Form it 634 Empire State Jobs Retention Program Credit Tax Year 2020

What is the NY 634 Form?

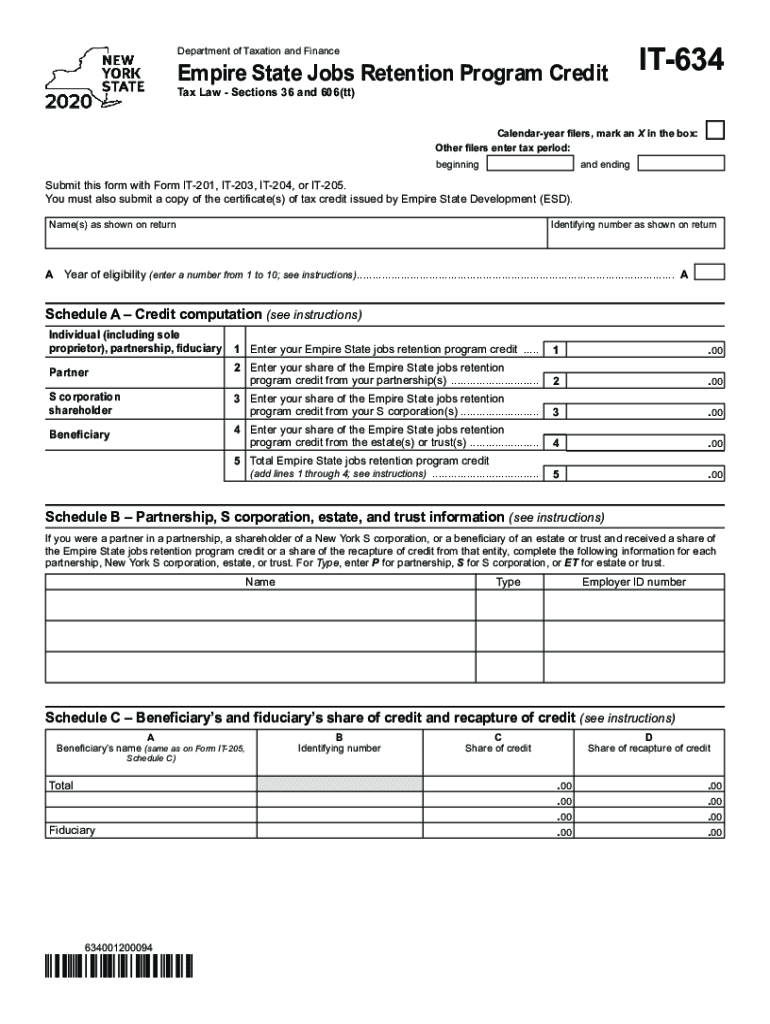

The NY 634 form, officially known as the Form IT-634 Empire State Jobs Retention Program Credit, is a tax form used by eligible businesses in New York State to claim a credit for retaining employees during challenging economic periods. This form is specifically designed to support businesses that have maintained their workforce despite economic downturns, thereby contributing to job stability within the state. The credit can reduce the amount of tax owed, making it a valuable resource for qualifying businesses.

Eligibility Criteria for the NY 634 Form

To qualify for the NY 634 form, businesses must meet specific criteria set by the New York State Department of Taxation and Finance. Generally, eligible businesses must demonstrate that they have retained a certain number of employees for a specified duration during the tax year. Additionally, the business must operate within New York State and be in good standing with state tax obligations. Understanding these criteria is essential for businesses looking to benefit from the tax credit.

Steps to Complete the NY 634 Form

Completing the NY 634 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including payroll records and tax identification numbers. Next, fill out the form by providing information about the business, including the number of retained employees and the duration of their employment. Be sure to calculate the credit amount based on the guidelines provided by the state. Finally, review the completed form for errors before submission.

Filing Deadlines for the NY 634 Form

It is crucial for businesses to be aware of the filing deadlines associated with the NY 634 form. Typically, the form must be filed alongside the business's annual tax return. Businesses should check the New York State Department of Taxation and Finance website for specific deadlines, as they may vary from year to year. Timely submission is essential to ensure eligibility for the credit.

Form Submission Methods for the NY 634 Form

Businesses can submit the NY 634 form through various methods, including online filing, mail, or in-person submission at designated tax offices. Online filing is often the most efficient option, allowing for quicker processing times. When submitting by mail, it is advisable to send the form via certified mail to ensure delivery confirmation. In-person submissions may be made at local tax offices during business hours.

Key Elements of the NY 634 Form

The NY 634 form includes several key elements that businesses must complete accurately. These elements typically include the business's name, address, tax identification number, and details about the retained employees. Additionally, the form requires calculations of the credit amount based on the number of employees retained and the applicable credit rate. Ensuring that all information is complete and accurate is vital for successful processing.

Legal Use of the NY 634 Form

The NY 634 form is legally binding when completed and submitted in accordance with New York State regulations. Businesses must ensure that all information provided is truthful and accurate to avoid penalties or legal issues. Utilizing a reliable eSignature platform can enhance the security and legality of the submission process, ensuring compliance with electronic signature laws.

Quick guide on how to complete form it 634 empire state jobs retention program credit tax year 2020

Complete Form IT 634 Empire State Jobs Retention Program Credit Tax Year effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form IT 634 Empire State Jobs Retention Program Credit Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Form IT 634 Empire State Jobs Retention Program Credit Tax Year without hassle

- Obtain Form IT 634 Empire State Jobs Retention Program Credit Tax Year and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or hide sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form IT 634 Empire State Jobs Retention Program Credit Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 634 empire state jobs retention program credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 634 empire state jobs retention program credit tax year 2020

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the NY 634 form?

The NY 634 form is a crucial document for New York State tax purposes. It is used to report and pay taxes owed to the state. Understanding how to fill out the NY 634 form correctly can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with completing the NY 634 form?

AirSlate SignNow provides a user-friendly platform that simplifies the process of completing and eSigning the NY 634 form. With features like templates and collaborative tools, you can streamline your document workflow and ensure accuracy when submitting your form.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans catering to businesses of all sizes. You can choose a plan that best suits your needs for managing documents like the NY 634 form, ensuring cost-effectiveness without compromising on functionality.

-

Is airSlate SignNow suitable for businesses that need to submit the NY 634 form frequently?

Yes, airSlate SignNow is ideal for businesses that often work with the NY 634 form or similar documents. Our platform streamlines the eSigning process, making it efficient to handle multiple submissions and manage recurring transactions seamlessly.

-

What features does airSlate SignNow offer for the NY 634 form?

AirSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking, which are all beneficial for managing the NY 634 form. These tools enhance your workflow and ensure that your forms are completed accurately and on time.

-

Can airSlate SignNow integrate with other software I use for the NY 634 form?

Absolutely! AirSlate SignNow integrates with a variety of applications that can help you manage your workflow around the NY 634 form. This makes it easy to connect with your existing systems, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for the NY 634 form?

Using airSlate SignNow for the NY 634 form offers numerous benefits, including enhanced security, faster processing times, and the convenience of managing documents from anywhere. Our platform ensures a smoother, more efficient process for submitting important tax documentation.

Get more for Form IT 634 Empire State Jobs Retention Program Credit Tax Year

- Confidential information form oregon

- Minor child power of attorney form eformscom

- Case management track designation form

- Intake information questionnaire span intake information questionnaire data sheet spanish

- Pennsylvania notary acknowledgement form

- Ri notarial certificates form

- South carolina quit claim deed form

- Tcrs overview and self service tennessee treasury tngov form

Find out other Form IT 634 Empire State Jobs Retention Program Credit Tax Year

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself