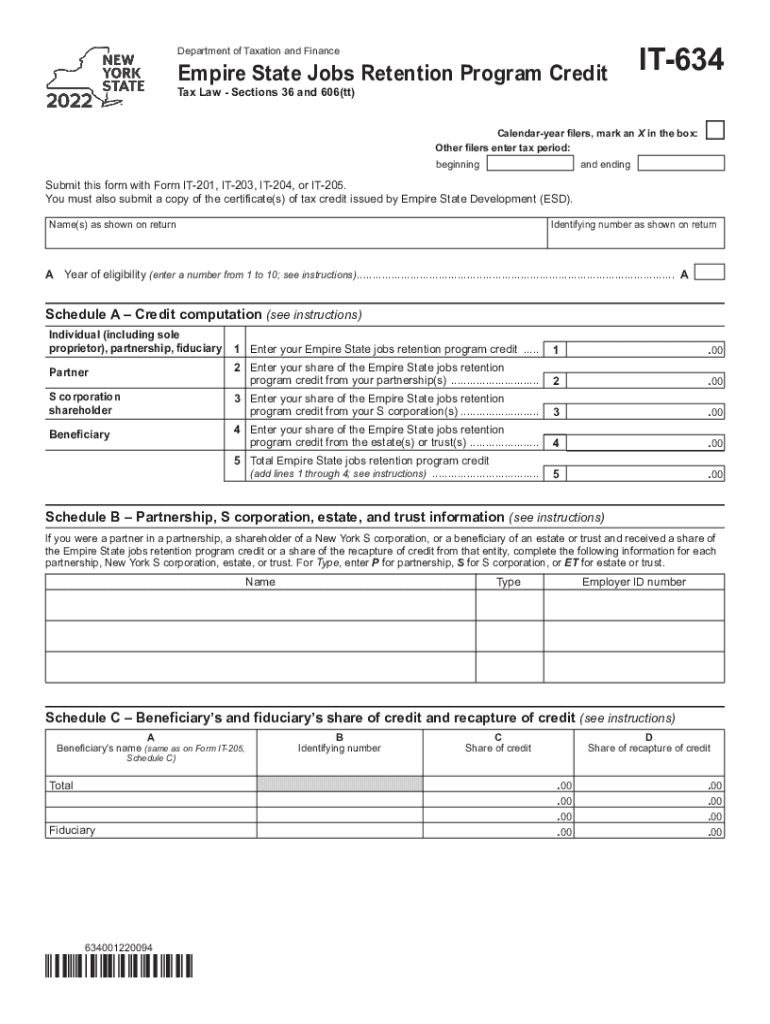

Form it 634 Empire State Jobs Retention Program Credit Tax Year 2022

What is the Form IT-634 Empire State Jobs Retention Program Credit Tax Year

The Form IT-634 is designed for businesses in New York to claim the Empire State Jobs Retention Program Credit. This credit aims to support employers who retain jobs in the state, particularly during challenging economic conditions. By completing this form, eligible businesses can reduce their tax liability, thereby encouraging job preservation and economic stability within New York. The form is specifically tailored for the tax year, ensuring that businesses can accurately report their retention efforts and claim the appropriate credits.

Eligibility Criteria

To qualify for the Empire State Jobs Retention Program Credit, businesses must meet specific criteria. Generally, the business must be located in New York and have retained a certain number of jobs during the tax year. Additionally, the business must demonstrate that the retained jobs are full-time positions. The program is particularly focused on industries that have faced significant challenges, ensuring that support is directed where it is most needed. Businesses should review the detailed eligibility requirements outlined in the form instructions to confirm their qualification.

Steps to Complete the Form IT-634 Empire State Jobs Retention Program Credit Tax Year

Completing the Form IT-634 involves several clear steps:

- Gather necessary documentation, including payroll records and proof of job retention.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the credit amount based on the number of retained jobs and applicable rates.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required attachments to the appropriate tax authority.

How to Obtain the Form IT-634 Empire State Jobs Retention Program Credit Tax Year

The Form IT-634 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a printable format, allowing businesses to fill it out manually. Additionally, businesses may also find the form at various tax preparation offices or through professional accountants who specialize in New York tax law. Ensuring that the most current version of the form is used is essential for compliance and accurate filing.

Legal Use of the Form IT-634 Empire State Jobs Retention Program Credit Tax Year

The legal use of the Form IT-634 is governed by New York state tax laws. To ensure compliance, businesses must adhere to the guidelines set forth by the state regarding job retention and credit claims. The form serves as a legal document that, when completed accurately, can provide significant tax benefits. It is crucial for businesses to maintain accurate records and documentation to support their claims, as the form may be subject to review by tax authorities.

Form Submission Methods

Businesses can submit the Form IT-634 through various methods, depending on their preference and the requirements set by the New York State Department of Taxation and Finance. The form can be submitted online through the department's e-filing system, mailed to the designated address, or delivered in person at local tax offices. Each submission method has its own guidelines and deadlines, so businesses should choose the option that best suits their needs while ensuring timely compliance.

Quick guide on how to complete form it 634 empire state jobs retention program credit tax year 2022

Effortlessly Prepare Form IT 634 Empire State Jobs Retention Program Credit Tax Year on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to quickly create, edit, and electronically sign your documents without delays. Manage Form IT 634 Empire State Jobs Retention Program Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The simplest method to modify and electronically sign Form IT 634 Empire State Jobs Retention Program Credit Tax Year with ease

- Obtain Form IT 634 Empire State Jobs Retention Program Credit Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form IT 634 Empire State Jobs Retention Program Credit Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 634 empire state jobs retention program credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 634 empire state jobs retention program credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 634 program form?

The 634 program form is a specific document used for various administrative and reporting purposes. It streamlines the process of submitting and managing program-related information. By utilizing our service, businesses can efficiently manage their 634 program forms with ease.

-

How can airSlate SignNow help with the 634 program form?

airSlate SignNow allows users to create, send, and eSign the 634 program form quickly and securely. Our intuitive platform simplifies document workflows, enabling teams to collaborate and finalize forms faster. With features like templates and electronic signatures, your 634 program forms will be managed efficiently.

-

Is there a cost associated with using airSlate SignNow for the 634 program form?

Yes, while airSlate SignNow offers various pricing plans, the cost will depend on the features you need for your 634 program form. We provide options for different business sizes, ensuring you find a plan that fits your budget. Our pricing is transparent with no hidden fees.

-

What features does airSlate SignNow offer for the 634 program form?

Key features for managing the 634 program form in airSlate SignNow include customizable templates, automatic reminders, and real-time status updates. These tools are designed to enhance efficiency and reduce the time spent on paperwork. You will also enjoy secure cloud storage for all your signed documents.

-

Can I integrate airSlate SignNow with other applications for the 634 program form?

Yes, airSlate SignNow offers integrations with various applications that can assist in managing your 634 program form. These integrations enhance functionality and make it easier to synchronize data and streamline workflows. Some popular integrations include CRM systems and cloud storage solutions.

-

What benefits can businesses expect from using airSlate SignNow for the 634 program form?

By using airSlate SignNow for your 634 program form, businesses can expect enhanced productivity, faster turnaround times, and improved compliance. Our user-friendly platform reduces the hassles of paperwork, enabling teams to focus on core business activities. Additionally, electronic signatures add a layer of security and authenticity to your forms.

-

How secure is the airSlate SignNow platform for handling the 634 program form?

Security is a top priority for airSlate SignNow. When handling your 634 program form, we utilize industry-standard encryption and secure cloud storage. This ensures that your documents are protected against unauthorized access and data bsignNowes throughout the signing process.

Get more for Form IT 634 Empire State Jobs Retention Program Credit Tax Year

Find out other Form IT 634 Empire State Jobs Retention Program Credit Tax Year

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free