Form 4684 Casualties and Thefts Irs Ustreas

What is the Form 4684 Casualties and Thefts IRS USTreas

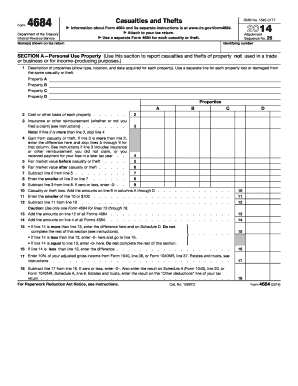

The Form 4684, titled "Casualties and Thefts," is an essential document used by taxpayers in the United States to report losses due to casualties, thefts, or vandalism. This form allows individuals and businesses to claim deductions for property damage or loss that occurred during the tax year. The IRS requires this form to provide a detailed account of the losses, including the type of property affected and the amount of the loss. Understanding the purpose and requirements of Form 4684 is crucial for accurate tax reporting and maximizing potential deductions.

How to use the Form 4684 Casualties and Thefts IRS USTreas

Using Form 4684 involves several steps to ensure accurate reporting of losses. First, gather all necessary documentation related to the casualty or theft, including police reports, insurance claims, and photographs of the damaged property. Next, complete the form by providing details such as the date of the incident, the type of property lost, and the estimated loss amount. It is important to follow the IRS instructions carefully to ensure all required information is included. After completing the form, it should be submitted with your tax return to the IRS.

Steps to complete the Form 4684 Casualties and Thefts IRS USTreas

Completing Form 4684 involves a systematic approach:

- Step 1: Identify the type of loss—casualty or theft—and gather relevant documentation.

- Step 2: Fill out the form, detailing the nature of the loss, including dates and descriptions of the property.

- Step 3: Calculate the loss amount, taking into account any insurance reimbursements.

- Step 4: Review the form for accuracy and completeness before submission.

- Step 5: Attach the completed form to your tax return and submit it to the IRS.

Legal use of the Form 4684 Casualties and Thefts IRS USTreas

Form 4684 is legally binding when completed accurately and submitted according to IRS guidelines. It serves as a formal declaration of losses incurred, which can affect tax liabilities. To ensure legal compliance, taxpayers must maintain thorough records supporting their claims, including receipts, photographs, and any relevant correspondence with insurance companies. Failing to provide accurate information or documentation may lead to penalties or denial of deductions.

Filing Deadlines / Important Dates

Filing deadlines for Form 4684 typically align with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. However, if you file for an extension, you may have until October 15 to submit your tax return and Form 4684. It is essential to stay informed about any changes to tax deadlines to avoid penalties for late filing.

Required Documents

To complete Form 4684, several key documents are required:

- Proof of ownership of the property affected, such as purchase receipts or title documents.

- Documentation of the loss, including police reports for thefts or insurance claims for casualties.

- Photographs of the damaged property to substantiate the claim.

- Any correspondence with insurance companies regarding the claim and reimbursements.

Form Submission Methods (Online / Mail / In-Person)

Form 4684 can be submitted through various methods, depending on how you file your tax return. If filing electronically, the form can be included in your e-filed return. For those submitting paper returns, the completed form should be mailed to the appropriate IRS address based on your location. In-person submission is generally not an option for this form, as it must be included with your overall tax return submission.

Quick guide on how to complete form 4684 casualties and thefts irs ustreas

Complete Form 4684 Casualties And Thefts Irs Ustreas effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the accurate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without issues. Manage Form 4684 Casualties And Thefts Irs Ustreas on any device using the airSlate SignNow Android or iOS applications and simplify any document-focused process today.

How to modify and eSign Form 4684 Casualties And Thefts Irs Ustreas effortlessly

- Locate Form 4684 Casualties And Thefts Irs Ustreas and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate the worries of lost or mismanaged files, tedious form searches, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 4684 Casualties And Thefts Irs Ustreas and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4684 casualties and thefts irs ustreas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4684 Casualties And Thefts Irs Ustreas used for?

Form 4684 Casualties And Thefts Irs Ustreas is used by individuals to report losses from casualties and thefts for tax purposes. This form helps taxpayers calculate and claim deductions for property that has been damaged or stolen, ensuring they receive the appropriate tax benefits. Completing this form accurately is crucial for effective tax filing.

-

How can airSlate SignNow help with Form 4684 Casualties And Thefts Irs Ustreas?

airSlate SignNow provides a seamless solution for signing and managing Form 4684 Casualties And Thefts Irs Ustreas electronically. With our platform, you can easily prepare, send, and eSign the form while keeping all your documents organized. This feature saves time and enhances the efficiency of your tax filing process.

-

Is airSlate SignNow affordable for small businesses needing to file Form 4684 Casualties And Thefts Irs Ustreas?

Yes, airSlate SignNow offers cost-effective plans tailored for small businesses looking to file Form 4684 Casualties And Thefts Irs Ustreas. Our pricing structure is designed to accommodate various budget levels, ensuring that you can leverage our eSigning capabilities without breaking the bank. You can choose a plan that suits your specific needs.

-

What features does airSlate SignNow offer for managing Form 4684 Casualties And Thefts Irs Ustreas?

airSlate SignNow offers several features that simplify the management of Form 4684 Casualties And Thefts Irs Ustreas. You can create templates, track document statuses, and set reminders for important deadlines. Additionally, our user-friendly interface ensures that even those new to e-signing can navigate the process with ease.

-

Can I integrate airSlate SignNow with other software for filing Form 4684 Casualties And Thefts Irs Ustreas?

Absolutely! airSlate SignNow supports integration with various software applications, enhancing your workflow for filing Form 4684 Casualties And Thefts Irs Ustreas. This allows you to connect with popular accounting and tax preparation tools, making document management even more efficient.

-

What are the benefits of using airSlate SignNow for Form 4684 Casualties And Thefts Irs Ustreas?

Using airSlate SignNow for Form 4684 Casualties And Thefts Irs Ustreas offers multiple benefits, including faster processing times and reduced paperwork. With our electronic signatures, you can achieve quicker approvals and more reliable document tracking. Additionally, our platform enhances security and compliance, giving you peace of mind.

-

Is it easy to eSign Form 4684 Casualties And Thefts Irs Ustreas with airSlate SignNow?

Yes, eSigning Form 4684 Casualties And Thefts Irs Ustreas with airSlate SignNow is straightforward. Our intuitive platform allows you to sign documents online in just a few clicks, making the entire process hassle-free. You can sign from anywhere, at any time, ensuring you meet your tax filing deadlines without any stress.

Get more for Form 4684 Casualties And Thefts Irs Ustreas

- Citizenship in society merit badge worksheet form

- Firpta affidavit form

- Marriage in saipan form

- Efu surrender form

- Introductory phonology bruce hayes answer key pdf form

- Security guard employment status notification form

- Asb kiwisaver scheme changing your fund switch f form

- Inz 1002 residence guide form

Find out other Form 4684 Casualties And Thefts Irs Ustreas

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template