Form it 258 Claim for Nursing Home Assessment Credit Tax 2023

What is the Form IT 258 Claim For Nursing Home Assessment Credit Tax

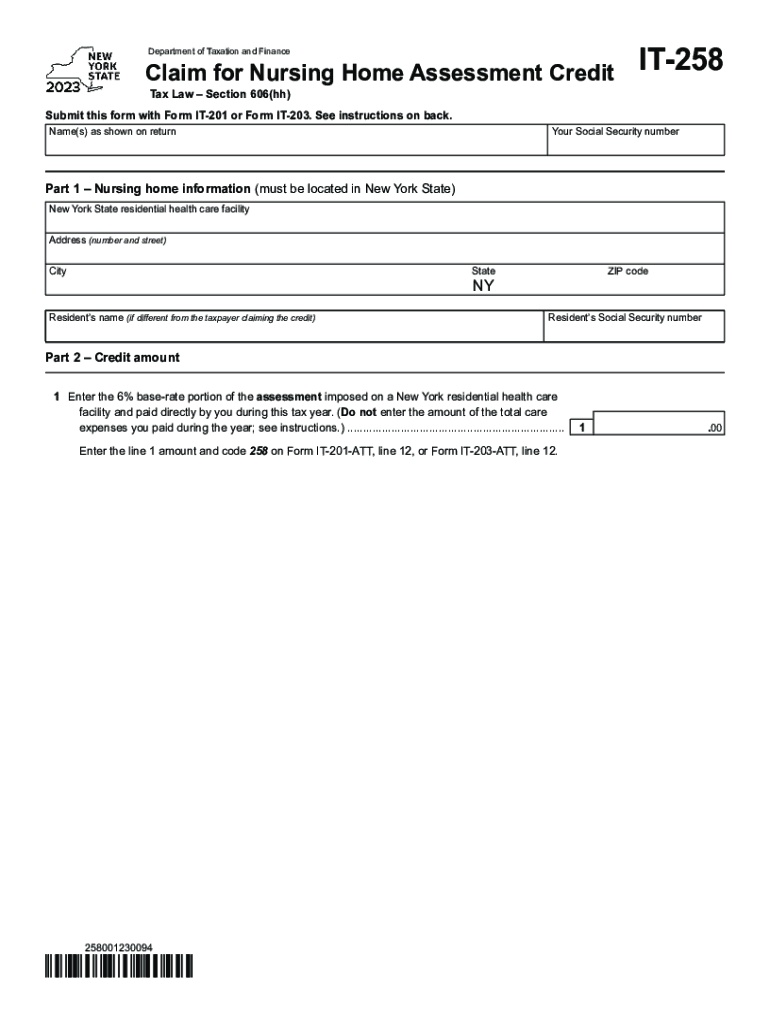

The Form IT 258 is a tax form used in New York State to claim the Nursing Home Assessment Credit. This credit is designed to provide financial relief to taxpayers who have incurred costs related to nursing home services. The form allows eligible individuals to offset some of their tax liabilities by claiming a credit based on the nursing home assessment fees paid. Understanding this form is essential for those who wish to maximize their tax benefits while ensuring compliance with state tax regulations.

How to use the Form IT 258 Claim For Nursing Home Assessment Credit Tax

Using the Form IT 258 involves several straightforward steps. First, gather all necessary documentation, including proof of nursing home payments and any relevant tax information. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to double-check your calculations and ensure that the amounts claimed align with your documentation. Once completed, the form can be submitted as part of your annual tax return. This process helps ensure that you receive the appropriate credit for your nursing home expenses.

Steps to complete the Form IT 258 Claim For Nursing Home Assessment Credit Tax

Completing the Form IT 258 requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the Form IT 258 from the New York State Department of Taxation and Finance.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the nursing home services, including the total amount paid and the assessment fees.

- Calculate the credit amount based on the instructions provided on the form.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return by the designated deadline.

Eligibility Criteria

To qualify for the Nursing Home Assessment Credit using Form IT 258, taxpayers must meet specific eligibility criteria. This includes having incurred nursing home assessment fees during the tax year and being a resident of New York State. Additionally, the nursing home services must be provided by a facility that is licensed and regulated by the state. It is essential to review these criteria carefully to ensure that you meet all requirements before filing your claim.

Required Documents

When filing Form IT 258, certain documents are necessary to support your claim. These typically include:

- Proof of payment for nursing home services, such as receipts or invoices.

- Documentation showing the nursing home assessment fees paid.

- Your completed tax return for the year in which you are claiming the credit.

Having these documents ready will streamline the filing process and help ensure that your claim is processed without delays.

Filing Deadlines / Important Dates

Timely submission of Form IT 258 is crucial to ensure that you receive your credit without penalties. The form must be filed along with your annual tax return, which is typically due on April fifteenth. If you are unable to file by this date, consider applying for an extension to avoid late fees. Be mindful of any updates or changes to filing deadlines announced by the New York State Department of Taxation and Finance, as these can impact your submission timeline.

Quick guide on how to complete form it 258 claim for nursing home assessment credit tax

Manage Form IT 258 Claim For Nursing Home Assessment Credit Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your files quickly and without hassle. Handle Form IT 258 Claim For Nursing Home Assessment Credit Tax on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Form IT 258 Claim For Nursing Home Assessment Credit Tax with ease

- Find Form IT 258 Claim For Nursing Home Assessment Credit Tax and click on Get Form to begin.

- Use the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from your selected device. Edit and eSign Form IT 258 Claim For Nursing Home Assessment Credit Tax and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 258 claim for nursing home assessment credit tax

Create this form in 5 minutes!

How to create an eSignature for the form it 258 claim for nursing home assessment credit tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a New York nursing home assessment?

A New York nursing home assessment is a comprehensive evaluation performed to determine an individual's eligibility for nursing home care. This assessment considers various factors, including medical history and personal needs, to ensure appropriate placement in a facility.

-

How can airSlate SignNow facilitate the New York nursing home assessment process?

airSlate SignNow streamlines the New York nursing home assessment process by enabling secure document sharing and eSignatures. This simplifies communication between healthcare providers and families, ensuring timely completion of necessary paperwork for nursing home admission.

-

What features does airSlate SignNow offer for nursing home assessments?

airSlate SignNow provides features such as customizable templates, secure storage, and real-time collaboration tools to enhance the New York nursing home assessment experience. These features help ensure all necessary forms are completed efficiently and accurately.

-

Are there any integrations available with airSlate SignNow for nursing home assessments?

Yes, airSlate SignNow integrates seamlessly with various healthcare management systems, enhancing the New York nursing home assessment process. These integrations allow for better data transfer and management, ensuring that all necessary information is at your fingertips.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you’re a small nursing home or a larger healthcare provider conducting multiple New York nursing home assessments, there’s a plan that can fit your budget.

-

How does airSlate SignNow ensure the security of nursing home assessment documents?

Security is a top priority at airSlate SignNow. All documents related to the New York nursing home assessment are encrypted and stored securely, ensuring that sensitive information remains confidential and protected from unauthorized access.

-

Can I track the status of documents during the New York nursing home assessment process?

Absolutely! airSlate SignNow allows you to easily track the status of documents throughout the New York nursing home assessment process. This feature provides transparency and helps ensure that all parties are informed of the progress in real-time.

Get more for Form IT 258 Claim For Nursing Home Assessment Credit Tax

Find out other Form IT 258 Claim For Nursing Home Assessment Credit Tax

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF