Form RI W 3 2023

What is the Form RI W-3

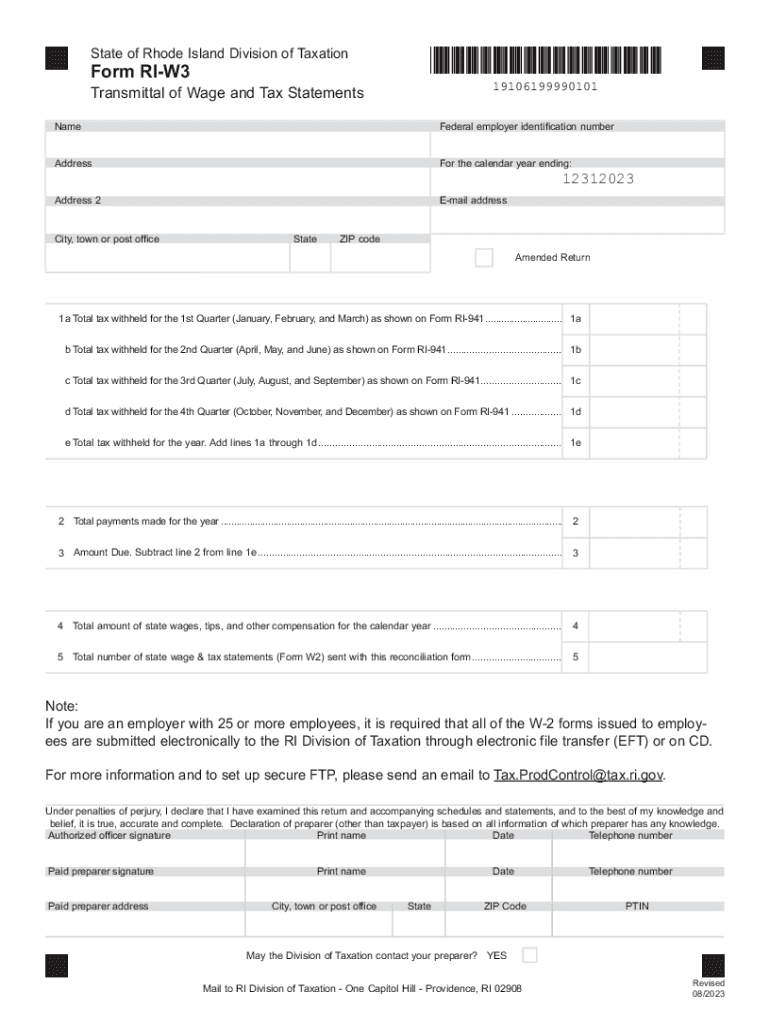

The Form RI W-3 is a state-specific tax form used in Rhode Island to report annual wage information and withholding for employees. This form is essential for employers, as it summarizes the total wages paid and the total state income tax withheld from those wages during the calendar year. The RI W-3 is submitted to the Rhode Island Division of Taxation and is typically filed alongside the individual W-2 forms for each employee.

How to use the Form RI W-3

Employers use the Form RI W-3 to report the aggregate wage data for all employees. It serves as a summary of the W-2 forms issued to employees, consolidating information such as total wages, tips, and other compensation. To use the form effectively, employers must ensure that all employee W-2 forms are accurately completed and then compile the totals to fill out the RI W-3. This ensures compliance with state tax regulations and facilitates the correct processing of employee tax records.

Steps to complete the Form RI W-3

Completing the Form RI W-3 involves several key steps:

- Gather all W-2 forms issued to employees for the tax year.

- Calculate the total wages, tips, and other compensation paid to employees.

- Determine the total state income tax withheld from all employees.

- Fill out the RI W-3 form with the calculated totals, ensuring accuracy.

- Review the completed form for any errors before submission.

Legal use of the Form RI W-3

The Form RI W-3 must be filed by employers in accordance with Rhode Island state law. It is a legal requirement for reporting wage and tax information to the state. Failure to file the form or inaccuracies in the reported information can result in penalties, including fines or additional scrutiny from tax authorities. Employers should maintain accurate records to support the figures reported on the RI W-3.

Filing Deadlines / Important Dates

Employers must submit the Form RI W-3 by the deadline established by the Rhode Island Division of Taxation. Typically, this deadline coincides with the federal filing deadline for W-2 forms, which is January thirty-first of the following year. Employers should be aware of any updates or changes to filing deadlines to ensure timely compliance.

Who Issues the Form

The Form RI W-3 is issued by the Rhode Island Division of Taxation. This state agency oversees tax collection and compliance, providing the necessary forms and guidelines for employers to report wage and tax information accurately. Employers can obtain the form directly from the Division of Taxation's website or through authorized tax preparation software.

Quick guide on how to complete form ri w 3

Effortlessly prepare Form RI W 3 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the needed form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Form RI W 3 on any device using the airSlate SignNow Android or iOS apps and streamline any document-related task today.

Effortlessly modify and electronically sign Form RI W 3

- Locate Form RI W 3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal standing as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form RI W 3 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ri w 3

Create this form in 5 minutes!

How to create an eSignature for the form ri w 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ri w3 and how does it relate to airSlate SignNow?

The term 'ri w3' refers to the web services integration offered by airSlate SignNow. This feature allows businesses to efficiently manage and streamline document workflows, making eSigning and document sharing seamless.

-

What pricing options are available for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs. With options starting from a cost-effective base rate, companies can choose the plan that best accommodates their usage and desired features, all while integrating with 'ri w3' functionalities.

-

Can airSlate SignNow integrate with other platforms?

Yes, airSlate SignNow provides robust integrations with various platforms, including CRM systems and cloud storage solutions. This ease of integration with 'ri w3' helps businesses streamline their processes and enhance workflow efficiency.

-

What are the main features of airSlate SignNow?

The key features of airSlate SignNow include easy document creation, customizable templates, and secure eSigning capabilities. All of these features work seamlessly with 'ri w3' to ensure that your document management is both simple and efficient.

-

How does airSlate SignNow benefit remote teams?

For remote teams, airSlate SignNow provides an efficient and user-friendly eSigning solution, allowing members to sign documents from anywhere. The 'ri w3' integration supports collaborative document workflows that enhance teamwork, even when working apart.

-

Is airSlate SignNow secure for sensitive documents?

Yes, airSlate SignNow prioritizes document security with advanced encryption and compliance standards. Using 'ri w3,' your sensitive documents are protected throughout the eSigning process, ensuring confidentiality and integrity.

-

How user-friendly is airSlate SignNow for new users?

airSlate SignNow is designed to be intuitive and easy to navigate, making it ideal for new users. The application’s integration with 'ri w3' enhances usability, allowing users to quickly learn and implement the platform for their document needs.

Get more for Form RI W 3

Find out other Form RI W 3

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word