Form CT 241 Claim for Clean Heating Fuel Credit Tax Year 2020

What is the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

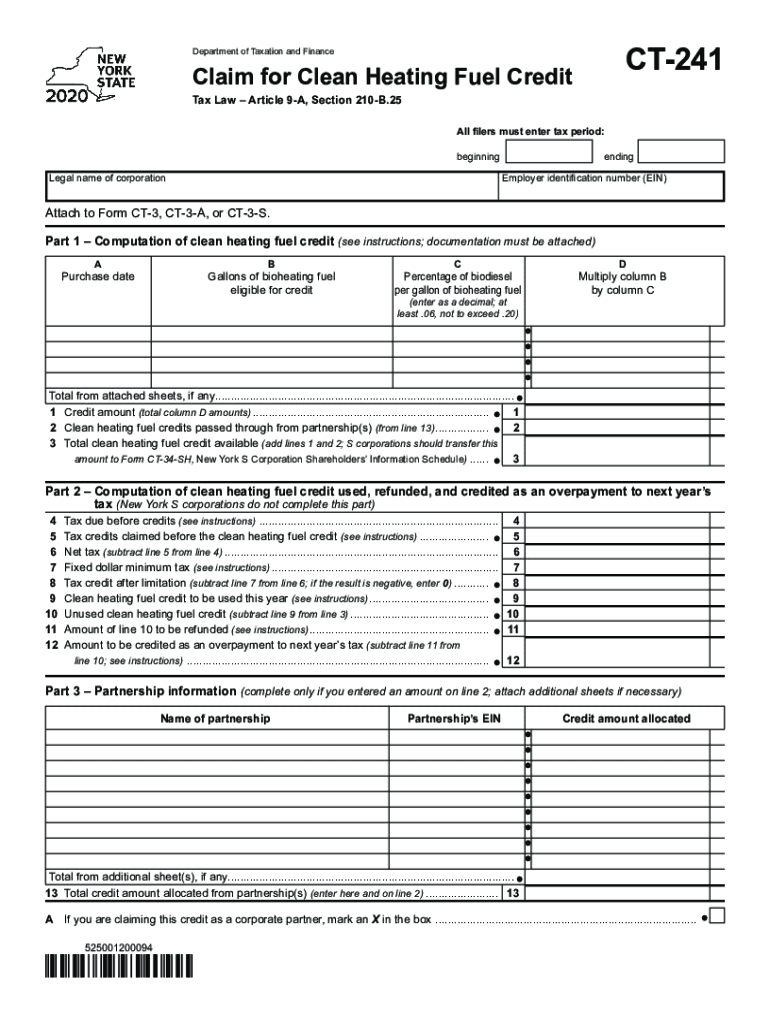

The Form CT 241 is a tax form used in the United States to claim a credit for clean heating fuel. This form is specifically designed for taxpayers who have purchased clean heating fuel and wish to receive a tax credit for their expenditures. The credit is intended to promote the use of environmentally friendly heating options, aligning with state and federal initiatives aimed at reducing carbon emissions and encouraging sustainable energy practices. Understanding the purpose of this form is crucial for taxpayers looking to benefit from the available credits.

Steps to complete the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

Completing the Form CT 241 involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all necessary documentation related to your clean heating fuel purchases, including receipts and invoices. Next, fill out the personal information section, providing your name, address, and Social Security number. In the main section of the form, detail the amount of clean heating fuel purchased and the corresponding costs. Finally, review the form for completeness and accuracy before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the credit claimed on Form CT 241, taxpayers must meet specific eligibility criteria. These criteria typically include being a resident of the state where the credit is offered and having purchased clean heating fuel that meets state-defined standards. Additionally, the fuel must be used for residential heating purposes. It is essential to review the eligibility requirements carefully to ensure compliance and maximize the potential credit received.

Required Documents

When filing Form CT 241, certain documents are required to substantiate your claim for the clean heating fuel credit. These documents include receipts or invoices for the clean heating fuel purchased, proof of payment, and any relevant tax identification numbers. Keeping organized records will facilitate a smoother filing process and help avoid potential delays or issues with your claim.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 241 can be submitted through various methods, depending on the preferences of the taxpayer and the regulations set forth by the state tax authority. Options typically include online submission through the state’s tax portal, mailing a physical copy of the completed form to the designated tax office, or delivering it in person. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your circumstances.

Filing Deadlines / Important Dates

Filing deadlines for Form CT 241 are critical to ensure that taxpayers receive their clean heating fuel credit in a timely manner. Typically, the form must be submitted by a specific date, often aligned with the general tax filing deadline. It is advisable to check the state’s tax authority website for the most current deadlines and any potential extensions that may apply, as missing the deadline could result in losing the credit.

Quick guide on how to complete form ct 241 claim for clean heating fuel credit tax year 2020

Effortlessly Prepare Form CT 241 Claim For Clean Heating Fuel Credit Tax Year on Any Device

Digital document management has grown increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Manage Form CT 241 Claim For Clean Heating Fuel Credit Tax Year on any device using the airSlate SignNow applications for Android or iOS and streamline your document-related tasks today.

Easily Edit and Electronically Sign Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

- Find Form CT 241 Claim For Clean Heating Fuel Credit Tax Year and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections or redact sensitive information with the tools provided by airSlate SignNow specially designed for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form CT 241 Claim For Clean Heating Fuel Credit Tax Year to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 241 claim for clean heating fuel credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 241 claim for clean heating fuel credit tax year 2020

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to 241?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents quickly and securely. With the growing demand for remote solutions, the service provides a cost-effective way to manage document workflows efficiently, making it ideal for organizations focusing on achieving their goals, like reducing inefficiencies by 241.

-

How much does airSlate SignNow cost?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs. By opting for this solution, you can save time and resources, ultimately reducing operational costs by an estimated 241 hours annually due to its efficient processing.

-

What key features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as document templates, real-time notifications, and advanced security options. These tools are designed to streamline your workflows, enhancing productivity levels signNowly, which can result in achieving benchmark goals like saving 241 hours in a busy workweek.

-

What are the benefits of using airSlate SignNow for electronic signatures?

Using airSlate SignNow for electronic signatures enhances efficiency, reduces paperwork, and accelerates the signature process. Businesses report an increase in signed contracts by 241 percent when utilizing electronic signatures compared to traditional methods, making it a valuable asset.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems and cloud storage services. This capability allows businesses to streamline their document management processes, resulting in smoother operations that can enhance productivity by 241 percent.

-

How secure is the airSlate SignNow platform?

airSlate SignNow employs robust security measures, including encryption and authentication protocols, to protect sensitive information. Organizations can trust that their data remains safe and compliant, which is critical for maintaining customer confidence and mitigating risks by up to 241 percent.

-

Is airSlate SignNow easy to use for beginners?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, ensuring that even those new to electronic signatures can navigate the platform easily. By simplifying the process, users often report saving up to 241 percent more time when managing document workflows.

Get more for Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

Find out other Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online