State of Hawaii Tax Information University of Hawaii at Manoa 2022

Steps to complete the 2022 N-11 tax form

Completing the 2022 N-11 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your Social Security number, filing status, and income details. This information will be essential for filling out the form correctly.

Next, download the 2022 N-11 form from the official State of Hawaii website or obtain a physical copy. Carefully read through the instructions provided with the form to understand the requirements and specific sections you need to complete.

As you fill out the form, ensure that you report all sources of income accurately. This includes wages, dividends, and any other taxable income. Be mindful of the deductions and credits available to you, as these can significantly impact your final tax liability.

Once you have completed the form, double-check all entries for accuracy. It is advisable to have another person review your form as well. After confirming that everything is correct, you can proceed to submit your form either electronically or by mail, as per the instructions provided.

Filing Deadlines / Important Dates for the 2022 N-11

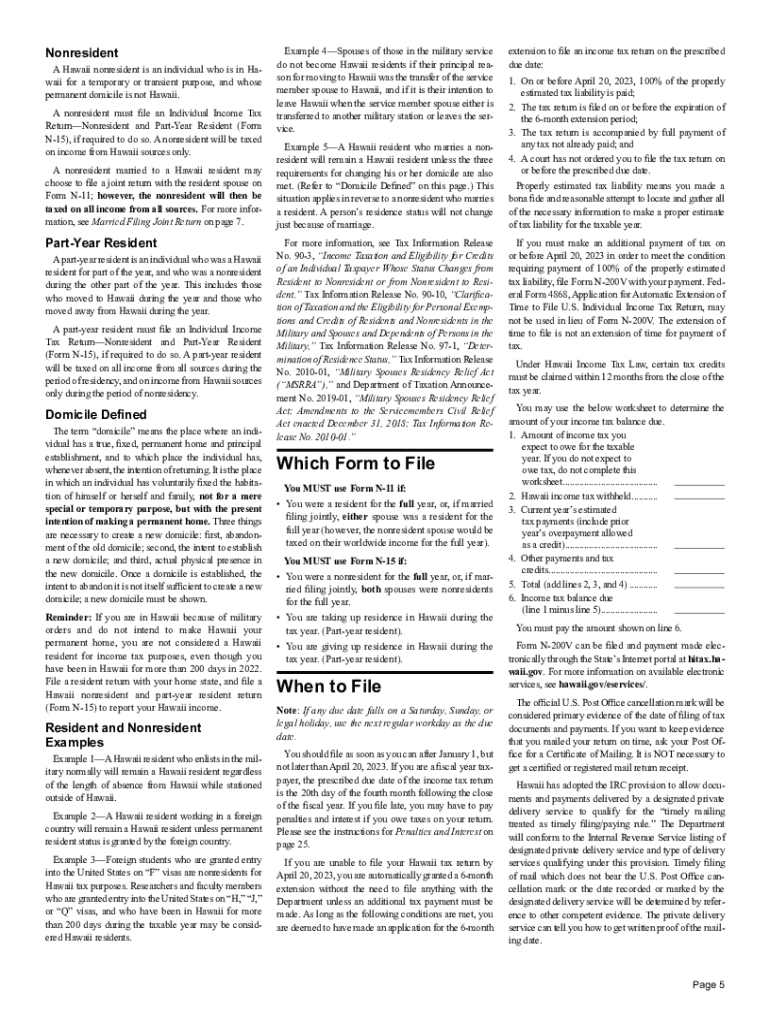

Filing deadlines are crucial to avoid penalties and ensure timely processing of your tax return. For the 2022 N-11 tax form, the deadline for submission is typically April 20 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is also important to keep track of any extensions you may apply for. If you cannot meet the deadline, you can file for an extension, which generally allows for an additional six months to submit your tax return. Be aware that while an extension gives you more time to file, it does not extend the time to pay any taxes owed.

Required Documents for the 2022 N-11

When preparing to complete the 2022 N-11 tax form, it is essential to gather all necessary documents to support your filing. Key documents include your W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources.

You should also collect documentation for deductions or credits you plan to claim. This may include receipts for medical expenses, educational expenses, or mortgage interest statements. Having all these documents organized will streamline the process and help ensure that your tax return is accurate.

Who Issues the 2022 N-11 Form

The 2022 N-11 tax form is issued by the State of Hawaii Department of Taxation. This agency is responsible for administering the state's tax laws and ensuring compliance among taxpayers. The form is specifically designed for residents of Hawaii who are filing their state income tax returns.

As part of the filing process, it is important to stay informed about any updates or changes to tax laws that the Department of Taxation may announce. Regularly checking their official website can provide valuable information regarding tax rates, deadlines, and any new forms that may be required.

Penalties for Non-Compliance with the 2022 N-11

Failing to comply with the requirements of the 2022 N-11 tax form can result in significant penalties. If you miss the filing deadline, you may incur late filing fees, which can accumulate over time. Additionally, if you underreport your income or fail to pay the taxes owed, you may face interest charges and further penalties from the State of Hawaii.

To avoid these consequences, it is crucial to file your tax return accurately and on time. If you are unsure about any aspect of the form, consider seeking assistance from a tax professional who can provide guidance and help you navigate the complexities of state tax regulations.

Quick guide on how to complete state of hawaii tax information university of hawaii at manoa

Prepare State Of Hawaii Tax Information University Of Hawaii At Manoa effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, since you can easily locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Manage State Of Hawaii Tax Information University Of Hawaii At Manoa on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign State Of Hawaii Tax Information University Of Hawaii At Manoa without hassle

- Obtain State Of Hawaii Tax Information University Of Hawaii At Manoa and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your desired method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign State Of Hawaii Tax Information University Of Hawaii At Manoa and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of hawaii tax information university of hawaii at manoa

Create this form in 5 minutes!

How to create an eSignature for the state of hawaii tax information university of hawaii at manoa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2022 n 11 instructions for using airSlate SignNow?

The 2022 n 11 instructions for using airSlate SignNow provide a comprehensive guide on how to effectively eSign and send documents. These instructions simplify the process, ensuring users can navigate through features effortlessly. By following the 2022 n 11 instructions, you can maximize your experience with our platform.

-

How much does airSlate SignNow cost in 2022?

The pricing for airSlate SignNow in 2022 is designed to fit various business needs, offering competitive rates for different tiers. You can choose from monthly or annual subscription plans, ensuring flexibility. By reviewing the 2022 n 11 instructions, you can better understand which plan is the most suitable for your organization.

-

What key features does airSlate SignNow offer?

AirSlate SignNow provides a suite of features including eSigning, document templates, and secure storage to streamline your workflow. These features are elaborated in the 2022 n 11 instructions, highlighting how they can boost productivity and collaboration within your team. By leveraging these features, businesses can enhance their document management processes.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with a variety of applications such as Google Drive, Salesforce, and Microsoft Office. The 2022 n 11 instructions detail how to set up these integrations, allowing seamless transfer of documents across platforms. This connectivity ensures that your eSigning process is as efficient as possible.

-

What benefits does airSlate SignNow provide for businesses?

AirSlate SignNow offers multiple benefits, including time savings, improved accuracy, and enhanced security for document signing. The 2022 n 11 instructions explain how these advantages can transform your business operations. By adopting airSlate SignNow, businesses can focus on their core activities while leaving document management to us.

-

Is airSlate SignNow suitable for all business sizes?

Absolutely! AirSlate SignNow is designed to accommodate businesses of all sizes, from startups to enterprises. The 2022 n 11 instructions cater to diverse user needs, ensuring that everyone can utilize our platform effectively. This versatility makes airSlate SignNow an ideal solution for any organization looking to streamline their document processes.

-

How secure is airSlate SignNow for eSigning documents?

Security is a top priority at airSlate SignNow; we implement robust measures including encryption and compliance with regulatory standards. The 2022 n 11 instructions outline these security features, reassuring users that their documents are protected. Trust our platform for a secure eSigning experience that safeguards sensitive information.

Get more for State Of Hawaii Tax Information University Of Hawaii At Manoa

- Bill of sale without warranty by individual seller south carolina form

- Bill of sale without warranty by corporate seller south carolina form

- Verification of creditors matrix south carolina form

- Correction statement and agreement south carolina form

- South carolina closing form

- Flood zone statement and authorization south carolina form

- Name affidavit of buyer south carolina form

- Name affidavit of seller south carolina form

Find out other State Of Hawaii Tax Information University Of Hawaii At Manoa

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online