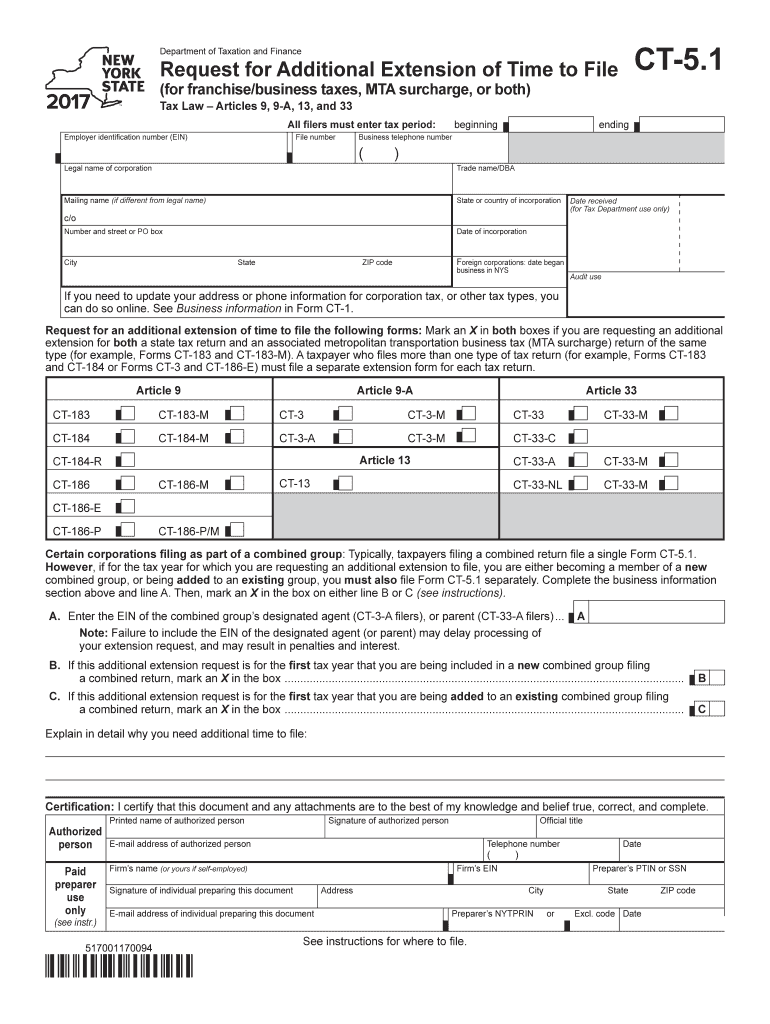

Ct 5 1 Form 2017

What is the Ct 5 1 Form

The Ct 5 1 Form is a specific tax document used in the state of Connecticut. It is primarily utilized for reporting certain income and tax information to the Connecticut Department of Revenue Services. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding the purpose of the Ct 5 1 Form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Ct 5 1 Form

Using the Ct 5 1 Form involves several key steps. First, gather all necessary financial documentation, including income statements and any relevant deductions. Next, accurately fill out the form by entering the required information in the designated fields. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the Connecticut Department of Revenue Services.

Steps to complete the Ct 5 1 Form

Completing the Ct 5 1 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, such as W-2s or 1099s.

- Access the form online or obtain a physical copy from the Connecticut Department of Revenue Services.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all figures are correct.

- Include any deductions or credits you may qualify for.

- Review the completed form for accuracy.

- Submit the form electronically or mail it to the appropriate address.

Legal use of the Ct 5 1 Form

The Ct 5 1 Form must be used in accordance with Connecticut state law. This means that all information reported must be truthful and accurate. Falsifying information on this form can lead to serious legal consequences, including fines and penalties. It is important to ensure that you are using the most current version of the form and adhering to any specific instructions provided by the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Timely filing of the Ct 5 1 Form is essential to avoid penalties. Typically, the filing deadline aligns with the federal tax return deadline, which is usually April fifteenth. However, it is advisable to check for any state-specific extensions or changes that may apply. Marking important dates on your calendar can help ensure that you do not miss the submission deadline.

Form Submission Methods (Online / Mail / In-Person)

The Ct 5 1 Form can be submitted through various methods, providing flexibility for taxpayers. You can file the form online through the Connecticut Department of Revenue Services website, which is often the quickest method. Alternatively, you can print the form and mail it to the designated address. In some cases, in-person submissions may also be possible at local tax offices. Each method has its own guidelines, so it is important to follow the instructions carefully to ensure successful submission.

Quick guide on how to complete ct 5 1 form 2017

Your assistance manual on how to prepare your Ct 5 1 Form

If you’re wondering how to create and submit your Ct 5 1 Form, below are several straightforward guidelines on making tax declaration simpler.

To start, you just need to set up your airSlate SignNow account to modify the way you handle documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to alter, draft, and finalize your income tax papers effortlessly. With its editor, you can toggle between text, checkbox options, and electronic signatures, and revisit to amend responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finish your Ct 5 1 Form in just a few moments:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to open your Ct 5 1 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save amendments, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to more return errors and delays in refunds. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 5 1 form 2017

Create this form in 5 minutes!

How to create an eSignature for the ct 5 1 form 2017

How to create an eSignature for the Ct 5 1 Form 2017 in the online mode

How to generate an electronic signature for the Ct 5 1 Form 2017 in Chrome

How to generate an electronic signature for signing the Ct 5 1 Form 2017 in Gmail

How to make an eSignature for the Ct 5 1 Form 2017 right from your mobile device

How to create an electronic signature for the Ct 5 1 Form 2017 on iOS devices

How to generate an electronic signature for the Ct 5 1 Form 2017 on Android OS

People also ask

-

What is the Ct 5 1 Form and how can I use it with airSlate SignNow?

The Ct 5 1 Form is a specific document required for various business processes, and airSlate SignNow makes it easy to manage this form electronically. With our platform, you can quickly upload the Ct 5 1 Form, add necessary fields for signatures, and send it for eSignature, streamlining your workflow.

-

How much does it cost to use airSlate SignNow for the Ct 5 1 Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. For users who frequently handle the Ct 5 1 Form, our subscription plans provide cost-effective solutions that include unlimited document signing and template creation.

-

What features does airSlate SignNow offer for the Ct 5 1 Form?

With airSlate SignNow, you get a range of features for the Ct 5 1 Form, including customizable templates, automated reminders, and secure cloud storage. These features enhance productivity and ensure that your documents are signed promptly and securely.

-

Can I integrate airSlate SignNow with other applications for managing the Ct 5 1 Form?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and more, which can enhance your management of the Ct 5 1 Form. This allows for easy access to your documents and improved workflow efficiency.

-

Is airSlate SignNow compliant with legal standards for the Ct 5 1 Form?

Absolutely! airSlate SignNow complies with electronic signature laws such as the ESIGN Act and UETA, ensuring that your Ct 5 1 Form is legally binding. You can trust our platform to keep your documents secure and compliant.

-

How can airSlate SignNow improve my business processes involving the Ct 5 1 Form?

By using airSlate SignNow for the Ct 5 1 Form, you can signNowly reduce the time and resources spent on document handling. Our user-friendly platform simplifies the signing process, allowing you to focus on your core business operations.

-

What support does airSlate SignNow provide for issues related to the Ct 5 1 Form?

airSlate SignNow offers comprehensive customer support, including live chat, email assistance, and a detailed knowledge base. If you encounter any issues with the Ct 5 1 Form, our support team is ready to help you resolve them quickly.

Get more for Ct 5 1 Form

- Village of mccomb ohio income tax form

- 928 form

- Temporary registration certificate 36451546 form

- Power cref form

- Sponsor form breast cancer care

- Directions you must read 4 times form

- Cahai form

- Turner board of education ffge suspected child abuse report form child s name date of birth address school parentslegal

Find out other Ct 5 1 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors