Form CT 5 1Request for Additional Extension of Time to File for Franchisebusiness Taxes, MTA Surcharge, or BothCT51 2014

Understanding Form CT-5.1 for Franchise Business Taxes and MTA Surcharge

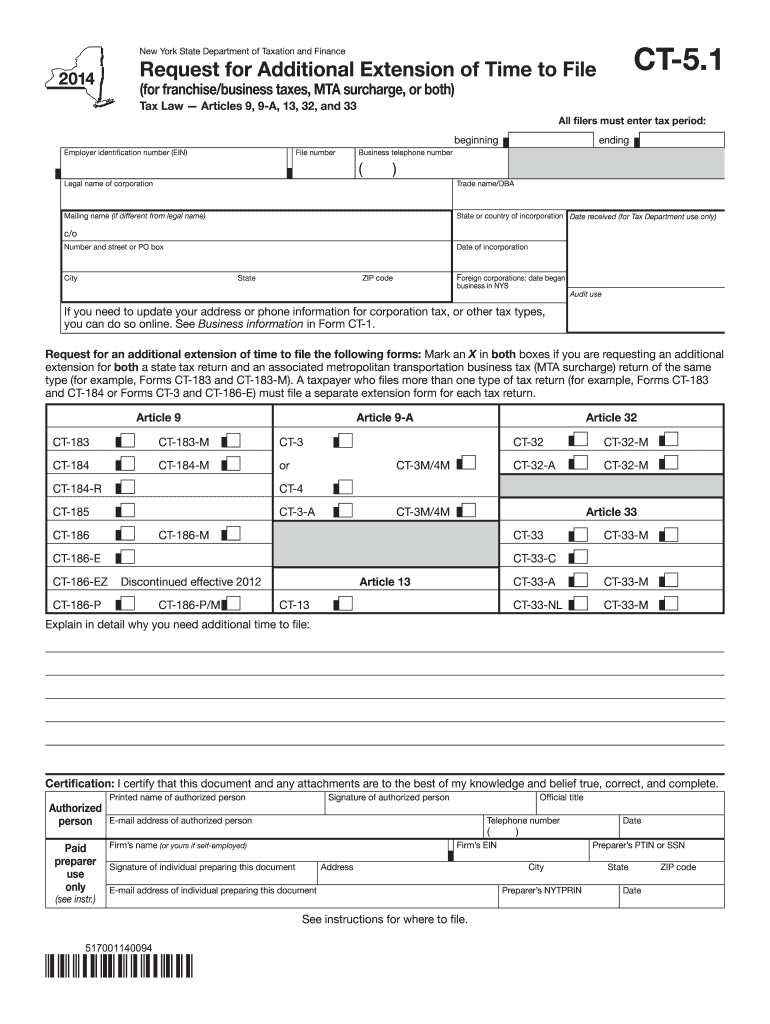

Form CT-5.1, officially known as the Request for Additional Extension of Time to File for Franchise Business Taxes, MTA Surcharge, or Both, is crucial for businesses in the United States seeking to extend their tax filing deadlines. This form allows taxpayers to request extra time to file their franchise tax returns or MTA surcharge, ensuring compliance with state tax regulations. Understanding the purpose and importance of this form is essential for maintaining good standing with tax authorities.

Steps to Complete Form CT-5.1

Completing Form CT-5.1 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business's tax identification number and details about your franchise tax obligations. Next, fill out the form with accurate data, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form to the appropriate tax authority by the specified deadline to avoid penalties.

Obtaining Form CT-5.1

Form CT-5.1 can be obtained through various channels. The easiest way is to visit the official state tax website, where you can download the form directly. Additionally, many tax preparation software programs include this form, making it accessible during the filing process. If you prefer a physical copy, you may request it from your local tax office or print it from the state’s website.

Filing Deadlines for Form CT-5.1

It is essential to be aware of the filing deadlines associated with Form CT-5.1. Typically, the request for an extension must be submitted by the original due date of the tax return. Failure to file by this deadline may result in penalties and interest on any unpaid taxes. It is advisable to check the specific dates each year, as they may vary based on state regulations and any changes in tax law.

Legal Use of Form CT-5.1

Form CT-5.1 is legally recognized as a valid request for an extension of time to file franchise business taxes and MTA surcharge. When completed correctly and submitted on time, it provides legal protection against late filing penalties. It is important to ensure that the form is used in accordance with state tax laws and regulations to maintain its validity.

Key Elements of Form CT-5.1

Several key elements must be included when completing Form CT-5.1. These include the business name, tax identification number, the type of tax for which the extension is requested, and the period for which the extension is sought. Additionally, the form may require a signature and date to validate the request. Ensuring that these elements are accurately filled out is crucial for the acceptance of the extension request.

Penalties for Non-Compliance with Form CT-5.1

Failure to file Form CT-5.1 or to meet the deadlines can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from tax authorities. It is important for businesses to be proactive in understanding their filing obligations and to utilize Form CT-5.1 to avoid these consequences.

Quick guide on how to complete 2014 ct 5 1 form

Your assistance manual on how to prepare your Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51

If you’re wondering how to finalize and submit your Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51, here are some concise instructions to make tax filing much more manageable.

To start, you simply need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly intuitive and robust document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and easily return to adjust information as needed. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to finalize your Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51 in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; navigate through various versions and schedules.

- Click Get form to access your Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding electronic signature (if necessary).

- Review your document and correct any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes digitally with airSlate SignNow. Keep in mind that filing on paper may lead to increased return mistakes and delays in refunds. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2014 ct 5 1 form

FAQs

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Can you add 5 odd numbers to get 30?

It is 7,9 + 9,1 + 1 + 3 + 9 = 30Wish you can find the 7,9 and 9,1 in the list of1,3,5, 7,9 ,11,13,151,3,5,7, 9,1 1,13,15

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Is it necessary to fill out Form 15G/Form 15H if my service is less than 5 years? I need to withdraw the amount.

Purposes for which Form 15G or Form 15H can be submitted. While these forms can be submitted to banks to make sure TDS is not deducted on interest, there a few other places too where you can submit them. TDS on EPF withdrawal – TDS is deducted on EPF balances if withdrawn before 5 years of continuous service.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How can I fill the improvement form for class 12th, CBSE 2014-15?

The forms are available in November or December only. You can't apply for an improvement now!And worse? You can't apply even for next session; it has to be in the year just after you graduated from your high school.

Create this form in 5 minutes!

How to create an eSignature for the 2014 ct 5 1 form

How to make an eSignature for the 2014 Ct 5 1 Form online

How to generate an eSignature for your 2014 Ct 5 1 Form in Google Chrome

How to generate an electronic signature for putting it on the 2014 Ct 5 1 Form in Gmail

How to generate an eSignature for the 2014 Ct 5 1 Form from your smart phone

How to generate an electronic signature for the 2014 Ct 5 1 Form on iOS

How to make an electronic signature for the 2014 Ct 5 1 Form on Android devices

People also ask

-

What is Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51?

Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51 is a document used by businesses in Connecticut to request an extension for filing their franchise business taxes and MTA surcharge. This form provides taxpayers additional time to prepare and submit their tax returns without incurring penalties.

-

How can airSlate SignNow help me with Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51?

airSlate SignNow offers a streamlined solution for completing and eSigning Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51. Our platform allows you to easily fill out the form electronically, ensuring that it is submitted accurately and on time, which helps prevent any late fees.

-

Is it easy to eSign Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51 using airSlate SignNow?

Yes, eSigning Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51 with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to sign documents quickly and securely, making the eSigning process efficient and hassle-free.

-

What features does airSlate SignNow offer for managing tax extension forms?

airSlate SignNow provides various features to manage tax extension forms, including customizable templates, automated workflows, and real-time tracking. These features simplify the process of preparing and submitting your Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51, ensuring you stay organized and compliant.

-

Can I integrate airSlate SignNow with my accounting software for filing Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51?

Absolutely! airSlate SignNow seamlessly integrates with numerous accounting software solutions, allowing you to streamline your workflow when handling Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51. This integration helps ensure that your financial data is synchronized and accurate.

-

What is the pricing structure for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individual users and teams. Whether you need to manage Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51 or other tax documents, our cost-effective solutions ensure you get the best value for your investment.

-

How does airSlate SignNow ensure the security of my Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51?

airSlate SignNow prioritizes the security of your documents, including Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51. Our platform employs advanced encryption and compliance with industry standards to protect your sensitive information throughout the signing and submission process.

Get more for Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51

- Form 2604 auto club agent applicationrenewal

- Coh notice of waiver form

- Annual report of deposits and reservable liabilitiesfr 2910a annual report of deposits and reservable liabilitiesfr 2910a form

- Health and safety watering variance application form

- Office of the secretary of state texas secretary of state webservices sos state tx form

- Pdf fr 2910a report form federal reserve bank of dallas

- Installment agreement form

- And judgment creditors consent to allow license and registration form sr 84

Find out other Form CT 5 1Request For Additional Extension Of Time To File for Franchisebusiness Taxes, MTA Surcharge, Or BothCT51

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors