Form it 634 Empire State Jobs Retention Program Credit Tax Year 2023

Understanding the Form IT 634 Empire State Jobs Retention Program Credit Tax Year

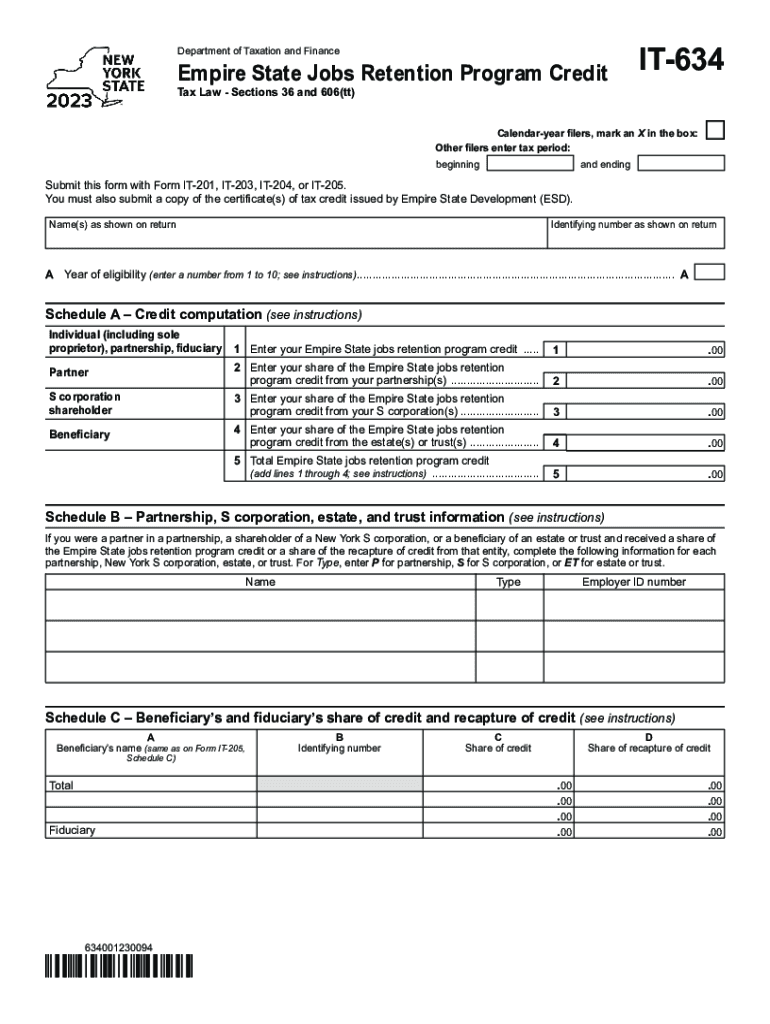

The Form IT 634 is designed for businesses participating in the Empire State Jobs Retention Program. This program aims to incentivize job retention in New York by offering tax credits to eligible employers. The primary objective is to support businesses in maintaining their workforce, particularly during challenging economic times. The tax credit can significantly reduce the overall tax liability for qualifying businesses, making it a valuable financial tool.

Steps to Complete the Form IT 634 Empire State Jobs Retention Program Credit Tax Year

Completing the Form IT 634 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including payroll records, employee information, and any prior tax filings relevant to the retention program. Next, accurately fill out each section of the form, ensuring that all figures reflect the actual number of retained jobs and associated wages. After completing the form, review it thoroughly for any errors or omissions before submission. Finally, submit the form by the designated deadline to avoid penalties.

Eligibility Criteria for the Form IT 634 Empire State Jobs Retention Program Credit Tax Year

To qualify for the Empire State Jobs Retention Program credit, businesses must meet specific eligibility criteria. These criteria typically include maintaining a minimum number of jobs over a defined period and demonstrating a commitment to retaining employees in New York. Additionally, businesses must be registered and in good standing with the New York State Department of Taxation and Finance. Understanding these requirements is crucial for businesses seeking to benefit from the program.

Required Documents for the Form IT 634 Empire State Jobs Retention Program Credit Tax Year

When preparing to submit the Form IT 634, businesses must compile several essential documents. These documents include proof of employment for retained workers, payroll records for the relevant tax year, and any additional forms required by the New York State Department of Taxation and Finance. Having these documents organized and readily available will streamline the completion process and ensure compliance with state regulations.

Filing Deadlines for the Form IT 634 Empire State Jobs Retention Program Credit Tax Year

Timely submission of the Form IT 634 is critical to avoid penalties and ensure eligibility for the tax credit. The filing deadline typically aligns with the annual tax return due date for businesses, which is generally April fifteenth for most entities. However, it is essential to verify the specific deadline for the tax year in question, as it may vary. Keeping track of these dates helps businesses maintain their compliance and maximize their potential benefits.

Examples of Using the Form IT 634 Empire State Jobs Retention Program Credit Tax Year

Businesses can benefit from the Form IT 634 in various ways. For instance, a manufacturing company that retains ten employees during an economic downturn may apply for the tax credit based on the wages paid to those employees. Similarly, a service-based business that maintains its workforce despite reduced demand can also leverage this form to reduce its tax liability. These examples illustrate how the program supports diverse industries in New York.

Quick guide on how to complete form it 634 empire state jobs retention program credit tax year

Complete Form IT 634 Empire State Jobs Retention Program Credit Tax Year seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, enabling you to obtain the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents efficiently without delays. Manage Form IT 634 Empire State Jobs Retention Program Credit Tax Year on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Form IT 634 Empire State Jobs Retention Program Credit Tax Year effortlessly

- Obtain Form IT 634 Empire State Jobs Retention Program Credit Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form IT 634 Empire State Jobs Retention Program Credit Tax Year and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 634 empire state jobs retention program credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 634 empire state jobs retention program credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a retention program in the context of airSlate SignNow?

A retention program at airSlate SignNow focuses on helping businesses keep their customers engaged and satisfied over time. By utilizing our eSignature solutions, organizations can streamline document workflows, ensuring prompt responses and enhancing client relationships. Ultimately, this leads to increased loyalty and retention rates.

-

How does airSlate SignNow's retention program enhance customer experience?

Our retention program is designed to optimize the way businesses interact with their clients. By providing a seamless and efficient eSigning experience, businesses can minimize delays in document handling, making it easier for customers to complete transactions. This contributes to a positive overall experience, helping to foster long-term relationships.

-

What features are included in airSlate SignNow's retention program?

The retention program includes features such as customizable document templates, automated reminders for signers, and real-time tracking of document status. Additionally, our user-friendly interface ensures that both businesses and customers can navigate the signing process with ease. These features work together to enhance customer satisfaction and retention.

-

Is there a cost associated with airSlate SignNow's retention program?

Yes, there is a pricing model for airSlate SignNow's retention program that varies based on usage and features required. We provide flexible plans that cater to different business sizes and needs. Investing in our retention program can lead to signNow savings by improving customer retention and streamlining processes.

-

Can airSlate SignNow integrate with other software as part of the retention program?

Absolutely! airSlate SignNow's retention program easily integrates with various popular software solutions, such as CRM systems and project management tools. These integrations allow businesses to maintain a cohesive workflow, ensuring that customer interactions are documented and managed efficiently, ultimately enhancing retention.

-

What are the key benefits of implementing a retention program with airSlate SignNow?

Implementing a retention program with airSlate SignNow offers numerous benefits, including improved customer satisfaction, reduced churn rates, and enhanced operational efficiency. Businesses can leverage our eSigning capabilities to make transactions quicker and more convenient for clients. This not only boosts retention but also helps in driving growth.

-

How can I get started with airSlate SignNow's retention program?

Getting started with airSlate SignNow's retention program is simple! You can sign up for a free trial on our website to explore the features and functionalities. Once you're ready, our team can assist you in choosing the right plan tailored to your business needs and help you optimize the retention strategies.

Get more for Form IT 634 Empire State Jobs Retention Program Credit Tax Year

Find out other Form IT 634 Empire State Jobs Retention Program Credit Tax Year

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form