N 11 2024-2026

What is the N 11?

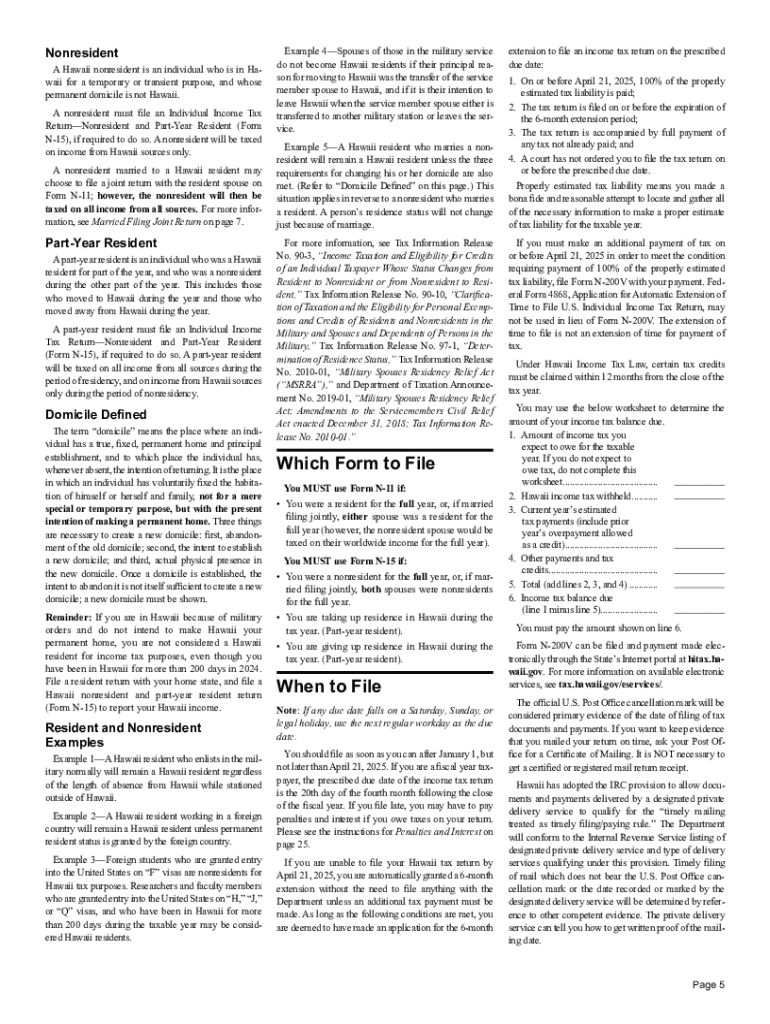

The N 11 is a specific tax form used in Hawaii for reporting income and calculating state tax obligations. It is primarily designed for residents and businesses operating within the state, allowing them to accurately report their earnings and claim any applicable deductions or credits. Understanding the purpose of the N 11 is essential for ensuring compliance with state tax laws and avoiding potential penalties.

Steps to Complete the N 11

Completing the N 11 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any prior tax returns. Next, fill out the form by entering your personal information, income details, and deductions. It's important to double-check all entries for accuracy. After completing the form, review it thoroughly before submitting it to the appropriate state tax authority.

Required Documents

To successfully complete the N 11, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any additional income sources

- Receipts for deductible expenses

- Previous year's tax return for reference

Having these documents ready will streamline the process of filling out the N 11 and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the N 11 is crucial for compliance. Typically, the deadline for submitting the N 11 is April 20 of the following year for individual taxpayers. However, if you are a business, the deadlines may vary based on your entity type. It is advisable to stay informed about any changes to these dates, as late submissions can result in penalties and interest on unpaid taxes.

Legal Use of the N 11

The N 11 must be used in accordance with Hawaii state tax laws. It is essential to ensure that all information provided is truthful and complete, as any discrepancies can lead to legal issues, including audits or fines. Taxpayers should familiarize themselves with the legal requirements surrounding the use of the N 11 to avoid complications in their tax filings.

Examples of Using the N 11

The N 11 can be used in various scenarios, such as:

- Reporting income from employment or self-employment

- Claiming deductions for business expenses

- Filing taxes as a married couple or head of household

These examples illustrate the versatility of the N 11 in addressing different taxpayer situations, making it a vital tool for accurate tax reporting in Hawaii.

Who Issues the Form

The N 11 is issued by the Hawaii Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any inquiries related to the N 11, including clarifications on the form or guidance on completing it, taxpayers can contact the Hawaii Department of Taxation directly for assistance.

Create this form in 5 minutes or less

Find and fill out the correct n 11

Create this form in 5 minutes!

How to create an eSignature for the n 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the n 11 instructions for using airSlate SignNow?

The n 11 instructions for airSlate SignNow provide a step-by-step guide on how to effectively send and eSign documents. These instructions are designed to help users navigate the platform easily, ensuring a smooth experience from document creation to signing.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. The n 11 instructions detail the different pricing tiers, allowing you to select the best option that fits your business needs and budget.

-

What features are included in the n 11 instructions?

The n 11 instructions cover a range of features including document templates, real-time tracking, and secure eSigning. These features are designed to enhance productivity and streamline your document management process.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers various integrations with popular applications. The n 11 instructions provide guidance on how to connect with tools like Google Drive, Salesforce, and more, making it easier to manage your documents.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. The n 11 instructions highlight how these advantages can help your business save time and resources.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. The n 11 instructions explain the security measures in place to protect your sensitive documents during the signing process.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple. Follow the n 11 instructions to create an account, set up your profile, and begin sending documents for eSigning in just a few minutes.

Get more for N 11

- Violation and review record form

- Rv space rental agreement oregon form

- Of trustee deed form

- Printable grooming forms

- Fd foc4033 a motion to transfer your case to another michigan 3rdcc form

- General change endorsement federal emergency management fema form

- Declaration of section 214 status www1 honolulu form

- Honorarium letter for pastor form

Find out other N 11

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free