Fillable Online Form CT 5 1 Request for Additional Extension of Time to 2022

What is the Fillable Online Form CT-5?

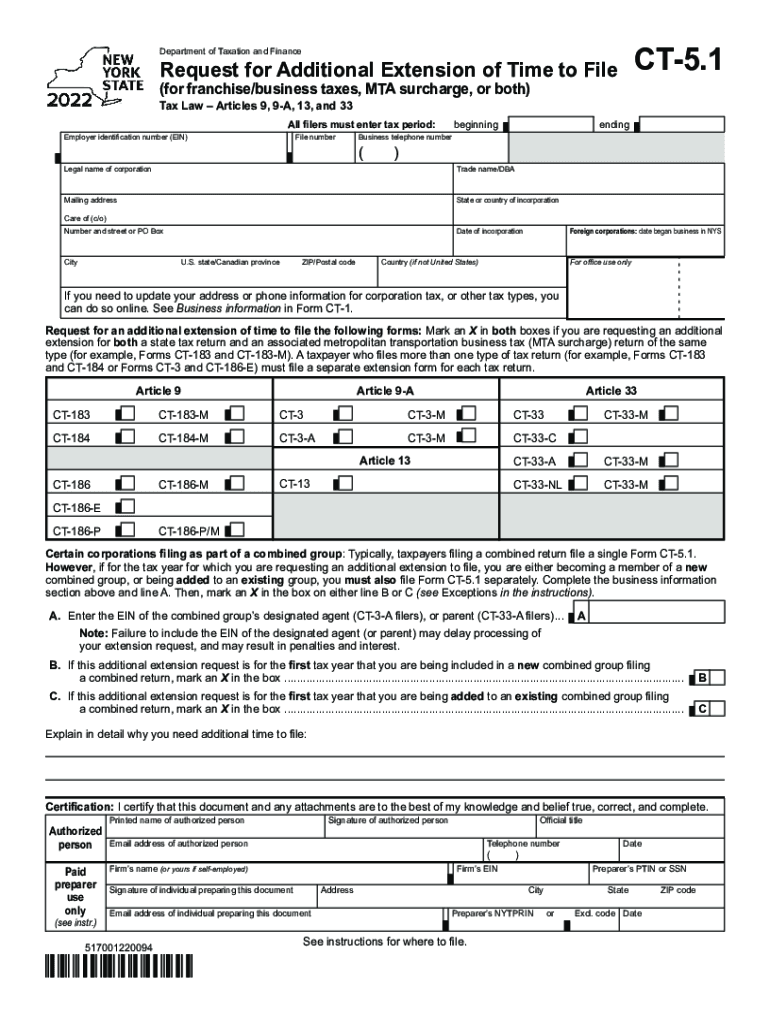

The Fillable Online Form CT-5 is a request for an additional extension of time to file New York State corporate tax returns. This form is essential for businesses that need extra time beyond the standard filing deadline. It allows taxpayers to avoid penalties associated with late submissions while ensuring compliance with state tax regulations. The form is specifically designed for corporations and partnerships that have already filed for an initial extension using Form CT-5.1.

Steps to Complete the Fillable Online Form CT-5

Completing the Fillable Online Form CT-5 involves several straightforward steps:

- Gather necessary information, including your business name, EIN, and previous tax filings.

- Access the fillable form on the official New York State Department of Taxation and Finance website.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal Use of the Fillable Online Form CT-5

The Fillable Online Form CT-5 serves a critical legal function in the New York State tax system. By submitting this form, businesses can formally request an extension to file their corporate tax returns, which is recognized by the state as a legitimate request. This legal acknowledgment helps protect taxpayers from potential penalties for late filing. It is important to ensure that the form is submitted within the appropriate time frame to maintain its validity.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form CT-5 is crucial for compliance. The request for an extension must typically be submitted by the original due date of the tax return. For most corporations, this date is the fifteenth day of the third month following the end of the tax year. Failure to file the extension request by this deadline may result in penalties and interest on any unpaid taxes.

Eligibility Criteria for Using Form CT-5

To qualify for using Form CT-5, businesses must meet specific eligibility criteria. Primarily, this form is intended for corporations and partnerships that have already filed an initial extension request using Form CT-5.1. Additionally, the business must be in good standing with the New York State Department of Taxation and Finance, meaning all previous tax obligations must be met. Understanding these criteria helps ensure that the extension request is valid and accepted.

Form Submission Methods

The Fillable Online Form CT-5 can be submitted through various methods to accommodate different preferences. Businesses can choose to file electronically through the New York State Department of Taxation and Finance website, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be possible, depending on local office policies. Each method has its own processing times and requirements, so selecting the most suitable option is essential.

Quick guide on how to complete fillable online form ct 51 request for additional extension of time to

Prepare Fillable Online Form CT 5 1 Request For Additional Extension Of Time To seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without complications. Manage Fillable Online Form CT 5 1 Request For Additional Extension Of Time To on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Fillable Online Form CT 5 1 Request For Additional Extension Of Time To effortlessly

- Locate Fillable Online Form CT 5 1 Request For Additional Extension Of Time To and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with specific tools provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending the form, whether by email, text message (SMS), invite link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and eSign Fillable Online Form CT 5 1 Request For Additional Extension Of Time To to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online form ct 51 request for additional extension of time to

Create this form in 5 minutes!

How to create an eSignature for the fillable online form ct 51 request for additional extension of time to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ct 5 and how is it used?

The form ct 5 is a crucial document used for various business transactions, especially in Connecticut. It can be utilized to file tax information or to report income and expenses. Understanding how to correctly fill out the form ct 5 can simplify your compliance process.

-

How can airSlate SignNow help with completing form ct 5?

airSlate SignNow provides an easy-to-use platform to fill out and eSign the form ct 5 digitally. With its intuitive interface, you can complete the form quickly and securely. This saves time and reduces the chances of errors associated with paper forms.

-

What are the pricing options for using airSlate SignNow for form ct 5?

airSlate SignNow offers various pricing plans to accommodate different business needs while preparing the form ct 5. You can choose from monthly or annual subscriptions, all designed to provide cost-effective solutions for document management. Pricing varies based on features and the number of users.

-

What features does airSlate SignNow offer for form ct 5 eSigning?

With airSlate SignNow, you can eSign the form ct 5 with just a few clicks. Key features include customizable templates, real-time tracking of document status, and the ability to invite multiple signers. These tools streamline the signing process, making it efficient and secure.

-

Are there any integrations available for using form ct 5 with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various applications to facilitate the completion of form ct 5. You can seamlessly connect it with popular productivity tools such as Google Drive, Microsoft Office, and CRM systems. These integrations enhance workflow efficiency.

-

What are the benefits of using airSlate SignNow for form ct 5?

Using airSlate SignNow for form ct 5 allows you to enhance productivity through streamlined processes. It eliminates the hassle of manual paperwork, provides secure document storage, and ensures compliance with legal requirements. These benefits ultimately save you time and resources.

-

Is airSlate SignNow user-friendly for preparing form ct 5?

Absolutely! airSlate SignNow is designed with usability in mind, making it simple for anyone to prepare and eSign form ct 5. The intuitive interface requires no technical expertise, allowing users to navigate and complete their tasks quickly and efficiently.

Get more for Fillable Online Form CT 5 1 Request For Additional Extension Of Time To

- Warranty deed from husband to himself and wife south carolina form

- Sc husband wife form

- Quitclaim deed from husband and wife to husband and wife south carolina form

- Sc husband wife 497325557 form

- South carolina revocation form

- Postnuptial property agreement south carolina south carolina form

- South carolina property 497325560 form

- Quitclaim deed from husband and wife to an individual south carolina form

Find out other Fillable Online Form CT 5 1 Request For Additional Extension Of Time To

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free