New York Tax Appeals Tribunal Requires Bank to Apply Its NOL 2022

Understanding the New York Tax Appeals Tribunal Requirements for Net Operating Loss (NOL)

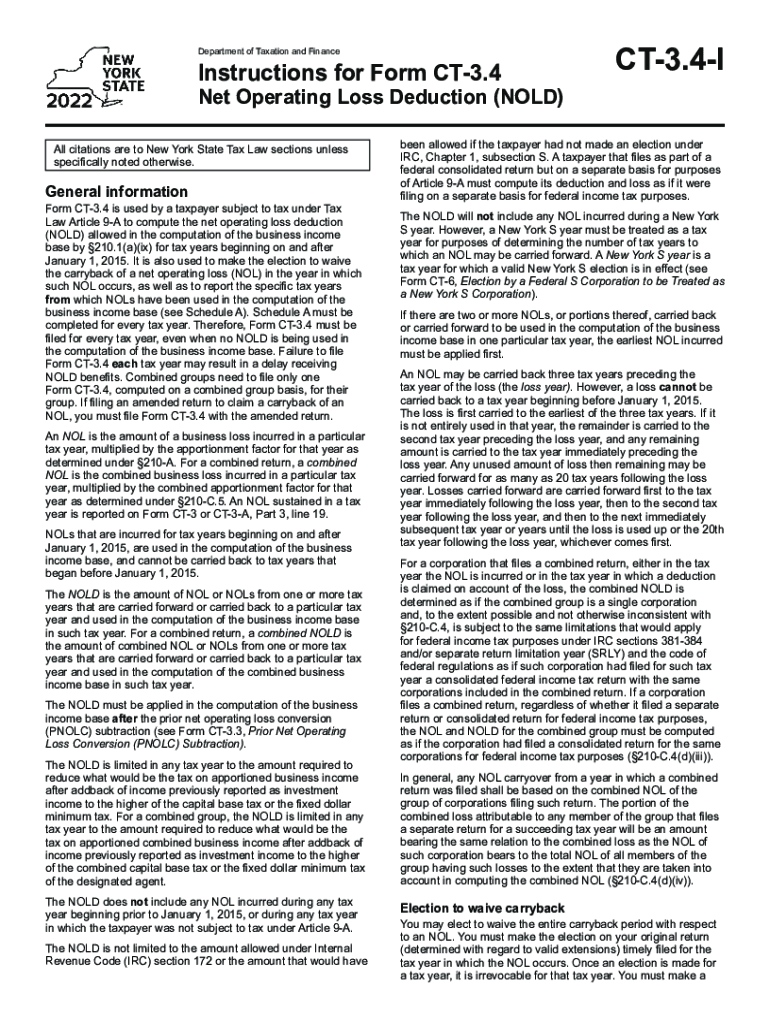

The New York Tax Appeals Tribunal has specific guidelines regarding the application of a Net Operating Loss (NOL) for tax purposes. These requirements ensure that businesses accurately report their financial losses and apply them to offset future taxable income. Understanding these requirements is crucial for compliance and optimizing tax liabilities.

Businesses must adhere to the regulations outlined by the Tribunal, which includes maintaining detailed records of losses and ensuring that all documentation is submitted in a timely manner. This process is essential for validating the NOL claims and ensuring they are recognized by the state tax authorities.

Steps to Apply the NOL with the New York Tax Appeals Tribunal

Applying your Net Operating Loss with the New York Tax Appeals Tribunal involves several key steps. First, gather all relevant financial documents that detail your losses. This includes tax returns, financial statements, and any other pertinent records.

Next, complete the necessary forms, including the form CT-3 or CT-4, which are specifically designed for corporate tax returns in New York. Ensure that you accurately report the NOL on these forms, following the instructions provided. Once completed, submit the forms either electronically or by mail, depending on your preference and the guidelines established by the Tribunal.

Required Documents for NOL Application

When applying for a Net Operating Loss with the New York Tax Appeals Tribunal, certain documents are essential. These include:

- Completed tax forms (CT-3 or CT-4)

- Financial statements demonstrating the loss

- Previous tax returns

- Any supporting documentation that validates the loss

Having these documents ready will streamline the application process and help in addressing any inquiries from the Tribunal regarding your NOL claim.

Filing Deadlines for NOL Applications

Timeliness is critical when submitting your NOL application to the New York Tax Appeals Tribunal. Generally, the deadline for filing your NOL claim coincides with the due date of your corporate tax return. It is advisable to check specific deadlines for the current tax year, as they may vary. Missing these deadlines could result in the denial of your NOL claim, so staying informed is essential.

Penalties for Non-Compliance with NOL Regulations

Failure to comply with the New York Tax Appeals Tribunal's regulations regarding Net Operating Loss applications can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is crucial to ensure that all information submitted is accurate and complete to avoid any repercussions.

Eligibility Criteria for NOL Claims

To qualify for a Net Operating Loss in New York, businesses must meet specific eligibility criteria. Generally, the business must be a corporation that has incurred a loss during the tax year. Additionally, the loss must be properly documented and reported on the appropriate tax forms. Understanding these criteria is vital for ensuring that your NOL claim is valid and accepted by the Tribunal.

Quick guide on how to complete new york tax appeals tribunal requires bank to apply its nol

Easily Prepare New York Tax Appeals Tribunal Requires Bank To Apply Its NOL on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to design, modify, and electronically sign your documents swiftly without delays. Handle New York Tax Appeals Tribunal Requires Bank To Apply Its NOL on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign New York Tax Appeals Tribunal Requires Bank To Apply Its NOL with Ease

- Find New York Tax Appeals Tribunal Requires Bank To Apply Its NOL and click Get Form to begin.

- Use the tools we offer to fill in your form.

- Emphasize important sections of the documents or redact sensitive information using the features that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign New York Tax Appeals Tribunal Requires Bank To Apply Its NOL to guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york tax appeals tribunal requires bank to apply its nol

Create this form in 5 minutes!

How to create an eSignature for the new york tax appeals tribunal requires bank to apply its nol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the NY CT 3 4 instructions for eSigning documents?

The NY CT 3 4 instructions provide a straightforward guide for electronically signing documents in New York. With airSlate SignNow, users can easily follow these instructions to complete their eSigning process securely and efficiently. Our platform adheres to all legal requirements, ensuring that your electronically signed documents are valid and enforceable.

-

How does airSlate SignNow simplify the NY CT 3 4 instructions process?

airSlate SignNow simplifies the NY CT 3 4 instructions by providing an intuitive interface that guides users through each step of the eSigning process. The platform eliminates confusion by offering templates and tips specific to New York regulations, making it easy for anyone to get their documents signed quickly. This user-friendly approach ensures compliance while saving valuable time.

-

What are the pricing options for using airSlate SignNow in relation to NY CT 3 4 instructions?

airSlate SignNow offers flexible pricing plans that cater to different needs, making it a cost-effective solution for following the NY CT 3 4 instructions. Users can choose from various subscription tiers, ensuring they only pay for the features they need. Each plan includes tools to help with electronic signatures and document management, all while adhering to NY regulations.

-

Can airSlate SignNow integrate with other applications while following NY CT 3 4 instructions?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, allowing users to enhance their workflows while adhering to NY CT 3 4 instructions. This capability ensures that you can manage your eSigning processes within your existing software ecosystem, streamlining your document handling. With multiple integration options, you can customize your experience to fit your business needs.

-

What benefits does airSlate SignNow offer when following NY CT 3 4 instructions?

Using airSlate SignNow provides numerous benefits when adhering to the NY CT 3 4 instructions, including heightened security and convenience. The platform ensures that your documents are encrypted and stored safely, making it easier to comply with legal requirements. Plus, you can sign documents anytime and anywhere, enhancing productivity and reducing turnaround times.

-

Is training available for using airSlate SignNow with NY CT 3 4 instructions?

Absolutely! airSlate SignNow offers extensive support and training resources to help users understand and efficiently utilize the NY CT 3 4 instructions. Whether you prefer written guides, video tutorials, or personalized assistance, our support team is here to ensure you get the most out of the platform and comply with New York’s eSigning requirements.

-

How secure is the eSigning process for NY CT 3 4 instructions with airSlate SignNow?

The eSigning process with airSlate SignNow is highly secure, adhering to strict protocols to protect your documents while following the NY CT 3 4 instructions. The platform uses advanced encryption technology and complies with industry standards to ensure that your data is safe from unauthorized access. You can sign confidently, knowing your information remains protected throughout the process.

Get more for New York Tax Appeals Tribunal Requires Bank To Apply Its NOL

- Notice to owner by corporation or llc south carolina form

- South carolina notice form

- Quitclaim deed by two individuals to corporation south carolina form

- Warranty deed from two individuals to corporation south carolina form

- South carolina corporation form

- Statement of account individual south carolina form

- Quitclaim deed from individual to corporation south carolina form

- Warranty deed from individual to corporation south carolina form

Find out other New York Tax Appeals Tribunal Requires Bank To Apply Its NOL

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors