Form it 634 Empire State Jobs Retention Program Credit Tax Year 2024-2026

Understanding the Form IT 634 for the Empire State Jobs Retention Program

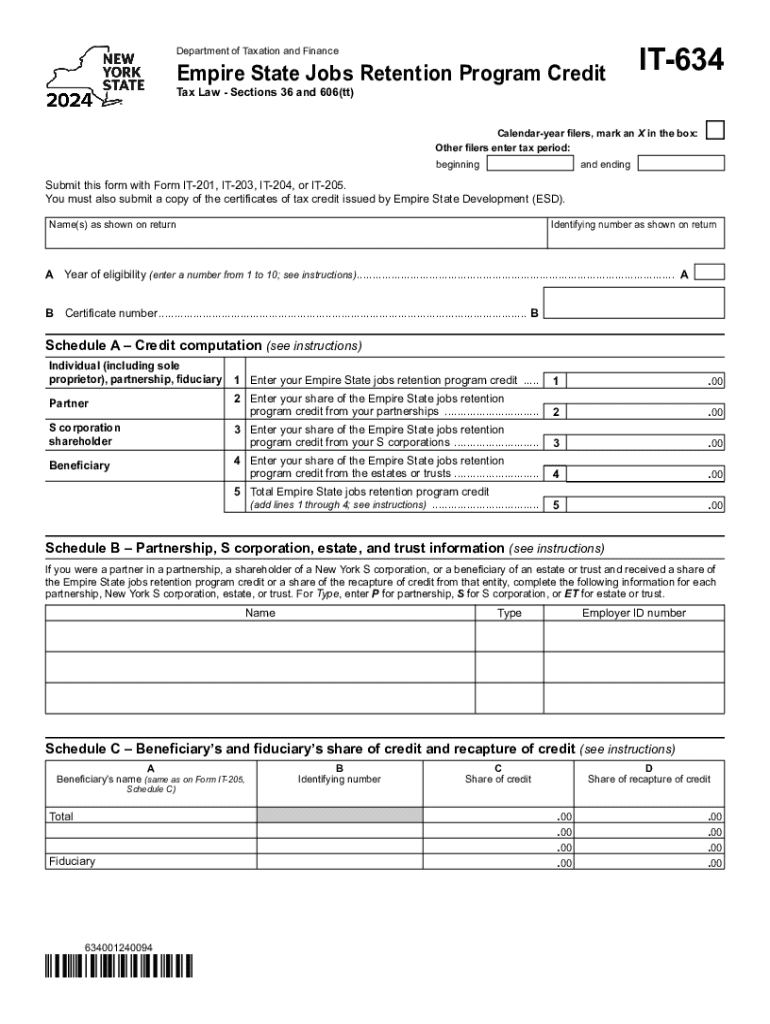

The Form IT 634 is designed for businesses participating in the Empire State Jobs Retention Program. This program aims to incentivize employers to retain jobs in New York State. By using this form, businesses can apply for a tax credit that helps offset costs associated with maintaining their workforce. The form is essential for businesses looking to benefit from state tax incentives aimed at job retention.

Steps to Complete the Form IT 634

Completing the Form IT 634 involves several steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including proof of employment and payroll records. Next, fill out the form with accurate business information, including your Employer Identification Number (EIN) and the number of retained jobs. Ensure you calculate the tax credit correctly based on the guidelines provided for your specific tax year. After completing the form, review it thoroughly before submission to avoid any errors that could delay processing.

Eligibility Criteria for the Empire State Jobs Retention Program

To qualify for the tax credit associated with Form IT 634, businesses must meet specific eligibility criteria. Companies must demonstrate that they have retained a certain number of jobs over a defined period. Additionally, businesses must operate within New York State and comply with all applicable state employment laws. It is crucial to review the detailed eligibility requirements outlined by the New York State Department of Taxation and Finance to ensure compliance.

Required Documents for Form IT 634 Submission

When submitting Form IT 634, businesses must provide supporting documentation to validate their claims. Required documents typically include payroll records, proof of employment for retained jobs, and any other relevant financial statements. These documents help substantiate the information provided on the form and are essential for the approval process. Ensure that all documents are organized and submitted along with the form to facilitate a smooth review.

Filing Deadlines for Form IT 634

Timely submission of Form IT 634 is critical to ensure eligibility for the tax credit. The filing deadlines may vary based on the tax year and specific program guidelines. Generally, businesses should submit the form by the due date for their annual tax return. It is important to stay informed about any changes to deadlines announced by the New York State Department of Taxation and Finance to avoid penalties.

Form Submission Methods for IT 634

Businesses have several options for submitting Form IT 634. The form can be filed online through the New York State Department of Taxation and Finance website, mailed to the appropriate address, or submitted in person at designated offices. Each submission method has its own processing times and requirements, so businesses should choose the method that best suits their needs and ensure they follow all guidelines for submission.

Create this form in 5 minutes or less

Find and fill out the correct form it 634 empire state jobs retention program credit tax year 772088711

Create this form in 5 minutes!

How to create an eSignature for the form it 634 empire state jobs retention program credit tax year 772088711

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's approach to new york retention?

airSlate SignNow focuses on enhancing new york retention by providing a seamless eSigning experience. Our platform ensures that documents are securely signed and stored, making it easy for businesses to manage their contracts and agreements efficiently.

-

How does airSlate SignNow improve document retention in New York?

With airSlate SignNow, businesses in New York can improve document retention through our cloud-based storage solutions. This allows for easy access and retrieval of signed documents, ensuring compliance and reducing the risk of lost paperwork.

-

What are the pricing options for airSlate SignNow in New York?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in New York. Our competitive pricing ensures that companies can achieve effective new york retention without breaking the bank, with options for monthly or annual subscriptions.

-

What features does airSlate SignNow offer for enhancing new york retention?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to enhance new york retention. These tools help streamline the signing process and ensure that all documents are easily accessible and organized.

-

Can airSlate SignNow integrate with other tools for better retention management?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, enhancing new york retention. This integration allows for a more cohesive workflow, ensuring that all signed documents are automatically stored and managed across platforms.

-

What benefits does airSlate SignNow provide for businesses focused on new york retention?

By using airSlate SignNow, businesses can benefit from improved efficiency, reduced paper usage, and enhanced compliance, all contributing to better new york retention. Our solution simplifies the signing process, allowing teams to focus on their core activities.

-

Is airSlate SignNow compliant with New York regulations for document retention?

Absolutely, airSlate SignNow is designed to comply with New York regulations regarding document retention. Our platform ensures that all signed documents are securely stored and easily retrievable, meeting legal requirements for businesses operating in the state.

Get more for Form IT 634 Empire State Jobs Retention Program Credit Tax Year

- Gap addendum form

- Swac football officials application form

- Personal financial statement valley national bank form

- Tractor registration victoria form

- Charitable giving request guidelines application james avery form

- Donation request form hasta la pasta

- Notice lease violation tenant form

- Supplemental health care timesheet form

Find out other Form IT 634 Empire State Jobs Retention Program Credit Tax Year

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast