HawaiiInternal Revenue Service 2022

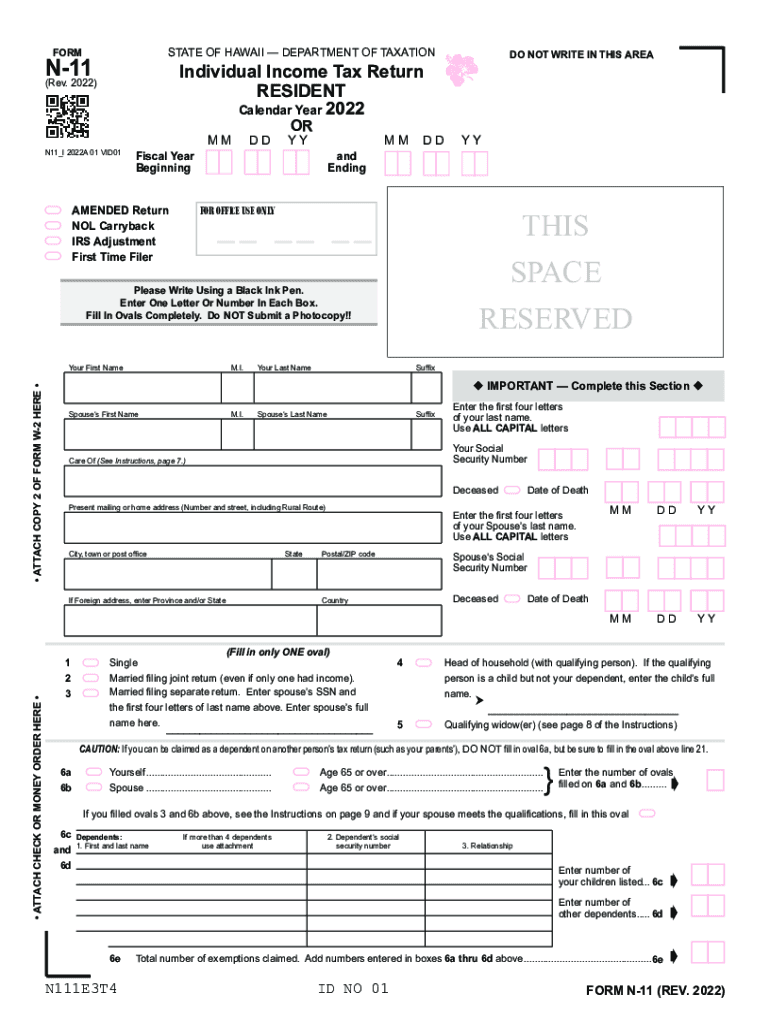

What is the Hawaii n 11?

The Hawaii n 11 is a specific tax form used by residents of Hawaii to report their income and calculate their state tax obligations. This form is essential for individuals who are required to file a state income tax return. The n 11 form is designed for those who have a straightforward tax situation, such as wage earners and individuals with limited income sources. Understanding the purpose and requirements of the n 11 is crucial for ensuring compliance with state tax laws.

Steps to complete the Hawaii n 11

Completing the Hawaii n 11 involves several key steps to ensure accuracy and compliance. Here is a brief overview of the process:

- Gather necessary documents, including W-2 forms and any 1099s.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income, including wages, interest, and dividends.

- Calculate your deductions and credits to determine your taxable income.

- Complete the form by signing and dating it.

Each step is important to ensure that the information provided is accurate and complete, which can help avoid potential issues with the Hawaii Department of Taxation.

Required Documents

To successfully complete the Hawaii n 11, certain documents are necessary. These include:

- W-2 forms from employers detailing your annual earnings.

- 1099 forms if you received income from freelance work or other non-employment sources.

- Records of any other income, such as rental income or interest from bank accounts.

- Documentation for any deductions you plan to claim, such as mortgage interest statements or medical expenses.

Having these documents ready will streamline the filing process and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

Filing the Hawaii n 11 is subject to specific deadlines that taxpayers must adhere to. Typically, the deadline for filing the n 11 is April 20 of the year following the tax year. For example, for the 2022 tax year, the deadline would be April 20, 2023. It is important to be aware of these dates to avoid late filing penalties and interest charges. Additionally, taxpayers may request an extension, but this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance

Failure to file the Hawaii n 11 on time or accurately can result in penalties. Common penalties include:

- A late filing penalty, which is typically a percentage of the unpaid tax amount.

- Interest on any unpaid taxes, which accrues from the original due date.

- Potential legal action for willful non-compliance, which can lead to further fines or consequences.

To avoid these penalties, it is advisable to file on time and ensure all information is correct.

Digital vs. Paper Version

Taxpayers have the option to file the Hawaii n 11 either digitally or via paper. The digital version offers several advantages, including:

- Faster processing times, leading to quicker refunds.

- Built-in error checks that can help prevent common mistakes.

- The convenience of filing from home without the need for mailing documents.

However, some individuals may prefer the traditional paper method for various reasons, such as familiarity or lack of access to technology. Understanding the benefits of each method can help taxpayers choose the best option for their needs.

Quick guide on how to complete hawaiiinternal revenue service

Complete HawaiiInternal Revenue Service effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the appropriate form and securely retain it online. airSlate SignNow offers you all the tools necessary to create, amend, and eSign your documents quickly without any holdups. Manage HawaiiInternal Revenue Service on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

The simplest method to alter and eSign HawaiiInternal Revenue Service with ease

- Locate HawaiiInternal Revenue Service and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select signNow sections of the documents or redact sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign HawaiiInternal Revenue Service to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaiiinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the hawaiiinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to n 11?

airSlate SignNow is an efficient eSignature solution designed to streamline document workflows. It provides businesses with tools to send and sign documents electronically, making it a cost-effective choice for organizations looking for an n 11-compliant solution.

-

How much does airSlate SignNow cost for n 11 features?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. The n 11 specific features are included in various packages, ensuring that you get the best value for your investment, regardless of your company's needs.

-

What features does airSlate SignNow offer for n 11 compliance?

airSlate SignNow includes robust features that help achieve n 11 compliance. Users can easily create, send, and manage electronically signed documents while ensuring that all transactions meet legal and industry standards.

-

How can airSlate SignNow benefit my business under n 11 guidelines?

By utilizing airSlate SignNow, businesses can enhance their workflow efficiency while adhering to n 11 guidelines. The platform allows for fast document turnaround, reduces paper usage, and enhances compliance with automated audit trails and security measures.

-

Can airSlate SignNow integrate with other tools for n 11 use cases?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing its functionality for n 11 scenarios. Popular integrations include CRM systems, cloud storage services, and productivity tools, making it easier to manage documents in one place.

-

Is training available for using airSlate SignNow with n 11 documents?

airSlate SignNow provides comprehensive training resources to help users effectively eSign documents in compliance with n 11. These resources include tutorials, webinars, and dedicated support to ensure everyone in your organization can leverage the platform.

-

What security measures does airSlate SignNow adopt for n 11 signed documents?

Security is a top priority for airSlate SignNow, especially for n 11 signed documents. The platform employs encryption, compliance with GDPR, and secure storage protocols to protect sensitive information and ensure your documents are safe.

Get more for HawaiiInternal Revenue Service

- Michigan lien 497311439 form

- Michigan release lien form

- Demand for statement of amount unpaid individual michigan form

- Michigan mortgage form 497311443

- Assignment of mortgage by corporate mortgage holder michigan form

- Michigan 30 day form

- Michigan 30 day 497311446 form

- Printable state of michigan 7 day notice to quit form

Find out other HawaiiInternal Revenue Service

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself

- Sign Colorado Hold Harmless (Indemnity) Agreement Now

- Help Me With Sign California Letter of Intent

- Can I Sign California Letter of Intent