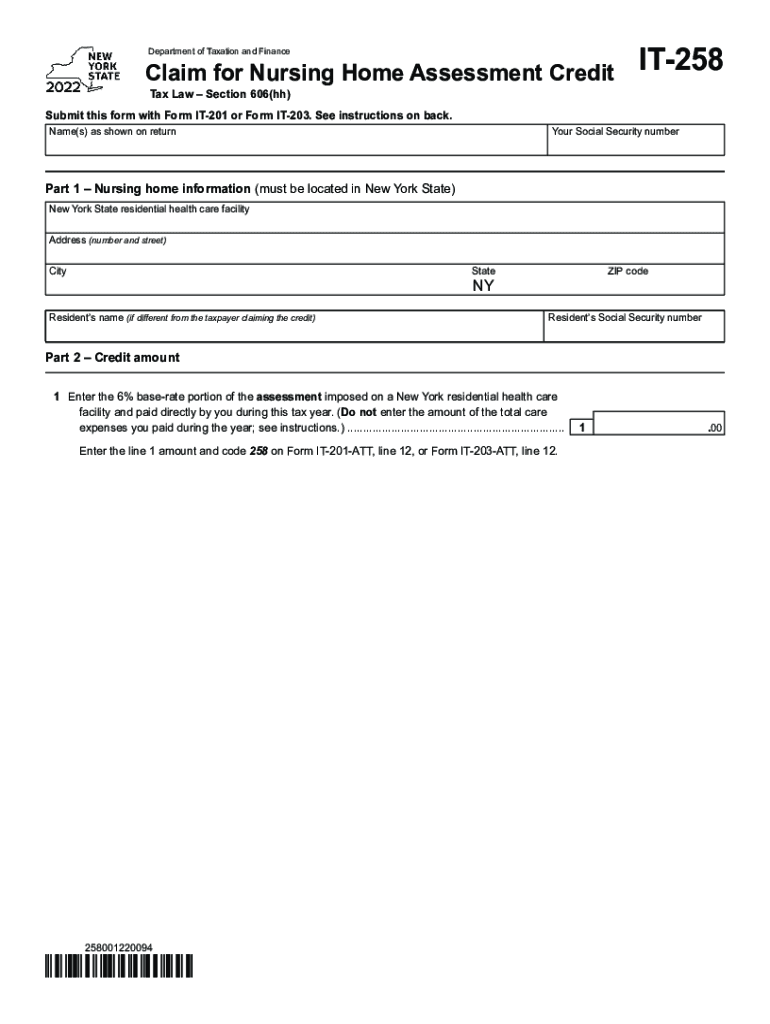

Form it 258 Claim for Nursing Home Assessment Credit Tax Year 2022

Understanding the Form IT 258 Claim for Nursing Home Assessment Credit

The Form IT 258 is designed for taxpayers seeking a nursing home assessment credit in the state of New York. This credit is available for individuals who incur expenses related to nursing home care for a dependent. By completing this form, taxpayers can potentially reduce their overall tax liability, making it a valuable resource for those who qualify. It is essential to understand the specific eligibility criteria and the types of expenses that can be claimed to maximize the benefits of this form.

Steps to Complete the Form IT 258 Claim for Nursing Home Assessment Credit

Completing the Form IT 258 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of nursing home expenses and any relevant financial records. Next, fill out the form with precise information regarding the taxpayer's details, the dependent's information, and the total amount of nursing home expenses incurred. After completing the form, review it for any errors before submitting. It is advisable to keep a copy of the completed form and all supporting documents for personal records.

Eligibility Criteria for the Form IT 258 Claim for Nursing Home Assessment Credit

To qualify for the nursing home assessment credit, specific eligibility criteria must be met. The taxpayer must be a resident of New York and have incurred eligible nursing home expenses for a dependent. The dependent must also meet certain age and relationship requirements. Additionally, the expenses claimed must be for care provided in a licensed nursing home facility. Understanding these criteria is crucial, as failure to meet them may result in denial of the credit.

Required Documents for the Form IT 258 Claim for Nursing Home Assessment Credit

When filing the Form IT 258, it is important to provide the necessary documentation to support the claim. Required documents typically include receipts or invoices from the nursing home, proof of payment, and any other relevant records that detail the care provided. Taxpayers should ensure that all documents are organized and legible, as this will facilitate a smoother review process by the tax authorities.

Form Submission Methods for the IT 258 Claim for Nursing Home Assessment Credit

The Form IT 258 can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can utilize the New York State Department of Taxation and Finance's e-filing system, which offers a convenient way to file. Alternatively, the completed form can be mailed to the appropriate tax office address, or taxpayers may choose to submit it in person at designated tax offices. Each method has its own processing times, so it is beneficial to consider these when planning the submission.

Legal Use of the Form IT 258 Claim for Nursing Home Assessment Credit

The Form IT 258 must be completed and submitted in accordance with New York State tax laws to be legally valid. This includes ensuring that all information provided is accurate and truthful. Filing the form with false information can lead to penalties, including fines or legal action. It is essential for taxpayers to familiarize themselves with the legal requirements surrounding the form to avoid any potential issues.

Quick guide on how to complete form it 258 claim for nursing home assessment credit tax year 2022

Complete Form IT 258 Claim For Nursing Home Assessment Credit Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to locate the appropriate form and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage Form IT 258 Claim For Nursing Home Assessment Credit Tax Year on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form IT 258 Claim For Nursing Home Assessment Credit Tax Year with ease

- Obtain Form IT 258 Claim For Nursing Home Assessment Credit Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from your chosen device. Edit and eSign Form IT 258 Claim For Nursing Home Assessment Credit Tax Year and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 258 claim for nursing home assessment credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 258 claim for nursing home assessment credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is assessment credit in the context of airSlate SignNow?

Assessment credit refers to the credits or discounts provided to users who engage with airSlate SignNow’s services. By utilizing assessment credit, businesses can save on costs while effectively managing their document signing processes. This makes airSlate SignNow an affordable choice for companies looking to streamline operations.

-

How does airSlate SignNow handle assessment credit for businesses?

airSlate SignNow offers a flexible approach to assessment credit, allowing businesses to apply them seamlessly during the payment process. Users can easily track their accumulated credits and apply them to reduce overall expenses when using the platform. This feature enhances the cost-effectiveness of our eSignature solution.

-

Are there any specific features related to assessment credit in airSlate SignNow?

Yes, airSlate SignNow provides features that allow users to manage their assessment credit effectively. This includes a user-friendly dashboard that displays available credits, enabling businesses to make informed decisions about their eSignature services. Our system ensures that you maximize savings through strategic use of assessment credits.

-

What benefits does assessment credit provide to users of airSlate SignNow?

By leveraging assessment credit, users can signNowly reduce their signing expenses, making airSlate SignNow a budget-friendly option. This financial relief can lead to increased document handling efficiency, as businesses can allocate more resources towards growth and innovation. It also enhances user satisfaction, knowing they're getting the best value for their investment.

-

Is there a limit to the assessment credit I can earn or use in airSlate SignNow?

While airSlate SignNow does not impose strict limits on the amount of assessment credit you can earn, there may be terms regarding how it can be applied. Users should refer to the platform’s business model for specific guidelines. This ensures transparency and helps users maximize their advantages.

-

How can I track my assessment credit balance in airSlate SignNow?

Tracking your assessment credit balance is easy with airSlate SignNow. Users can log into their account and navigate to the billing or credits section where the current balance and history of use are displayed. This feature emphasizes transparency, allowing businesses to make informed choices regarding their document management.

-

Are there integrations available for using assessment credits in airSlate SignNow?

Yes, airSlate SignNow integrates with several applications to streamline the use of assessment credits. This includes popular CRM systems and workflow automation tools that allow for easy credit application during document transactions. Such integrations ensure that your experience with assessment credits is seamless and efficient.

Get more for Form IT 258 Claim For Nursing Home Assessment Credit Tax Year

- South carolina filing requirement form

- South carolina filing form

- South carolina name change 497325856 form

- South carolina change form

- Sc change name form

- Sc change 497325859 form

- South carolina installments fixed rate promissory note secured by residential real estate south carolina form

- South carolina note form

Find out other Form IT 258 Claim For Nursing Home Assessment Credit Tax Year

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast