Form RI W3 Rhode Island Division of Taxation 2024

What is the Form RI W3?

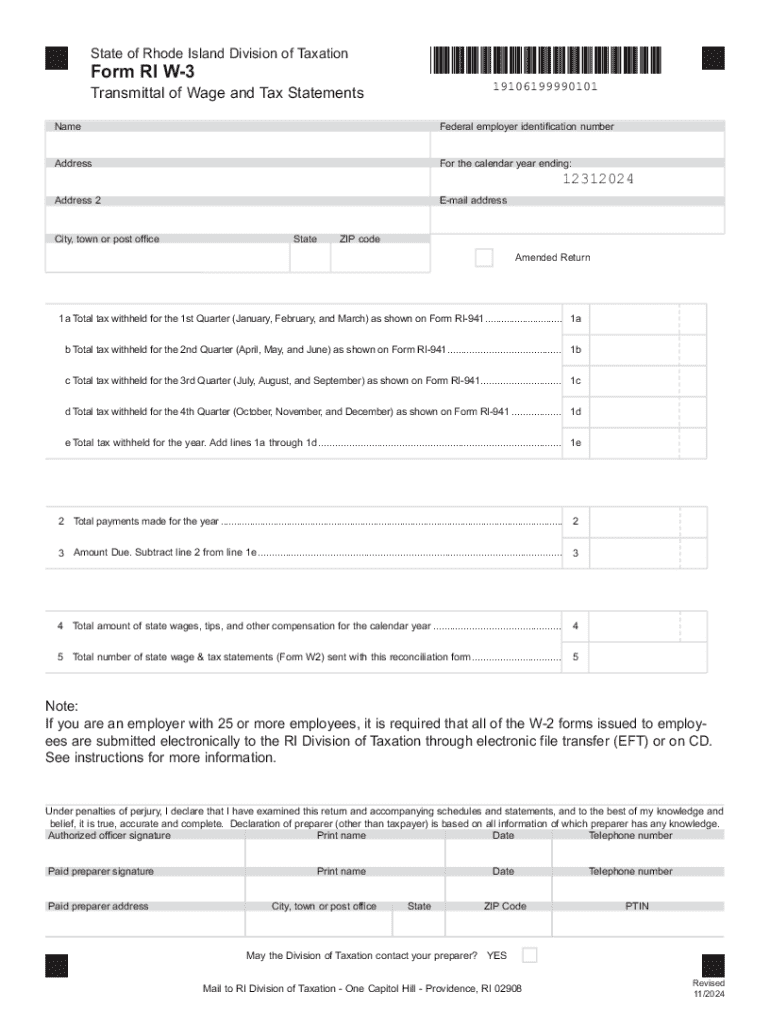

The Form RI W3 is a tax document issued by the Rhode Island Division of Taxation. It serves as a reconciliation form that employers must file to report the total amount of personal income tax withheld from employees' wages during the tax year. This form consolidates information from individual employee W-2 forms, ensuring that the state has an accurate record of tax withholdings for each employer. Understanding the purpose of the RI W3 is essential for compliance with Rhode Island tax regulations.

Steps to Complete the Form RI W3

Completing the Form RI W3 involves several key steps to ensure accuracy and compliance. First, gather all employee W-2 forms for the tax year. Next, calculate the total amount of personal income tax withheld from all employees. This total should match the sum of the amounts reported on the individual W-2 forms. After compiling this information, fill out the RI W3 form with the required details, including the employer's information and the total tax withheld. Finally, review the completed form for accuracy before submission.

Legal Use of the Form RI W3

The Form RI W3 is legally required for all employers in Rhode Island who withhold personal income tax from employee wages. Filing this form is essential for compliance with state tax laws. Employers must submit the RI W3 along with their W-2 forms by the designated deadline to avoid penalties. Failure to file or inaccuracies in reporting can lead to legal repercussions, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form RI W3. Typically, the form is due by the last day of January following the end of the tax year. For example, for the tax year ending December 31, the RI W3 must be submitted by January 31 of the following year. It is crucial to adhere to these deadlines to ensure compliance and avoid potential penalties for late filing.

Required Documents

To complete the Form RI W3, employers need several supporting documents. The primary document is the employee W-2 forms, which detail individual earnings and tax withholdings for each employee. Additionally, employers should have records of any adjustments or corrections made throughout the year, as these may need to be reflected on the RI W3. Keeping accurate records will facilitate a smoother filing process and help ensure compliance with tax regulations.

Form Submission Methods

The Form RI W3 can be submitted through various methods, depending on the preferences of the employer. Employers may file the form electronically through the Rhode Island Division of Taxation's online portal, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate tax office. It is important to ensure that all submissions are completed accurately and on time, regardless of the chosen method.

Penalties for Non-Compliance

Employers who fail to file the Form RI W3 on time or submit inaccurate information may face penalties imposed by the Rhode Island Division of Taxation. These penalties can include fines and interest on any unpaid taxes. Additionally, repeated non-compliance may lead to more severe consequences, including audits or further legal action. Therefore, it is essential for employers to understand their obligations and ensure timely and accurate filing of the RI W3.

Create this form in 5 minutes or less

Find and fill out the correct form ri w3 rhode island division of taxation

Create this form in 5 minutes!

How to create an eSignature for the form ri w3 rhode island division of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ri riw3 reconciliation personal employers?

The ri riw3 reconciliation personal employers refers to a process that helps employers reconcile their payroll records with the IRS requirements. This ensures that all employee tax information is accurate and compliant. Using airSlate SignNow, businesses can streamline this process with ease.

-

How does airSlate SignNow assist with ri riw3 reconciliation personal employers?

airSlate SignNow provides tools that simplify the ri riw3 reconciliation personal employers process by allowing businesses to electronically sign and manage documents. This reduces the time spent on paperwork and minimizes errors. With our platform, employers can ensure compliance and accuracy in their reconciliation efforts.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses, including those focused on ri riw3 reconciliation personal employers. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for ri riw3 reconciliation personal employers?

Our platform includes features such as document templates, automated workflows, and secure eSigning, all of which are beneficial for ri riw3 reconciliation personal employers. These tools help streamline the reconciliation process, making it easier for employers to manage their payroll documentation efficiently.

-

Can airSlate SignNow integrate with other software for ri riw3 reconciliation personal employers?

Yes, airSlate SignNow offers integrations with various accounting and payroll software, enhancing the ri riw3 reconciliation personal employers process. This allows for seamless data transfer and ensures that all records are up-to-date and accurate. Integrating with your existing systems can signNowly improve efficiency.

-

What are the benefits of using airSlate SignNow for ri riw3 reconciliation personal employers?

Using airSlate SignNow for ri riw3 reconciliation personal employers provides numerous benefits, including increased accuracy, reduced processing time, and enhanced compliance. Our platform helps businesses avoid costly errors and ensures that all documentation is securely stored and easily accessible.

-

Is airSlate SignNow secure for handling sensitive information related to ri riw3 reconciliation personal employers?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to ri riw3 reconciliation personal employers. You can trust that your data is safe while using our platform for document management and eSigning.

Get more for Form RI W3 Rhode Island Division Of Taxation

Find out other Form RI W3 Rhode Island Division Of Taxation

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free