Instructions for Form CT 5 Request for Six Month Extension to 2021

What is the CT-5 Extension Request?

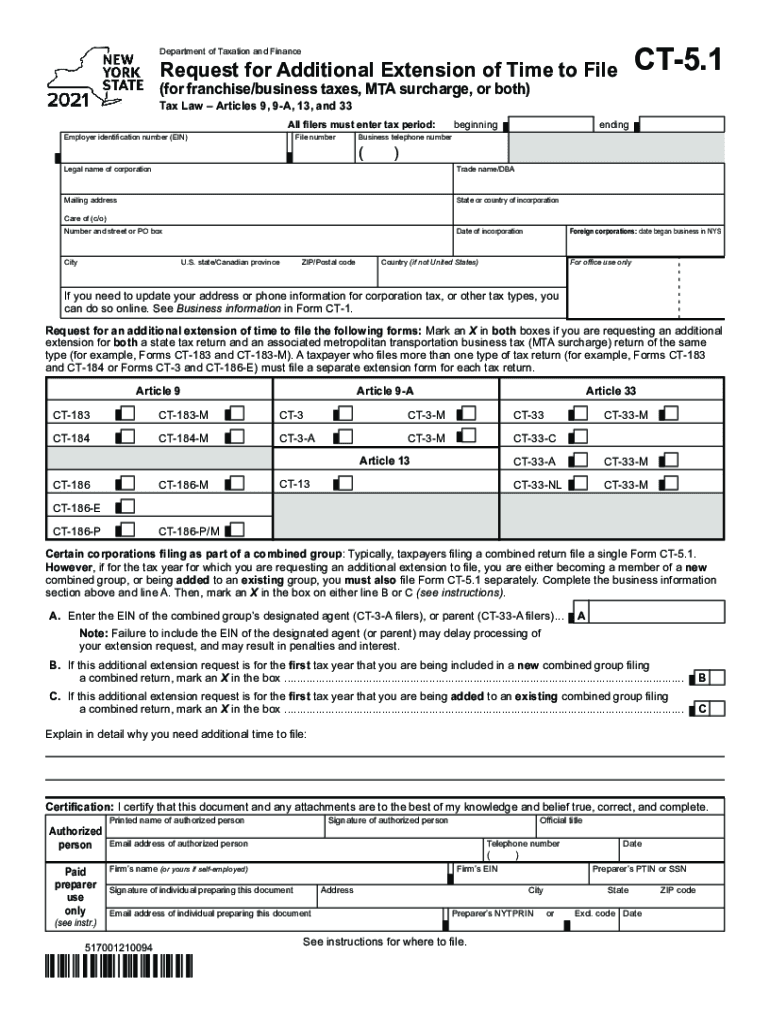

The CT-5 form, officially known as the Request for Six Month Extension to File for New York State, allows taxpayers to request an extension for filing their state tax returns. This form is particularly relevant for individuals and businesses that may need additional time to gather necessary documentation or complete their tax filings accurately. By submitting the CT-5, taxpayers can secure an automatic six-month extension, providing them with the flexibility to manage their financial obligations effectively.

Steps to Complete the CT-5 Extension Request

Completing the CT-5 form involves several straightforward steps:

- Obtain the Form: Download the CT-5 form from the New York State Department of Taxation and Finance website or access it through authorized tax software.

- Fill in Your Information: Provide your name, address, and taxpayer identification number. Ensure that all information is accurate to avoid processing delays.

- Select the Type of Extension: Indicate whether you are requesting an extension for personal or business taxes. This distinction is crucial for proper processing.

- Estimate Your Tax Liability: Calculate your expected tax liability for the year. This estimation helps in determining if any payment is required with the extension request.

- Sign and Date the Form: Ensure that you sign and date the form before submission. An unsigned form may be considered invalid.

Filing Deadlines for the CT-5 Extension Request

It is essential to be aware of the filing deadlines associated with the CT-5 form. Typically, the request for an extension must be submitted by the original due date of the tax return. For most individual taxpayers, this date is April fifteenth. Businesses may have different deadlines depending on their fiscal year. Submitting the CT-5 on time is crucial to avoid penalties and ensure that the extension is granted.

Legal Use of the CT-5 Extension Request

The CT-5 form is legally recognized as a valid means for taxpayers to request additional time to file their state tax returns. It complies with New York State tax regulations and is accepted by the Department of Taxation and Finance. Utilizing this form correctly ensures that taxpayers remain in good standing with state tax laws and avoid potential penalties associated with late filings.

Required Documents for the CT-5 Extension Request

When submitting the CT-5 form, taxpayers may need to include certain supporting documents, depending on their specific situation. Commonly required documents include:

- Previous Year’s Tax Return: This document helps to provide context for your current year’s tax situation.

- Income Statements: W-2s, 1099s, or other income documentation may be necessary for accurate estimations.

- Payment Information: If you expect to owe taxes, include any payment details or estimates to avoid penalties.

Form Submission Methods for the CT-5

The CT-5 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers opt to file electronically through authorized tax software, which streamlines the process.

- Mail: The completed form can be printed and mailed to the appropriate address as indicated on the form.

- In-Person: Taxpayers may also submit the form in person at designated tax offices, ensuring immediate processing.

Quick guide on how to complete instructions for form ct 5 request for six month extension to

Complete Instructions For Form CT 5 Request For Six Month Extension To effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Instructions For Form CT 5 Request For Six Month Extension To on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Instructions For Form CT 5 Request For Six Month Extension To effortlessly

- Locate Instructions For Form CT 5 Request For Six Month Extension To and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form CT 5 Request For Six Month Extension To and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 5 request for six month extension to

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 5 request for six month extension to

How to create an e-signature for a PDF document online

How to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the nys extension york feature offered by airSlate SignNow?

The nys extension york feature allows users to manage and eSign documents more efficiently within New York. It simplifies the signing process for businesses operating in New York State by ensuring compliance with local regulations.

-

How much does airSlate SignNow cost for users in nys extension york?

airSlate SignNow offers flexible pricing plans to accommodate different needs, including users in nys extension york. You can choose from monthly and annual subscriptions tailored for businesses of all sizes, ensuring cost-effectiveness and scalability.

-

What are the key benefits of using airSlate SignNow for nys extension york?

Using airSlate SignNow in the nys extension york provides businesses with a streamlined eSigning experience. Key benefits include increased efficiency, reduced turnaround time for document signing, and enhanced security for sensitive information.

-

Can airSlate SignNow integrate with other software for nys extension york users?

Yes, airSlate SignNow offers seamless integrations with various platforms and applications, making it ideal for nys extension york users. This capability enhances workflow by connecting with tools you already use, such as CRM systems and project management software.

-

Is airSlate SignNow secure for handling documents in nys extension york?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for handling documents in nys extension york. It uses advanced encryption protocols and complies with industry standards to ensure your information remains protected.

-

What types of documents can be signed using airSlate SignNow in nys extension york?

airSlate SignNow allows for the signing of a wide variety of documents in nys extension york, including contracts, agreements, and consent forms. This versatility makes it a valuable tool for individuals and businesses needing efficient document management.

-

How do I get started with airSlate SignNow in the nys extension york area?

Getting started with airSlate SignNow in the nys extension york area is easy. Simply sign up for a free trial on our website, explore the features, and start sending and signing documents within minutes.

Get more for Instructions For Form CT 5 Request For Six Month Extension To

Find out other Instructions For Form CT 5 Request For Six Month Extension To

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast