Form RI W3 RI Division of Taxation 2022

What is the Form RI W3?

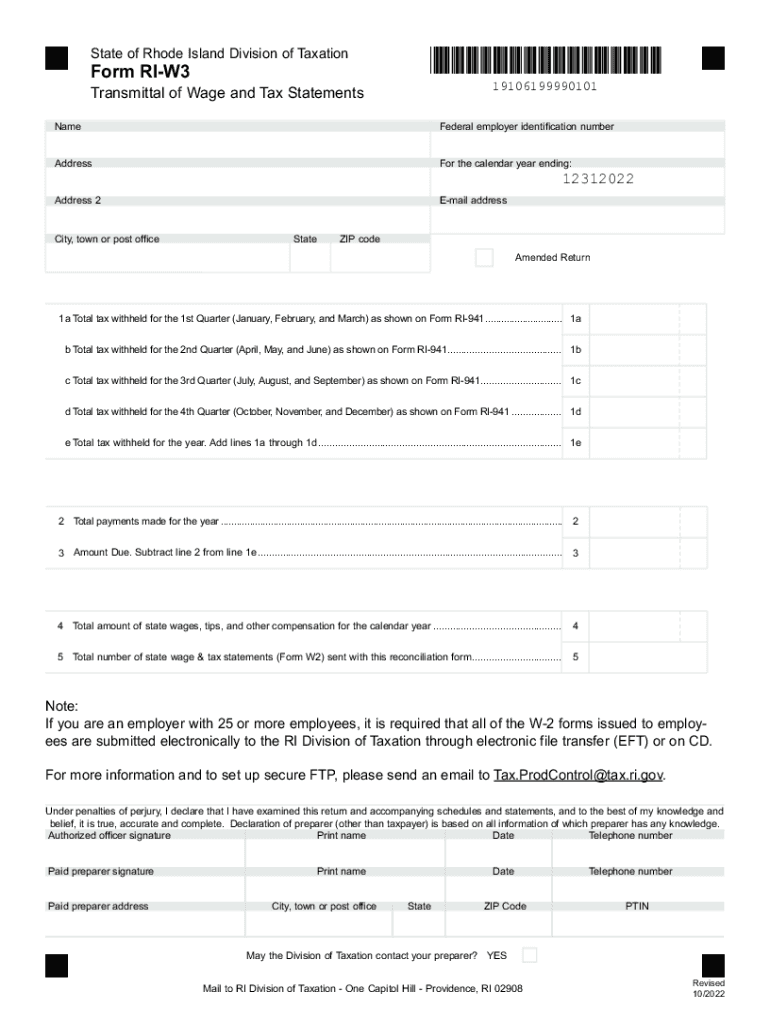

The Form RI W3 is a tax document used by employers in Rhode Island to report the total amount of wages paid and the total amount of state income tax withheld from employees during the tax year. This form is essential for both the employer and the state, as it ensures accurate reporting of income and tax contributions. The RI Division of Taxation requires this form to be submitted annually, typically alongside the employer's quarterly and annual tax filings.

How to use the Form RI W3

To effectively use the Form RI W3, employers must gather all necessary payroll information for the reporting year. This includes total wages paid to employees and the total state income tax that has been withheld. The completed form should then be submitted to the Rhode Island Division of Taxation. Employers can file the form electronically or through traditional mail, depending on their preference and compliance requirements.

Steps to complete the Form RI W3

Completing the Form RI W3 involves several key steps:

- Gather payroll records for the entire tax year, including total wages and tax withheld.

- Fill in the employer's information, including name, address, and federal employer identification number (EIN).

- Input the total wages paid and the total state income tax withheld in the designated fields.

- Review the information for accuracy to ensure compliance with state regulations.

- Submit the completed form by the specified deadline, which is typically January 31 of the following year.

Legal use of the Form RI W3

The legal use of the Form RI W3 is governed by state tax laws, which mandate that employers accurately report wages and tax withholdings. Failure to submit this form can result in penalties and fines. It is crucial for employers to understand their obligations under Rhode Island law to avoid any legal repercussions. Compliance with these regulations not only supports the state's tax system but also ensures that employees receive proper credit for their withholdings.

Key elements of the Form RI W3

Key elements of the Form RI W3 include:

- Employer information: Name, address, and EIN.

- Total wages paid to employees during the year.

- Total state income tax withheld.

- Signature of the employer or authorized representative.

These elements are critical for the accurate processing of tax information by the Rhode Island Division of Taxation.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form RI W3. The form is due annually by January 31 of the year following the tax year being reported. It is important to adhere to this deadline to avoid penalties. Additionally, employers should keep track of any changes in state tax regulations that may affect filing requirements.

Quick guide on how to complete form ri w3 ri division of taxation

Easily prepare Form RI W3 RI Division Of Taxation on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Form RI W3 RI Division Of Taxation on any device using airSlate SignNow's applications for Android or iOS and streamline any document-related process today.

How to edit and eSign Form RI W3 RI Division Of Taxation effortlessly

- Locate Form RI W3 RI Division Of Taxation and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form RI W3 RI Division Of Taxation and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ri w3 ri division of taxation

Create this form in 5 minutes!

How to create an eSignature for the form ri w3 ri division of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W3 and how does it relate to airSlate SignNow?

What is a W3? It refers to a 'Web 3' concept that emphasizes decentralized and user-centric experiences. In the context of airSlate SignNow, it highlights our commitment to providing businesses with innovative, secure, and efficient eSigning solutions that align with modern web practices.

-

How does airSlate SignNow ensure security when eSigning documents?

What is a W3? It's about ensuring security in digital interactions. AirSlate SignNow utilizes advanced encryption protocols and complies with industry regulations to protect your documents and signatures, making it a trustworthy solution for businesses.

-

Is there a cost associated with using airSlate SignNow?

What is a W3? As part of our commitment to transparency, airSlate SignNow offers various pricing plans designed to meet different business needs. Our pricing is competitive and provides exceptional value for features such as unlimited eSignatures and document storage.

-

What features does airSlate SignNow offer for document management?

What is a W3? It refers to advanced web functionalities. AirSlate SignNow provides features like automated workflows, templates, and real-time collaboration, enabling you to manage documents efficiently and effectively.

-

Can I integrate airSlate SignNow with other software tools?

What is a W3? It signifies integration and collaboration. AirSlate SignNow supports seamless integrations with popular software applications like Salesforce, Google Drive, and Microsoft Office, enhancing your workflow and productivity.

-

What are the benefits of using airSlate SignNow for my business?

What is a W3? It's about leveraging technology for better business outcomes. AirSlate SignNow enhances efficiency by streamlining document signing processes, reducing turnaround time, and improving client satisfaction with quick and convenient eSigning.

-

How easy is it to use airSlate SignNow for document eSigning?

What is a W3? It embodies user-friendly design. AirSlate SignNow features an intuitive interface that makes it easy for anyone to send and eSign documents, regardless of their technical expertise. Quick onboarding ensures you can get started right away.

Get more for Form RI W3 RI Division Of Taxation

- Refrigeration contract for contractor rhode island form

- Drainage contract for contractor rhode island form

- Foundation contract for contractor rhode island form

- Plumbing contract for contractor rhode island form

- Brick mason contract for contractor rhode island form

- Roofing contract for contractor rhode island form

- Electrical contract for contractor rhode island form

- Sheetrock drywall contract for contractor rhode island form

Find out other Form RI W3 RI Division Of Taxation

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure