Fillable Online Instructions for Forms N 11 and N 12 Rev 2020

Understanding the Fillable Online Instructions for Forms N-11 and N-12

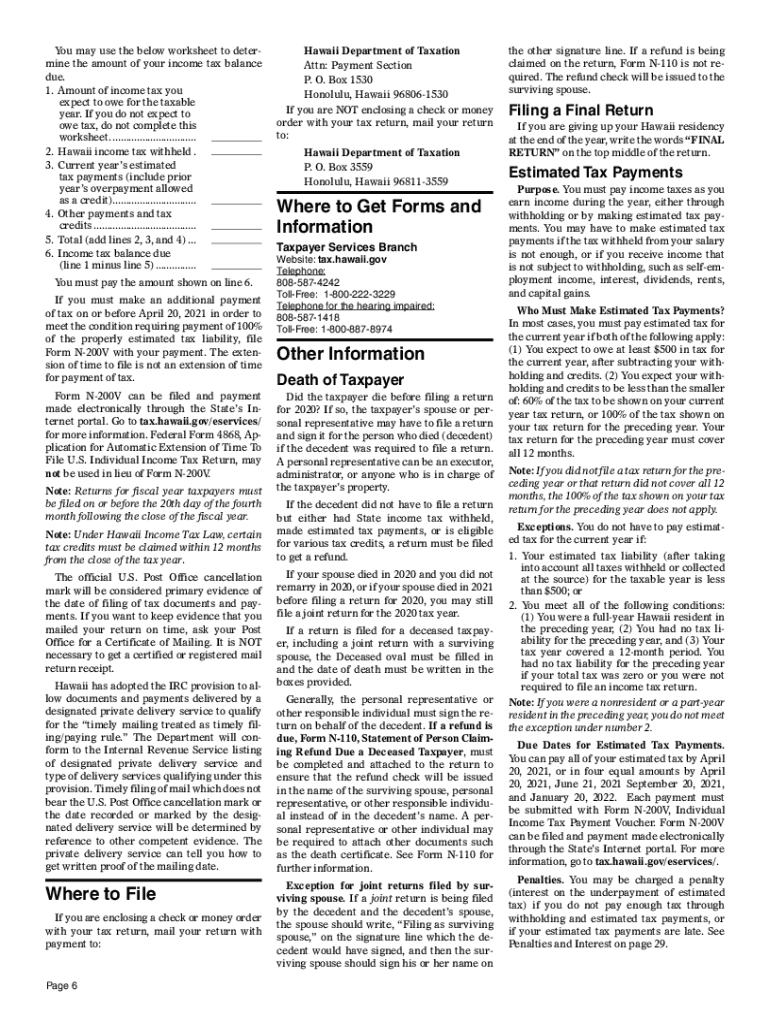

The Fillable Online Instructions for Forms N-11 and N-12 provide essential guidance for taxpayers in Hawaii. These forms are primarily used for income tax filing and require specific information to ensure compliance with state tax regulations. Understanding the purpose and requirements of these forms is crucial for accurate filing.

Form N-11 is designed for individuals who are residents of Hawaii, while Form N-12 is for non-residents. Both forms require detailed financial information, including income sources, deductions, and credits. Familiarizing yourself with these instructions can help streamline the filing process and minimize errors.

Steps to Complete the Fillable Online Instructions for Forms N-11 and N-12

Completing the Fillable Online Instructions for Forms N-11 and N-12 involves several key steps. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, access the online form and ensure you are using a compatible web browser to avoid technical issues.

Begin filling out the form by entering your personal information, such as your name, address, and Social Security number. Follow the prompts to input your income details and any applicable deductions. Review your entries carefully before submitting the form to ensure accuracy. Once completed, you can save a copy for your records.

Legal Use of the Fillable Online Instructions for Forms N-11 and N-12

The legal use of the Fillable Online Instructions for Forms N-11 and N-12 is governed by Hawaii state tax laws. These forms must be completed accurately and submitted by the designated filing deadline to avoid penalties. The instructions provide guidance on what constitutes a valid submission, including the necessary signatures and certifications.

Using a reliable digital platform, such as signNow, ensures that your eSignature meets legal requirements. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential for the validity of your electronic submissions.

Filing Deadlines and Important Dates

Filing deadlines for Forms N-11 and N-12 are critical for compliance with Hawaii tax regulations. Typically, the deadline for submitting these forms is April 20 for individual taxpayers. However, if you file for an extension, the deadline may be extended to October 20.

It is important to stay informed about any changes to these dates, as they can vary from year to year. Marking your calendar with these deadlines can help ensure timely submission and avoid late fees.

Required Documents for Forms N-11 and N-12

To complete Forms N-11 and N-12, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions, such as mortgage interest or charitable contributions

- Proof of residency, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Examples of Using the Fillable Online Instructions for Forms N-11 and N-12

Examples of using the Fillable Online Instructions for Forms N-11 and N-12 can provide clarity on how to approach your tax filing. For instance, if you are a self-employed individual, you will need to report your business income and expenses. The instructions guide you on how to calculate your net income and what deductions you can claim.

Similarly, if you are a student, the instructions will help you identify eligible education credits that can reduce your tax liability. Understanding these examples can make the filing process less daunting and more manageable.

Quick guide on how to complete fillable online instructions for forms n 11 and n 12 rev

Complete Fillable Online Instructions For Forms N 11 And N 12 Rev effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an excellent environmentally friendly alternative to traditionally printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Handle Fillable Online Instructions For Forms N 11 And N 12 Rev on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Fillable Online Instructions For Forms N 11 And N 12 Rev with ease

- Locate Fillable Online Instructions For Forms N 11 And N 12 Rev and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as an ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Fillable Online Instructions For Forms N 11 And N 12 Rev and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online instructions for forms n 11 and n 12 rev

Create this form in 5 minutes!

How to create an eSignature for the fillable online instructions for forms n 11 and n 12 rev

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What are the benefits of using airSlate SignNow for Hawaii instructions?

Using airSlate SignNow for Hawaii instructions streamlines the process of sending and signing documents electronically. It saves time, reduces paperwork, and ensures compliance with local regulations. The platform offers easy access and promotes efficiency, allowing businesses to focus on their core operations.

-

How much does airSlate SignNow cost for Hawaii customers?

The pricing for airSlate SignNow varies based on the plan chosen, with options suitable for individuals and businesses in Hawaii. Depending on the features you need, you can select from basic to premium plans. Each plan offers scalable solutions tailored to accommodate various document management needs.

-

Are the Hawaii instructions features user-friendly?

Yes, airSlate SignNow is designed with a user-friendly interface that simplifies the process of managing Hawaii instructions. Users can easily navigate through the platform to upload, send, and eSign documents without technical expertise. This intuitive design helps ensure a seamless user experience.

-

What types of documents can be signed with airSlate SignNow following Hawaii instructions?

airSlate SignNow allows users to sign a variety of document types following Hawaii instructions, including contracts, agreements, and forms. The platform supports various file formats, making it versatile for businesses in need of electronic signatures. This flexibility helps businesses adapt to different document requirements.

-

Can I integrate airSlate SignNow with other applications for Hawaii instructions?

Absolutely! airSlate SignNow integrates with numerous third-party applications, enabling businesses in Hawaii to enhance their workflows. Whether it's CRM tools, cloud storage, or email services, these integrations ensure that your document management process is efficient and connected.

-

Is there a mobile app for airSlate SignNow to handle Hawaii instructions?

Yes, airSlate SignNow offers a mobile app that allows you to manage Hawaii instructions on the go. This app provides functionality to send and eSign documents from anywhere, making it ideal for busy professionals. It ensures that you can keep your business moving forward, no matter where you are.

-

How secure is airSlate SignNow for handling Hawaii instructions?

airSlate SignNow prioritizes security and complies with industry standards to protect your documents and data. With features like data encryption and secure cloud storage, you can trust that your Hawaii instructions are safe from unauthorized access. This focus on security helps businesses operate with confidence.

Get more for Fillable Online Instructions For Forms N 11 And N 12 Rev

- Form ds 7646 download printable pdf or fill online us national commission for unesco laura w bush

- Us department of state time and attendance 2018 form

- Ds 4151 form

- Completed application coversheet form ds 7646 state

- Application for repair station certificate andor form

- Mcs 150 form

- Faa form 8120 10

- Fhwa 1273 form

Find out other Fillable Online Instructions For Forms N 11 And N 12 Rev

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word