are particularly useful for handling the ri 1120s form. These features enable businesses to create tailored documents quickly and facilitate easy collaboration among stakeholders for timely submission. Enhanced security measures also protect sensitive information.

-

Can I integrate airSlate SignNow with other software for ri 1120s management?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management software. This means you can effortlessly connect your tools for improved efficiency when preparing and submitting the ri 1120s form. Integrations help streamline data transfer, reducing manual entry and minimizing errors.

-

What are the benefits of using airSlate SignNow for the ri 1120s form?

Using airSlate SignNow for the ri 1120s form offers notable benefits like increased efficiency, enhanced security, and improved collaboration among team members. The platform's user-friendly design allows for quick document creation and easy access, making tax filing less daunting. Plus, eSigning capabilities speed up the approval process.

-

Is airSlate SignNow legally compliant for electronic signatures on the ri 1120s form?

Absolutely! airSlate SignNow is compliant with industry standards and electronic signature laws, such as the ESIGN Act and UETA. This means that signatures captured through the platform are legally binding and valid for the ri 1120s form. Businesses can confidently use airSlate SignNow for their electronic document needs.

Get more for 3 Total Additions From Page 2, Schedule C, Line 1d

- Request records form

- Closure estate form

- Stock option agreement form

- Sample letter for aptitude test request form

- Sample letter waiver form

- Shareholders buy sell agreement of stock in a close corporation with agreement of spouse and stock transfer restrictions 497333374 form

- Sample letter workplace form

- Deed conveying 497333376 form

Find out other 3 Total Additions From Page 2, Schedule C, Line 1d

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure