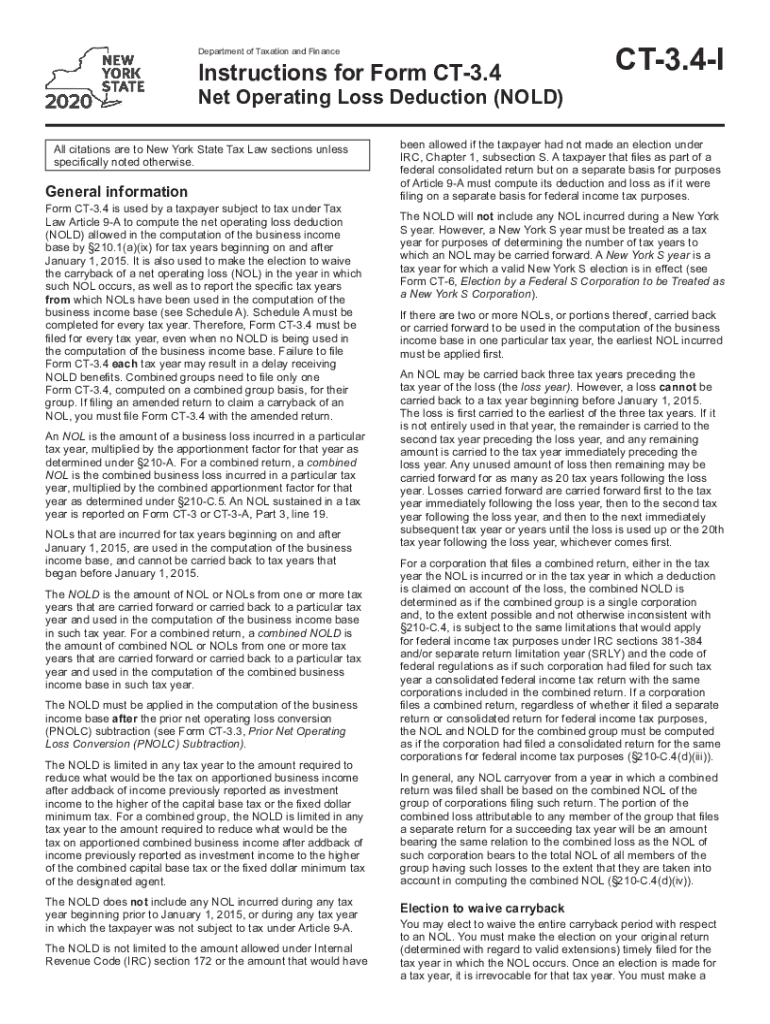

Instructions for Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year 2020

What is the Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year

The Instructions for Form CT 3 4 detail the process for claiming a Net Operating Loss Deduction (NOLD) for a specific tax year. This form is essential for corporations in New York State that have incurred losses and wish to offset these losses against future taxable income. Understanding the purpose and structure of the form helps ensure compliance with state tax regulations and maximizes potential tax benefits.

Steps to complete the Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year

Completing the Instructions for Form CT 3 4 involves several key steps:

- Gather necessary financial documents, including income statements and prior year tax returns.

- Review the specific eligibility criteria for claiming the NOLD, ensuring your corporation qualifies.

- Follow the outlined steps in the instructions to accurately fill out the form, providing all required information regarding the net operating loss.

- Calculate the amount of the deduction based on the guidelines provided, ensuring accuracy in your calculations.

- Submit the completed form by the designated filing deadline to avoid penalties.

Legal use of the Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year

The legal use of the Instructions for Form CT 3 4 is crucial for ensuring that the net operating loss deduction is claimed correctly. Compliance with state tax laws is mandatory, and the instructions provide the necessary framework to navigate these regulations. Utilizing the form in accordance with the guidelines helps protect against potential audits and ensures that the deduction is recognized by tax authorities.

State-specific rules for the Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year

New York State has specific rules governing the application of the Net Operating Loss Deduction. These rules may differ from federal regulations, making it essential to refer to the state-specific instructions. Key aspects include the time frame for carrying forward losses, limitations on the amount that can be deducted in a given year, and any additional documentation required to substantiate the claim.

Eligibility Criteria

To be eligible for the Net Operating Loss Deduction using Form CT 3 4, corporations must meet certain criteria. These include having incurred a net operating loss in a previous tax year and being in compliance with all state tax obligations. Additionally, corporations must ensure that their losses are properly documented and that they follow the specific guidelines outlined in the instructions to qualify for the deduction.

Filing Deadlines / Important Dates

Filing deadlines for Form CT 3 4 are critical to ensure compliance and avoid penalties. Corporations must submit the form by the due date specified in the instructions, typically aligned with the annual corporate tax return deadlines. Keeping track of these dates is essential for proper tax planning and to ensure that all claims for deductions are submitted in a timely manner.

Quick guide on how to complete instructions for form ct 34 net operating loss deduction nold tax year 2020

Complete Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year effortlessly on any device

Online document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without hassle. Handle Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to edit and electronically sign Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year without any hassle

- Find Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your edits.

- Select your preferred method to send your form: via email, SMS, invite link, or download to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 34 net operating loss deduction nold tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 34 net operating loss deduction nold tax year 2020

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is ct3 4 and how does it relate to airSlate SignNow?

Ct3 4 is a signNow code that helps categorize document management solutions, including airSlate SignNow. This platform allows businesses to streamline their document signing process, making it more efficient and effective. Understanding ct3 4 can assist users in identifying the right tools for their specific document needs.

-

What pricing options are available for airSlate SignNow under ct3 4?

AirSlate SignNow offers competitive pricing plans that align with the ct3 4 classification. Customers can choose from several tiers, depending on their document usage and business size. Each plan provides access to essential features that enhance document signing efficiency while remaining budget-friendly.

-

What features does airSlate SignNow include for those focused on ct3 4?

AirSlate SignNow's features are designed with ct3 4 users in mind, providing tools such as customizable templates, and real-time collaboration capabilities. Users can easily create, send, and store documents securely, ensuring that their signing experience is seamless and efficient. These features make it an ideal choice for businesses looking to improve their document management.

-

How can airSlate SignNow benefit businesses interested in ct3 4?

Businesses seeking solutions under ct3 4 can benefit signNowly from airSlate SignNow's user-friendly interface and cost-effective pricing. The platform enables teams to save time by automating document workflows and reduces the need for physical document handling. This leads to enhanced productivity and streamlined operations for organizations.

-

Can airSlate SignNow integrate with other tools for ct3 4 users?

Yes, airSlate SignNow offers integrations with various applications, catering to the needs of ct3 4 users. These integrations enable seamless data transfer and enhance the functionality of your existing tools. This ensures that businesses can maintain their current workflow while enjoying the benefits of efficient eSigning.

-

Is airSlate SignNow secure for handling documents related to ct3 4?

Security is a top priority for airSlate SignNow, particularly for users dealing with ct3 4 documentation. The platform employs advanced encryption methods and complies with industry standards to ensure that all documents are private and secure. This commitment to safety increases confidence for businesses in managing sensitive information.

-

What support options are available for ct3 4 users of airSlate SignNow?

AirSlate SignNow provides comprehensive support options for ct3 4 users, including live chat, email, and a detailed knowledge base. Customers can easily find answers to their questions or get assistance with their account. This dedication to customer support ensures that users can make the most of the platform's features.

Get more for Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year

Find out other Instructions For Form CT 3 4 Net Operating Loss Deduction NOLD Tax Year

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy