Www Irs Govbusinessessmall Businesses SelfFAQs for Disaster VictimsInternal Revenue IRS Tax Forms 2021

Understanding the 241 new state form

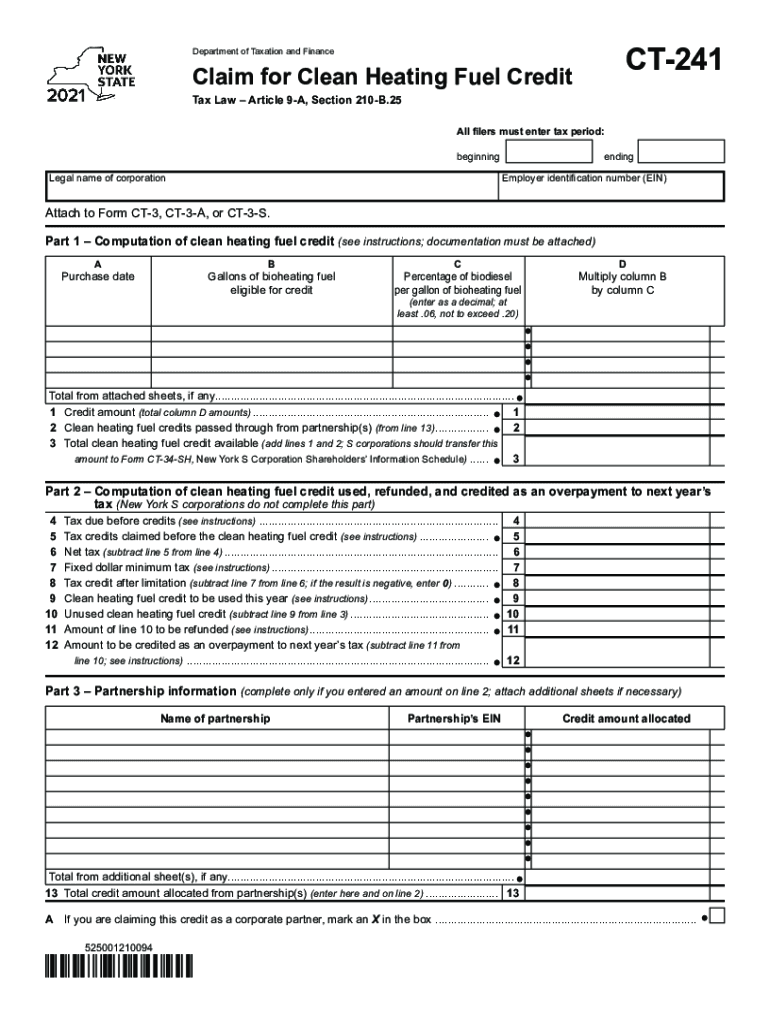

The 241 new state form, also known as the ct241 form, is essential for individuals and businesses seeking to claim clean heating fuel credits in the United States. This form is specifically designed for those who have utilized clean heating fuels, allowing them to receive tax credits that can significantly reduce their overall tax liability. Understanding the purpose and requirements of this form is crucial for successful submission and compliance with state regulations.

Steps to complete the 241 new state form

Filling out the 241 new state form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for clean heating fuel purchases and any relevant identification numbers. Next, carefully fill in your personal information, including your name, address, and tax identification number. Ensure that you provide accurate details about the amount of clean heating fuel used and any other required information. Once completed, review the form for any errors before submission.

Eligibility criteria for claiming clean heating fuel credits

To qualify for the clean heating fuel credits through the 241 new state form, applicants must meet specific eligibility criteria. These criteria typically include being a resident of the state where the credits are being claimed, having purchased qualifying clean heating fuels, and using these fuels for residential or business purposes. It is important to verify the specific requirements for your state, as they may vary. Additionally, applicants should ensure they have all necessary documentation to support their claim.

Required documents for submission

When submitting the 241 new state form, certain documents are necessary to validate your claim for clean heating fuel credits. These may include:

- Receipts or invoices for clean heating fuel purchases

- Proof of residency or business location

- Tax identification number

- Any additional forms or documentation as specified by state regulations

Having these documents ready will facilitate a smoother submission process and help avoid delays in processing your claim.

Form submission methods

The 241 new state form can typically be submitted through various methods, depending on state guidelines. Common submission methods include:

- Online submission through the state’s tax website

- Mailing a printed copy of the form to the appropriate tax authority

- In-person submission at designated tax offices

Choosing the right submission method can affect the speed of processing your claim, so it is advisable to check the state’s official resources for the most efficient options.

Penalties for non-compliance

Failing to comply with the requirements associated with the 241 new state form can result in penalties. These may include fines, disallowance of the claimed credits, or additional tax liabilities. It is essential to ensure that all information provided is accurate and that all eligibility criteria are met to avoid any repercussions. Keeping thorough records and understanding the submission guidelines can help mitigate the risk of non-compliance.

Quick guide on how to complete wwwirsgovbusinessessmall businesses selffaqs for disaster victimsinternal revenue irs tax forms

Finalize Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers a superb environmentally-friendly alternative to traditional printed and signed paperwork, as you can locate the desired form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms from any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to edit and electronically sign Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms with ease

- Obtain Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms and guarantee excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovbusinessessmall businesses selffaqs for disaster victimsinternal revenue irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovbusinessessmall businesses selffaqs for disaster victimsinternal revenue irs tax forms

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What is the 241 new state form and why is it important?

The 241 new state form is a crucial document for businesses operating in certain states, ensuring compliance with local regulations. It streamlines the process of filing necessary documents and is essential for maintaining legal integrity. Utilizing airSlate SignNow makes completing and submitting this form easier and more efficient.

-

How can airSlate SignNow help with the 241 new state form?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign the 241 new state form. With our document management features, you can also track submissions and ensure that your forms are always up to date. This simplifies compliance and saves time for businesses.

-

Is airSlate SignNow affordable for small businesses handling the 241 new state form?

Yes, airSlate SignNow offers cost-effective pricing plans that are ideal for small businesses dealing with the 241 new state form. Our flexible subscription options ensure that you can choose a plan that fits your budget while enjoying premium features. This affordability makes it easier for all businesses to stay compliant.

-

What features does airSlate SignNow include for managing the 241 new state form?

airSlate SignNow includes features like templated document creation, bulk sending, and robust eSigning capabilities for the 241 new state form. Additionally, it offers secure storage and easy integration with other business applications. These features streamline the management of your documents, ensuring a hassle-free experience.

-

Can I integrate airSlate SignNow with other software for the 241 new state form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your workflow while handling the 241 new state form. This allows you to connect with CRM systems, cloud storage, and other applications for a cohesive document management experience. Integration boosts efficiency and saves time.

-

What are the benefits of using airSlate SignNow for the 241 new state form?

Using airSlate SignNow for the 241 new state form offers numerous benefits, including enhanced security, ease of use, and faster processing times. By automating the signing process, you reduce the chance of errors and ensure that your documents are completed correctly. This contributes to more efficient business operations.

-

Is there customer support available when using airSlate SignNow for the 241 new state form?

Yes, airSlate SignNow provides excellent customer support for users dealing with the 241 new state form. Our dedicated support team is available to assist you with any questions or issues you may encounter during the eSigning or document management process. We are committed to ensuring your experience is smooth and satisfactory.

Get more for Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms

Find out other Www irs govbusinessessmall businesses selfFAQs For Disaster VictimsInternal Revenue IRS Tax Forms

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now