Get the IRS Tax Forms Internal Revenue Service Tax Ri 2021

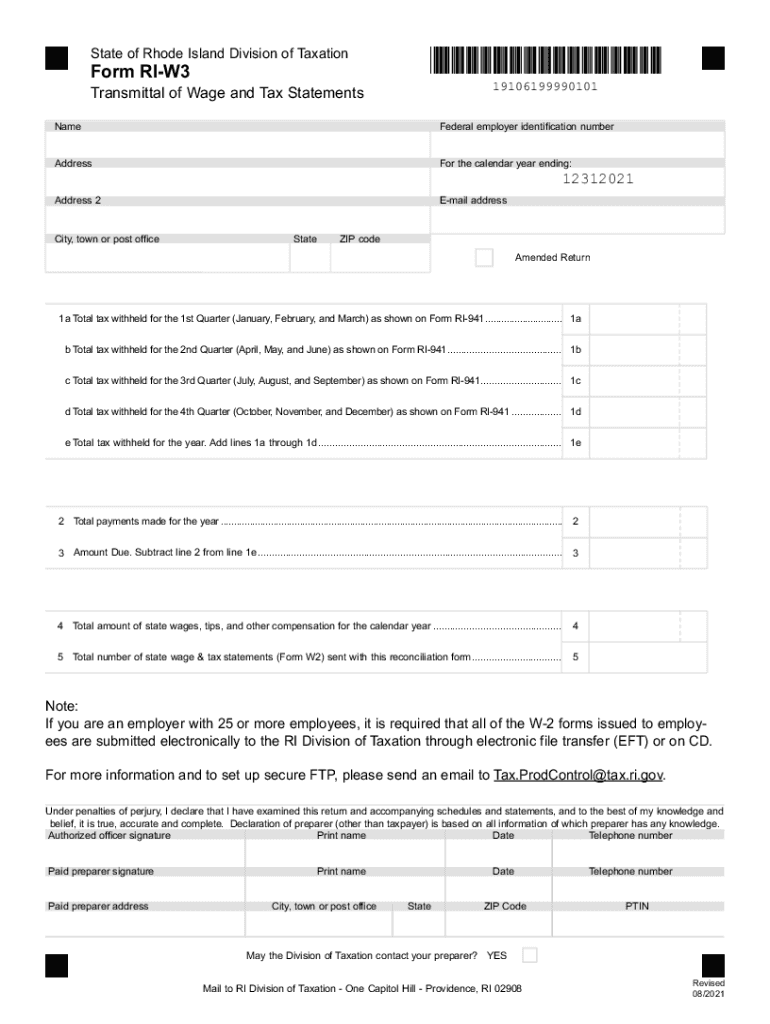

What is the RI W-3 Form?

The RI W-3 form is a state-specific tax document used by employers in Rhode Island to report annual wage and tax information. It summarizes the total wages paid and the taxes withheld for all employees during the calendar year. This form is crucial for ensuring compliance with state tax regulations and is typically submitted alongside the individual employee W-2 forms. Employers must accurately complete the RI W-3 to avoid potential penalties and ensure proper tax reporting.

Steps to Complete the RI W-3 Form

Completing the RI W-3 form involves several key steps to ensure accuracy and compliance:

- Gather all relevant employee wage information, including total wages and tax withheld for each employee.

- Fill out the employer information section, including your business name, address, and federal employer identification number (FEIN).

- Enter the total number of W-2 forms being submitted along with the RI W-3.

- Calculate the total wages paid and total state income tax withheld, ensuring these figures match the totals reported on the W-2 forms.

- Review the completed form for accuracy before submission.

Legal Use of the RI W-3 Form

The RI W-3 form is a legally required document for employers in Rhode Island. Its proper submission is essential for compliance with state tax laws. Failure to submit the form or providing inaccurate information can lead to penalties, including fines and interest on unpaid taxes. Employers should retain copies of the RI W-3 and associated W-2 forms for their records, as they may be required for audits or other tax inquiries.

Filing Deadlines for the RI W-3 Form

Employers must adhere to specific filing deadlines for the RI W-3 form to avoid penalties. The form is typically due by the last day of January following the end of the tax year. For example, for the 2021 tax year, the RI W-3 must be submitted by January 31, 2022. It is important to stay informed about any changes to deadlines, as they can vary from year to year.

Required Documents for Filing the RI W-3 Form

To complete the RI W-3 form, employers need to have several documents on hand:

- All W-2 forms issued to employees for the reporting year.

- Employer identification information, including the FEIN.

- Total wage and tax information for each employee.

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy.

Digital vs. Paper Version of the RI W-3 Form

Employers have the option to file the RI W-3 form either digitally or via paper submission. Digital filing is often preferred for its efficiency and ease of use, allowing for faster processing and confirmation of receipt. However, some employers may still opt for paper filing due to personal preference or specific business practices. Regardless of the method chosen, it is essential to ensure that the form is completed accurately to avoid complications.

Penalties for Non-Compliance with the RI W-3 Form

Failure to file the RI W-3 form on time or submitting inaccurate information can result in significant penalties. The Rhode Island Division of Taxation may impose fines for late submissions, which can accumulate over time. Additionally, employers may face interest charges on any unpaid taxes associated with the discrepancies. It is crucial for employers to understand these potential consequences and prioritize timely and accurate filing to maintain compliance.

Quick guide on how to complete get the free irs tax forms internal revenue service tax ri

Accomplish Get The IRS Tax Forms Internal Revenue Service Tax Ri effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to find the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Get The IRS Tax Forms Internal Revenue Service Tax Ri on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Get The IRS Tax Forms Internal Revenue Service Tax Ri seamlessly

- Obtain Get The IRS Tax Forms Internal Revenue Service Tax Ri and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Get The IRS Tax Forms Internal Revenue Service Tax Ri and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free irs tax forms internal revenue service tax ri

Create this form in 5 minutes!

How to create an eSignature for the get the free irs tax forms internal revenue service tax ri

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is RI W 3 and how does it relate to airSlate SignNow?

RI W 3 refers to a specific document type you might encounter while using airSlate SignNow. It's important to ensure that your RI W 3 documents are eSigned correctly to maintain compliance and authenticity. With airSlate SignNow, you can effortlessly manage and eSign your RI W 3 documents, ensuring a smooth workflow.

-

What features does airSlate SignNow offer for managing RI W 3 documents?

AirSlate SignNow offers a range of features for effectively managing RI W 3 documents, including customizable templates, drag-and-drop functionality, and secure cloud storage. You can also track the status of your RI W 3 documents in real-time, allowing for better collaboration and efficiency. These features help streamline your document signing process.

-

How much does airSlate SignNow cost for handling RI W 3 documents?

AirSlate SignNow provides various pricing plans to accommodate your needs for handling RI W 3 documents. Whether you're a small business or a large enterprise, you can find a plan that fits your budget and usage requirements. The pricing is transparent, ensuring that you get value for your investment.

-

Is airSlate SignNow secure for eSigning RI W 3 documents?

Yes, airSlate SignNow prioritizes security when it comes to eSigning RI W 3 documents. The platform employs robust encryption protocols and is compliant with industry standards to ensure your documents are safe and secure. You can sign with confidence knowing that your data is protected.

-

Can I integrate airSlate SignNow with other tools for RI W 3 document management?

Absolutely! AirSlate SignNow integrates seamlessly with various tools to enhance your RI W 3 document management process. Whether you are using CRM systems, project management tools, or cloud storage solutions, you can easily connect them with airSlate SignNow to streamline workflows and improve productivity.

-

What benefits does airSlate SignNow provide for signing RI W 3 documents remotely?

AirSlate SignNow offers signNow benefits for signing RI W 3 documents remotely, including increased flexibility and speed. You can send documents for eSignature from anywhere, reducing turnaround time and improving overall efficiency. This is especially beneficial for businesses with remote teams or clients.

-

How do I get started with airSlate SignNow for RI W 3 documents?

Getting started with airSlate SignNow for RI W 3 documents is simple. You can sign up for a free trial, explore the platform's features, and upload your documents within minutes. With user-friendly tutorials and customer support available, you'll be up and running in no time.

Get more for Get The IRS Tax Forms Internal Revenue Service Tax Ri

- Mississippi paternity 497314641 form

- Stipulated agreement 497314642 form

- Mississippi stipulated agreement form

- Ms paternity 497314644 form

- Mississippi paternity 497314645 form

- Power of attorney for healthcare mississippi form

- Motion to examine judgment debtor mississippi form

- Affidavit for nonresident status mississippi form

Find out other Get The IRS Tax Forms Internal Revenue Service Tax Ri

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors