Form Ct3 Instructions 2016

What is the Form Ct3 Instructions

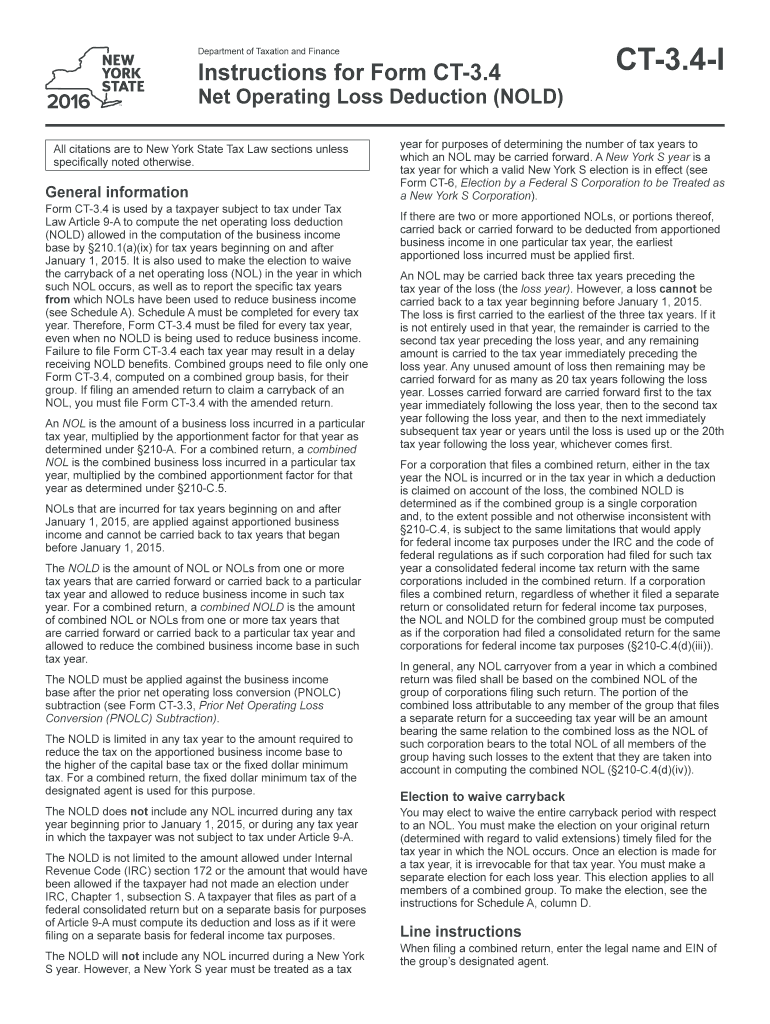

The Form Ct3 Instructions provide essential guidelines for completing the New York City Corporation Tax Return. This form is specifically designed for corporations operating within the city, detailing the necessary steps to accurately report income, deductions, and tax liabilities. Understanding these instructions is crucial for ensuring compliance with local tax regulations and avoiding potential penalties.

How to use the Form Ct3 Instructions

To effectively use the Form Ct3 Instructions, begin by carefully reviewing each section to familiarize yourself with the requirements. The instructions outline the information needed, including financial data and supporting documentation. It is important to follow the guidelines closely to ensure that all entries are accurate and complete. This will help facilitate a smooth filing process and reduce the likelihood of errors that could lead to delays or audits.

Steps to complete the Form Ct3 Instructions

Completing the Form Ct3 Instructions involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Follow the line-by-line instructions to fill out the form accurately.

- Double-check all calculations to ensure accuracy.

- Attach any required schedules or additional forms as specified in the instructions.

- Review the completed form for completeness before submission.

Legal use of the Form Ct3 Instructions

The legal use of the Form Ct3 Instructions is governed by New York City tax laws. Corporations must adhere to these guidelines to ensure their tax returns are valid and accepted by the authorities. Compliance with these instructions not only fulfills legal obligations but also helps in avoiding penalties associated with incorrect filings or late submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct3 Instructions are crucial for compliance. Corporations must submit their returns by the specified due date to avoid penalties. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is advisable to check for any updates or changes to deadlines annually, as these can vary based on specific circumstances or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

Corporations have multiple options for submitting the Form Ct3 Instructions. The form can be filed online through the New York City Department of Finance website, which offers a streamlined process. Alternatively, corporations may choose to mail the completed form to the appropriate address or submit it in person at designated locations. Each method has its own advantages, such as immediate confirmation for online submissions or the ability to ask questions in person.

Quick guide on how to complete form ct3 instructions 2016

Effortlessly Prepare Form Ct3 Instructions on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without waiting. Manage Form Ct3 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Simplest Way to Edit and Electronically Sign Form Ct3 Instructions Effortlessly

- Find Form Ct3 Instructions and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Mark signNow portions of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method to submit your form: via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Form Ct3 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct3 instructions 2016

Create this form in 5 minutes!

How to create an eSignature for the form ct3 instructions 2016

How to generate an eSignature for your Form Ct3 Instructions 2016 in the online mode

How to make an electronic signature for the Form Ct3 Instructions 2016 in Chrome

How to make an electronic signature for putting it on the Form Ct3 Instructions 2016 in Gmail

How to make an eSignature for the Form Ct3 Instructions 2016 right from your smart phone

How to generate an electronic signature for the Form Ct3 Instructions 2016 on iOS

How to make an electronic signature for the Form Ct3 Instructions 2016 on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing Form Ct3 Instructions?

airSlate SignNow offers a range of features tailored for managing Form Ct3 Instructions, including customizable templates, secure eSignature capabilities, and automated workflows. These tools streamline the process of completing and submitting your Form Ct3, making it efficient and straightforward. Additionally, you can track document status in real-time, ensuring you never miss a deadline.

-

How does airSlate SignNow simplify the completion of Form Ct3 Instructions?

With airSlate SignNow, completing Form Ct3 Instructions is easier than ever. The platform provides step-by-step guidance and pre-filled fields based on your previous submissions, reducing the chances of errors. This user-friendly interface allows you to focus on the details of your form while ensuring compliance with all necessary regulations.

-

What is the pricing structure for using airSlate SignNow for Form Ct3 Instructions?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes looking to manage Form Ct3 Instructions efficiently. Plans start with a basic option, providing essential features, and scale up to more advanced tiers that include additional functionalities and support. This ensures cost-effectiveness while meeting your specific needs.

-

Can I integrate airSlate SignNow with other software for Form Ct3 Instructions?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for Form Ct3 Instructions. Whether you use CRM systems, cloud storage services, or productivity tools, these integrations allow for easy data transfer and improved collaboration. This connectivity helps streamline your processes and keeps all your documents organized.

-

How secure is airSlate SignNow for handling Form Ct3 Instructions?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form Ct3 Instructions. The platform utilizes advanced encryption protocols and secure cloud storage to protect your data. Additionally, compliance with industry standards ensures that your information remains confidential and secure throughout the signing process.

-

What benefits can my business expect from using airSlate SignNow for Form Ct3 Instructions?

By using airSlate SignNow for Form Ct3 Instructions, your business can expect increased efficiency and reduced turnaround times for document processing. The ability to eSign and send documents quickly helps maintain compliance and meet deadlines more effectively. Furthermore, enhanced visibility into document status allows for better project management.

-

Is there customer support available for users of airSlate SignNow concerning Form Ct3 Instructions?

Absolutely! airSlate SignNow provides dedicated customer support for all users, including those focused on Form Ct3 Instructions. You can access help through various channels such as live chat, email, and comprehensive knowledge base articles. This ensures that you have the guidance needed to navigate the platform effectively.

Get more for Form Ct3 Instructions

- Residency petition for university of oklahoma form

- Preview a t shirt order form

- Irb decision questionnaire form valparaiso university valpo

- Victory university transcript form

- Grabbe utley scholarship form

- Transcript request form virginia intermont college vic

- Viterbo university transcript form

- Washburn reinstatement petition form

Find out other Form Ct3 Instructions

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free