Hawaii State N 11 Forms 2018

What is the Hawaii State N 11 Form?

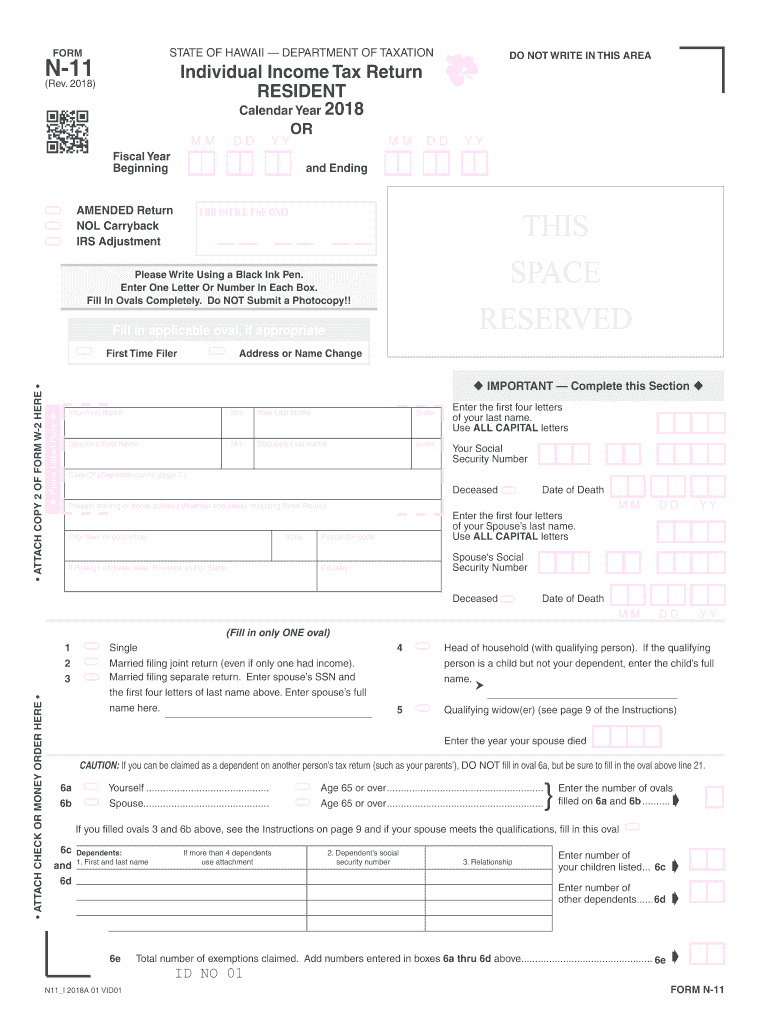

The Hawaii State N 11 form is a tax document used by residents of Hawaii to report their income and calculate their state tax liability. This form is specifically designed for individual taxpayers who meet certain eligibility criteria. The N 11 form collects essential information, including personal details, income sources, and deductions, allowing the Hawaii Department of Taxation to assess the taxpayer's financial situation accurately. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax laws.

Steps to Complete the Hawaii State N 11 Form

Completing the Hawaii State N 11 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill in your personal information, such as your name, address, and Social Security number. Then, report your income by entering the amounts from your income statements into the appropriate sections of the form. After that, calculate any deductions and credits you qualify for, which can significantly reduce your tax liability. Finally, review the form for accuracy before signing and submitting it to the Hawaii Department of Taxation.

Legal Use of the Hawaii State N 11 Form

The Hawaii State N 11 form is legally recognized for filing state income taxes. It must be completed accurately and submitted by the designated deadline to avoid penalties. The form complies with Hawaii state tax laws, ensuring that taxpayers fulfill their legal obligations. Using this form correctly helps maintain transparency with the state tax authorities and protects taxpayers from potential legal issues related to non-compliance.

Filing Deadlines / Important Dates

Timely filing of the Hawaii State N 11 form is essential to avoid penalties. Generally, the deadline for submitting the N 11 form aligns with the federal tax filing deadline, which is typically April 15. However, taxpayers should verify specific dates each year, as they may vary due to weekends or holidays. It is advisable to file early to ensure all documentation is in order and to address any potential issues that may arise during the filing process.

Form Submission Methods

The Hawaii State N 11 form can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online through the Hawaii Department of Taxation's e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, the form can be mailed to the appropriate address listed on the form or delivered in person to a local tax office. Each submission method has its advantages, and taxpayers should choose the one that best suits their needs.

Required Documents

To complete the Hawaii State N 11 form accurately, several documents are necessary. Taxpayers should have their W-2 forms from employers, 1099 forms for any freelance or contract work, and any other relevant income documentation. Additionally, records of deductions and credits, such as receipts for charitable contributions or mortgage interest statements, should be collected. Having these documents on hand will streamline the process of filling out the N 11 form and help ensure that all income and deductions are reported correctly.

Eligibility Criteria

Eligibility to use the Hawaii State N 11 form is generally limited to residents of Hawaii who meet specific income thresholds and filing requirements. Typically, individuals who earn a certain amount of income are required to file this form. Additionally, taxpayers must be residents of Hawaii for the entire tax year to qualify. Understanding these criteria is essential for determining whether the N 11 form is the appropriate tax form for your situation.

Quick guide on how to complete n11 fillable form 2018 2019

Your assistance manual on how to prepare your Hawaii State N 11 Forms

If you’re curious about how to develop and dispatch your Hawaii State N 11 Forms, here are some concise guidelines on how to simplify tax submission.

To begin, you just need to sign up for your airSlate SignNow account to change your approach to managing documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to adjust, draft, and finalize your income tax forms effortlessly. Utilizing its editor, you can toggle between text, checklists, and eSignatures and return to modify data as required. Optimize your tax administration with advanced PDF editing, eSigning, and convenient sharing options.

Adhere to the instructions below to finish your Hawaii State N 11 Forms in no time:

- Create your account and begin editing PDFs within moments.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your Hawaii State N 11 Forms in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Preserve modifications, print your version, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes digitally with airSlate SignNow. Please be aware that submitting traditionally can heighten return inaccuracies and prolong refunds. Obviously, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct n11 fillable form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the n11 fillable form 2018 2019

How to make an eSignature for the N11 Fillable Form 2018 2019 in the online mode

How to generate an eSignature for your N11 Fillable Form 2018 2019 in Google Chrome

How to generate an eSignature for putting it on the N11 Fillable Form 2018 2019 in Gmail

How to create an eSignature for the N11 Fillable Form 2018 2019 straight from your smartphone

How to generate an eSignature for the N11 Fillable Form 2018 2019 on iOS devices

How to make an eSignature for the N11 Fillable Form 2018 2019 on Android

People also ask

-

What is the 2018 n 11 form, and why is it important?

The 2018 n 11 form is a crucial document used in various business and legal transactions. It is essential for ensuring compliance with state regulations and helps streamline the signing process. airSlate SignNow simplifies the management of the 2018 n 11 form, making it easy to fill, send, and eSign securely.

-

How can I fill out the 2018 n 11 form using airSlate SignNow?

Filling out the 2018 n 11 form with airSlate SignNow is straightforward. You can upload the form directly to the platform, fill in the required fields, and integrate your eSignature seamlessly. This process ensures accuracy and compliance, giving you confidence in your documentation.

-

Is there a cost associated with using airSlate SignNow for the 2018 n 11 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The costs are designed to be cost-effective, especially for businesses frequently dealing with documents like the 2018 n 11 form. You can choose a plan that fits your usage and budget.

-

What features does airSlate SignNow offer for managing the 2018 n 11 form?

airSlate SignNow provides several features for managing the 2018 n 11 form, including template creation, document tracking, and customizable workflows. These features help you streamline the process, ensuring that you can send and track your forms efficiently.

-

Can I integrate airSlate SignNow with other applications for the 2018 n 11 form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easier to handle the 2018 n 11 form within your existing workflows. Popular integrations include Salesforce, Google Drive, and Dropbox, enhancing your efficiency.

-

What are the benefits of using airSlate SignNow for the 2018 n 11 form?

Using airSlate SignNow for the 2018 n 11 form offers numerous benefits, such as enhanced security, reduced turnaround times, and improved accuracy. The platform ensures that your documents are securely signed and stored, giving you peace of mind during compliance.

-

How does airSlate SignNow ensure the security of the 2018 n 11 form?

AirSlate SignNow prioritizes security by employing robust encryption protocols for the 2018 n 11 form and all documents handled through the platform. The solution also includes authentication measures and audit trails, ensuring that your data remains safe and compliant with industry standards.

Get more for Hawaii State N 11 Forms

- Mv2610 national safety code abstract national safety code abstract form

- Irs mandate form chittaranjan locomotive works

- Atomic dating game answer key form

- Utsw willed body program 12757951 form

- Palm beach county community action program liheap liheap full application form

- Adr reporting form version 1 3

- Foresters life insurance claim forms

- Firebreaks and burning permitscity of armadale form

Find out other Hawaii State N 11 Forms

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online