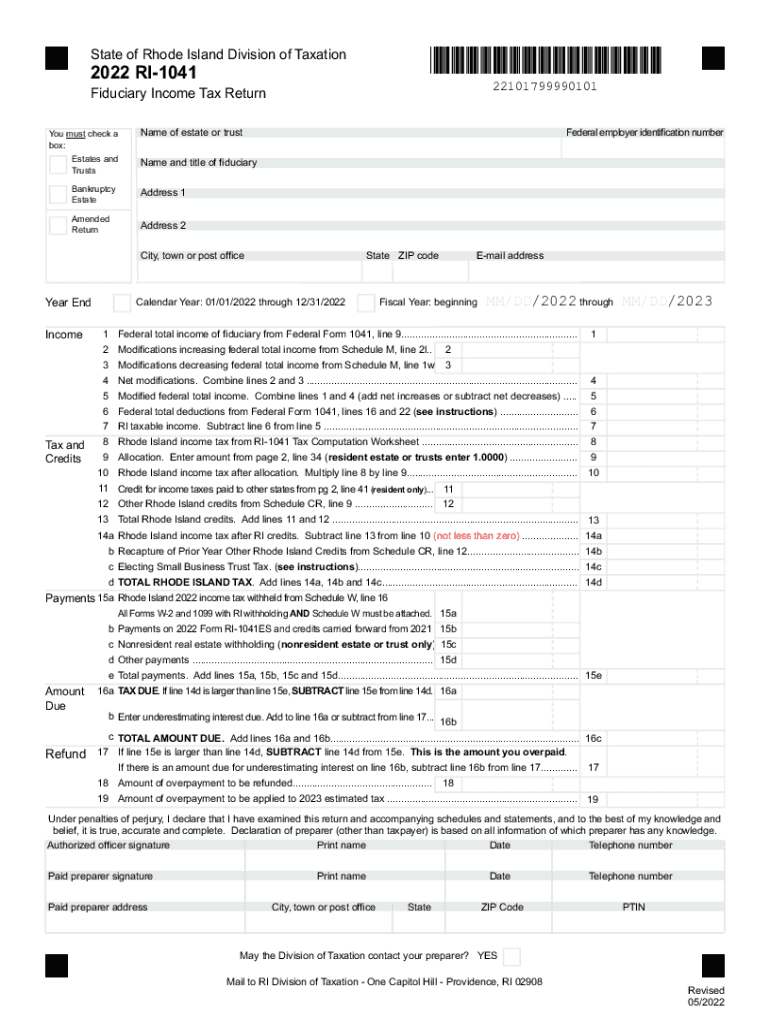

Fiduciary Income Tax Forms RI Division of Taxation RI Gov 2022-2026

Understanding the IRS Name Control

The IRS name control is a critical element used by the Internal Revenue Service to identify taxpayers and their associated accounts. It is derived from the first four characters of a taxpayer's last name, or in the case of a business, the first four characters of the business name. This control helps the IRS efficiently manage and track tax records, ensuring that all filings are accurately assigned to the correct taxpayer. Understanding how to correctly identify and use the name control can streamline the filing process and reduce the likelihood of errors.

Steps to Use the IRS Name Control

To effectively utilize the IRS name control, follow these steps:

- Identify the last name or business name as it appears on the tax return.

- Extract the first four characters from the last name or business name. If the name has fewer than four characters, use the full name and add spaces to fill the remaining characters.

- Ensure that the name control is entered correctly on all relevant tax forms to avoid processing delays.

- Verify the name control against IRS guidelines to ensure compliance.

Common Issues with IRS Name Control

Errors in the IRS name control can lead to significant issues, such as delayed processing of tax returns or refunds. Common problems include:

- Incorrect spelling of names or business names.

- Using nicknames or variations of names instead of the legal name.

- Failing to account for spaces in names with fewer than four characters.

To avoid these issues, double-check the name control against official documents and IRS records before submission.

IRS Guidelines for Name Control

The IRS provides specific guidelines on how to determine and use name controls. These include:

- For individuals, the name control is based on the last name. For married couples filing jointly, use the last name of the primary taxpayer.

- For businesses, the name control is based on the business name as registered with the IRS.

- In cases of name changes, such as marriage or divorce, the name control must be updated to reflect the current legal name.

Following these guidelines ensures compliance and helps prevent processing errors.

Importance of Accurate IRS Name Control

Accurate IRS name control is essential for several reasons:

- It facilitates the correct processing of tax returns, reducing the risk of audits or inquiries.

- It ensures that refunds and correspondence are directed to the right taxpayer.

- It helps maintain accurate tax records, which is crucial for future filings and audits.

By prioritizing accuracy in name control, taxpayers can enhance their filing experience and minimize complications.

Quick guide on how to complete fiduciary income tax forms ri division of taxation rigov

Effortlessly Prepare Fiduciary Income Tax Forms RI Division Of Taxation RI gov on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Fiduciary Income Tax Forms RI Division Of Taxation RI gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to Edit and eSign Fiduciary Income Tax Forms RI Division Of Taxation RI gov with Ease

- Locate Fiduciary Income Tax Forms RI Division Of Taxation RI gov and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Fiduciary Income Tax Forms RI Division Of Taxation RI gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary income tax forms ri division of taxation rigov

Create this form in 5 minutes!

How to create an eSignature for the fiduciary income tax forms ri division of taxation rigov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for managing the 2022 ri return?

The airSlate SignNow solution provides businesses with a streamlined process for managing their 2022 ri return. It allows users to easily create, send, and eSign important documents related to tax returns, ensuring a secure and efficient workflow. With our user-friendly interface, handling your 2022 ri return becomes a hassle-free experience.

-

How much does airSlate SignNow cost for managing the 2022 ri return?

airSlate SignNow offers various pricing plans to suit different business needs, starting at a budget-friendly monthly rate. Each plan includes features designed to effectively handle your 2022 ri return, ensuring businesses of all sizes can find a solution that fits their budget. Additionally, there may be free trials available to help you get started without upfront costs.

-

What features does airSlate SignNow provide for the 2022 ri return?

For your 2022 ri return, airSlate SignNow offers features like customizable templates, secure eSigning, and automated workflows. These tools help you streamline the documentation process, reduce paper usage, and ensure compliance with regulatory standards. By leveraging these features, businesses can easily manage their 2022 ri return more effectively.

-

Can airSlate SignNow integrate with other software to assist with the 2022 ri return?

Yes, airSlate SignNow seamlessly integrates with popular accounting and financial software to assist with your 2022 ri return. This integration ensures that all documents and financial data are synchronized, allowing for a comprehensive approach to managing your tax processes. By using these integrations, you can increase efficiency and reduce the chances of errors during your 2022 ri return preparation.

-

How secure is airSlate SignNow when handling the 2022 ri return?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption methods and adheres to best practices in data protection to ensure that your confidential information related to the 2022 ri return remains safe and secure. You can trust that your documents are handled with the utmost care and are compliant with industry regulations.

-

What are the benefits of using airSlate SignNow for the 2022 ri return?

Using airSlate SignNow for your 2022 ri return provides numerous benefits, including time savings, increased accuracy, and enhanced compliance. Our platform simplifies the signing process, reducing the time spent on document handling. Additionally, it minimizes the risk of errors, ensuring that your 2022 ri return is accurate and meets all necessary requirements.

-

Is there customer support available for issues related to the 2022 ri return?

Absolutely! airSlate SignNow offers dedicated customer support to assist with any questions or issues you may encounter while managing your 2022 ri return. Our knowledgeable support team is available through multiple channels, ensuring you receive prompt assistance whenever it's needed during your tax preparation process.

Get more for Fiduciary Income Tax Forms RI Division Of Taxation RI gov

- Legal last will and testament form for married person with minor children pennsylvania

- Codicil form sample

- Legal last will and testament form for married person with adult and minor children from prior marriage pennsylvania

- Legal last will and testament form for married person with adult and minor children pennsylvania

- Mutual wills package with last wills and testaments for married couple with adult and minor children pennsylvania form

- Pennsylvania widow 497324932 form

- Legal last will and testament form for widow or widower with minor children pennsylvania

- Legal last will form for a widow or widower with no children pennsylvania

Find out other Fiduciary Income Tax Forms RI Division Of Taxation RI gov

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later