Form it 241 Claim for Clean Heating Fuel Credit Tax Year 2022

What is the Form IT-241 Claim for Clean Heating Fuel Credit Tax Year

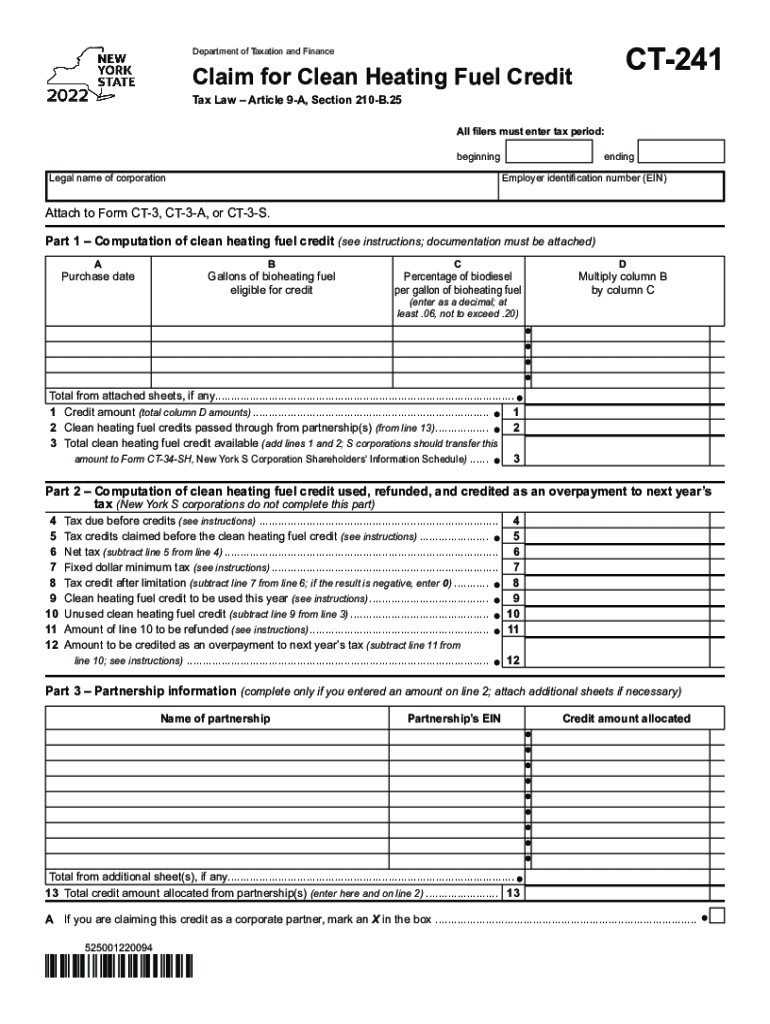

The Form IT-241 is a tax form used by residents of New York to claim a credit for clean heating fuel expenses. This credit is designed to incentivize the use of cleaner heating fuels, thereby promoting environmental sustainability. Taxpayers who have incurred eligible expenses for purchasing clean heating fuels, such as natural gas or biofuels, can utilize this form to reduce their overall tax liability. Understanding the specifics of this form is crucial for ensuring compliance and maximizing potential tax benefits.

Steps to Complete the Form IT-241 Claim for Clean Heating Fuel Credit Tax Year

Completing the Form IT-241 involves several key steps to ensure accuracy and compliance with state regulations. Here is a structured approach:

- Gather necessary documentation, including receipts for clean heating fuel purchases and any relevant tax records.

- Fill out personal information, including your name, address, and Social Security number.

- Detail the amount of clean heating fuel purchased and the corresponding expenses incurred during the tax year.

- Calculate the credit amount based on the provided guidelines and ensure all figures are accurate.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for the Form IT-241 Claim for Clean Heating Fuel Credit Tax Year

To qualify for the clean heating fuel credit, certain eligibility criteria must be met. Taxpayers must have purchased clean heating fuels for residential use within New York State. Additionally, the fuels must meet specific environmental standards set forth by the state. It is important to ensure that all expenses claimed are documented and that the taxpayer is in good standing with state tax obligations. Understanding these criteria helps in determining eligibility and prevents potential issues during the filing process.

Required Documents for the Form IT-241 Claim for Clean Heating Fuel Credit Tax Year

When filing the Form IT-241, several documents are required to substantiate the claim. These include:

- Receipts or invoices for clean heating fuel purchases.

- Proof of residency in New York State.

- Any previous tax returns that may relate to the claim.

- Documentation showing compliance with environmental standards for the fuels used.

Having these documents ready ensures a smooth filing process and supports the validity of the claim.

Form Submission Methods for the Form IT-241 Claim for Clean Heating Fuel Credit Tax Year

The Form IT-241 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a completed paper form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the taxpayer's needs.

Legal Use of the Form IT-241 Claim for Clean Heating Fuel Credit Tax Year

The legal use of the Form IT-241 is governed by New York State tax laws. This form must be completed accurately and submitted within the designated filing period to be considered valid. Misrepresentation or failure to comply with the stated requirements can lead to penalties or disqualification from receiving the credit. Understanding the legal framework surrounding this form is essential for taxpayers to navigate the process confidently.

Quick guide on how to complete form it 241 claim for clean heating fuel credit tax year

Complete Form IT 241 Claim For Clean Heating Fuel Credit Tax Year seamlessly on any gadget

The management of online documents has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form IT 241 Claim For Clean Heating Fuel Credit Tax Year on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

The easiest way to modify and electronically sign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year effortlessly

- Find Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 241 claim for clean heating fuel credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 241 claim for clean heating fuel credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the clean heating fuel credit?

The clean heating fuel credit is a tax incentive designed to encourage the use of environmentally friendly heating fuels. By utilizing this credit, you can potentially reduce your overall energy costs while contributing to a cleaner environment. It's a great option for homeowners and businesses looking to upgrade their heating systems.

-

How can airSlate SignNow help with the clean heating fuel credit application process?

airSlate SignNow simplifies the documentation process associated with applying for the clean heating fuel credit. Our platform allows for easy eSigning and management of the necessary forms, helping you stay organized. This efficiency can save you time and ensure that your application is submitted accurately.

-

What are the eligibility requirements for claiming the clean heating fuel credit?

To be eligible for the clean heating fuel credit, you typically need to meet specific criteria defined by tax regulations. Generally, you must use approved clean heating fuels in your residence or commercial space. Consulting with a tax professional can provide clarity on your specific situation and eligibility.

-

Is there a limit to the amount I can claim for the clean heating fuel credit?

Yes, the clean heating fuel credit has specific caps based on the type and amount of clean fuels used. It's important to review the guidelines set by your local tax authority to determine how much you can claim. Keeping accurate records of your fuel purchases will be essential for maximizing your credit.

-

Can I use airSlate SignNow to track my clean heating fuel credit documents?

Absolutely! airSlate SignNow provides document tracking features that allow you to monitor the status of your clean heating fuel credit-related documents. You can see when they are opened, signed, and completed, ensuring you are always aware of where your application stands in the process.

-

What benefits does the clean heating fuel credit provide for businesses?

For businesses, the clean heating fuel credit can lower energy expenses while enhancing corporate sustainability efforts. By adopting clean heating solutions, businesses can also improve their public image and attract eco-conscious customers. Leveraging this credit can lead to signNow long-term savings.

-

Does the clean heating fuel credit apply to renewable energy installations?

Yes, the clean heating fuel credit may also extend to renewable energy installations that utilize approved fuels. This makes it a fantastic option for those investing in solar heating systems or other renewable technologies. Applicants should check local guidelines to ensure their projects qualify.

Get more for Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- Letter tenant agreement form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants south carolina form

- Tenant landlord utility 497325688 form

- South carolina tenant landlord 497325689 form

- Unconditional waiver and release of claim of lien upon final payment south carolina form

- South carolina 14 day notice form

- 5 day notice 497325694 form

- Assignment of mortgage by individual mortgage holder south carolina form

Find out other Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure