Fiduciary Income Tax Forms Rhode Island Division of Taxation 2020

What is the Fiduciary Income Tax Forms Rhode Island Division Of Taxation

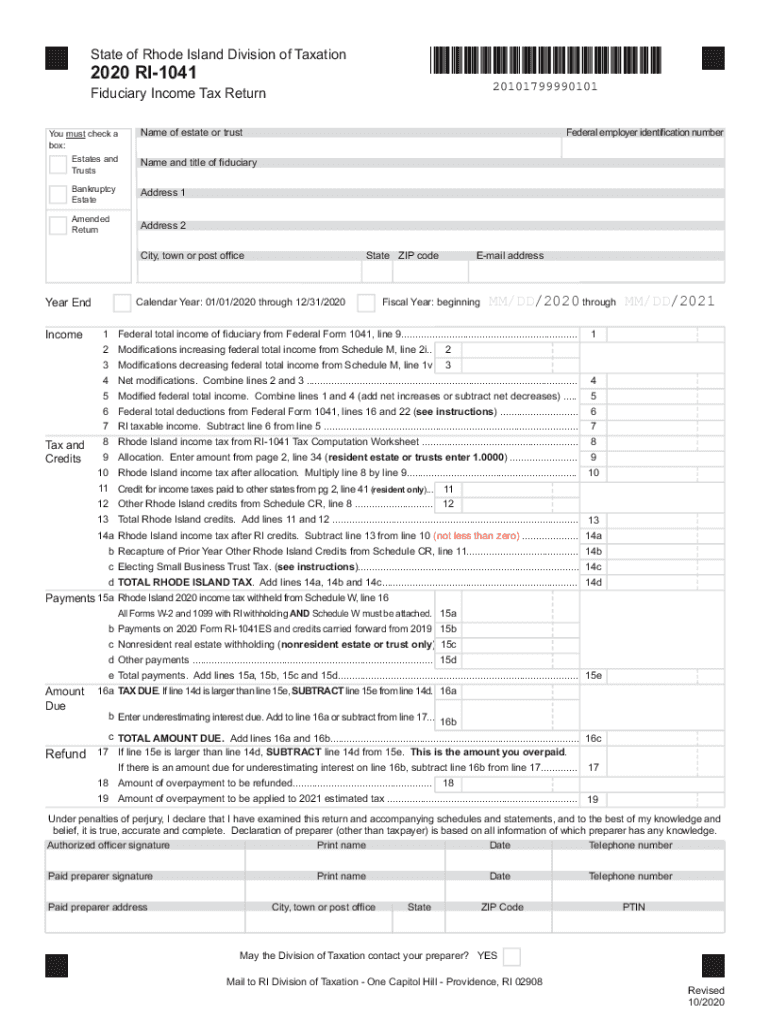

The Rhode Island 1041 form, also known as the Fiduciary Income Tax Return, is utilized by estates and trusts to report income, deductions, and tax liabilities. This form is essential for fiduciaries managing the financial affairs of deceased individuals or individuals who are unable to manage their own finances. It is important for ensuring compliance with state tax regulations and for accurately calculating the tax obligations of the estate or trust.

Steps to complete the Fiduciary Income Tax Forms Rhode Island Division Of Taxation

Completing the Rhode Island 1041 form involves several key steps:

- Gather necessary documentation, including income statements, deduction records, and information about beneficiaries.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate the total tax liability based on the information provided.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Rhode Island 1041 form is crucial to avoid penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts that operate on a calendar year, this means the deadline is April 15. Extensions may be available, but it is important to file for an extension before the original deadline.

Required Documents

To complete the Rhode Island 1041 form, certain documents are required:

- Income statements for the estate or trust, such as interest, dividends, and rental income.

- Records of deductions, including administrative expenses and distributions to beneficiaries.

- Identification information for the trust or estate, including the Employer Identification Number (EIN).

- Any prior year returns that may provide context for the current filing.

Legal use of the Fiduciary Income Tax Forms Rhode Island Division Of Taxation

The Rhode Island 1041 form is legally binding when completed and submitted according to state regulations. It must be signed by the fiduciary, who is responsible for the accuracy of the information provided. Failure to comply with the legal requirements for filing can result in penalties or legal consequences for the fiduciary.

Form Submission Methods (Online / Mail / In-Person)

The Rhode Island 1041 form can be submitted in several ways. Taxpayers may file the form electronically through approved e-filing systems, which can expedite processing and reduce errors. Alternatively, the form can be mailed to the Rhode Island Division of Taxation. In-person submissions are generally not available, as most filings are processed electronically or via mail.

Quick guide on how to complete fiduciary income tax forms rhode island division of taxation

Effortlessly Prepare Fiduciary Income Tax Forms Rhode Island Division Of Taxation on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a flawless eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Fiduciary Income Tax Forms Rhode Island Division Of Taxation on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Fiduciary Income Tax Forms Rhode Island Division Of Taxation

- Obtain Fiduciary Income Tax Forms Rhode Island Division Of Taxation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Dismiss concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fiduciary Income Tax Forms Rhode Island Division Of Taxation and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary income tax forms rhode island division of taxation

Create this form in 5 minutes!

How to create an eSignature for the fiduciary income tax forms rhode island division of taxation

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Rhode Island 1041 form?

The Rhode Island 1041 form is a state income tax return filed by estates and trusts in Rhode Island. This form is essential for reporting income and distributions to beneficiaries. Using airSlate SignNow, you can seamlessly eSign your Rhode Island 1041, making tax filing more efficient.

-

How can airSlate SignNow help with filing the Rhode Island 1041?

airSlate SignNow simplifies the process of preparing and submitting your Rhode Island 1041. With its user-friendly interface, you can easily gather signatures from trustees and beneficiaries, ensuring compliance with state regulations. Plus, our platform offers secure storage for all your documents.

-

Is airSlate SignNow cost-effective for Rhode Island 1041 eSigning?

Yes, airSlate SignNow provides a cost-effective solution for eSigning your Rhode Island 1041. With various pricing plans tailored to meet different business needs, you can choose the one that fits your budget while enjoying powerful features. Investing in our solution can save time and reduce the hassle of manual signatures.

-

What features does airSlate SignNow offer for Rhode Island 1041 signing?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure cloud storage that are essential for efficiently managing your Rhode Island 1041 signing process. Additionally, our solution includes reminder notifications and audit trails, ensuring that every signature is captured and documented.

-

Can airSlate SignNow integrate with other software for Rhode Island 1041 management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage your Rhode Island 1041 documentation. These integrations help streamline your workflows and maintain organized records across different platforms.

-

What are the benefits of using airSlate SignNow for the Rhode Island 1041?

Using airSlate SignNow for your Rhode Island 1041 comes with numerous benefits, including increased efficiency, reduced paperwork, and expedited signature collection. The platform's compliance with legal eSigning standards also ensures that your forms meet state requirements without hassle.

-

How secure is airSlate SignNow for handling the Rhode Island 1041?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the Rhode Island 1041. We utilize industry-standard encryption and compliance measures to safeguard your data. Rest assured, your information will remain confidential and secure throughout the signing process.

Get more for Fiduciary Income Tax Forms Rhode Island Division Of Taxation

Find out other Fiduciary Income Tax Forms Rhode Island Division Of Taxation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors