N 11, Rev , Individual Income Tax Return Resident Forms 2023

Understanding the N-11 Individual Income Tax Return for Residents

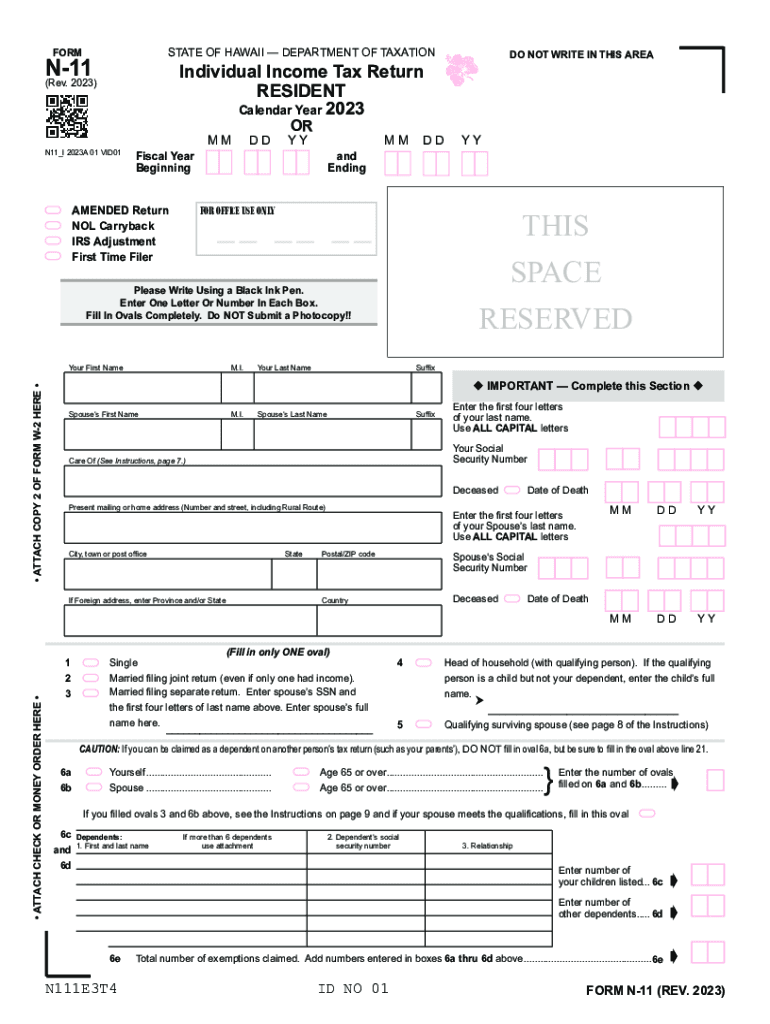

The N-11 form, officially known as the Individual Income Tax Return Resident Form, is utilized by residents of Hawaii to report their income and calculate their state tax liability. This form is specifically designed for individuals who are considered residents for tax purposes and need to file their income tax returns with the state of Hawaii. It is essential for ensuring compliance with state tax laws and for determining any potential refunds or payments owed to the state.

Steps to Complete the N-11 Form

Completing the N-11 form involves several key steps that ensure accurate reporting of income and tax liability. Here is a simplified process:

- Gather Required Documents: Collect all necessary documents, including W-2 forms, 1099 forms, and records of other income.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, dividends, and any other taxable income.

- Calculate Deductions: Identify any deductions you are eligible for, such as standard deductions or itemized deductions.

- Determine Tax Liability: Use the tax tables provided with the form to calculate your total tax owed based on your taxable income.

- Review and Sign: Carefully review all entries for accuracy, then sign and date the form before submission.

Obtaining the N-11 Form

The N-11 form can be obtained through various means to ensure accessibility for all residents. It is available online through the Hawaii Department of Taxation website, where you can download a fillable PDF version. Additionally, physical copies can be requested at local tax offices or public libraries throughout Hawaii. Ensuring you have the correct version of the form for the tax year is crucial, as tax laws and requirements may change annually.

Filing Deadlines for the N-11 Form

Timely filing of the N-11 form is essential to avoid penalties and interest on unpaid taxes. The standard deadline for filing the N-11 form is typically April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Residents should also be aware of any extensions that may be available, which can provide additional time for filing under certain circumstances.

Legal Use of the N-11 Form

The N-11 form serves a legal purpose in the state of Hawaii, as it is the official document used to report income and calculate state taxes for residents. Filing this form accurately and on time is a legal requirement for all residents who meet the income thresholds set by the state. Failure to file or inaccuracies in reporting can lead to penalties, audits, and potential legal repercussions.

Key Elements of the N-11 Form

Understanding the key elements of the N-11 form is vital for accurate completion. The form includes sections for personal information, income reporting, deductions, tax credits, and final tax calculations. Each section must be filled out carefully, and taxpayers should ensure they have supporting documentation for all reported income and deductions. Additionally, the form provides instructions for claiming any applicable tax credits, which can significantly reduce overall tax liability.

Quick guide on how to complete n 11 rev individual income tax return resident forms

Effortlessly Prepare N 11, Rev , Individual Income Tax Return Resident Forms on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage N 11, Rev , Individual Income Tax Return Resident Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The Easiest Method to Edit and eSign N 11, Rev , Individual Income Tax Return Resident Forms

- Locate N 11, Rev , Individual Income Tax Return Resident Forms and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or obscure private information with specific tools that airSlate SignNow supplies for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Dismiss concerns over lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign N 11, Rev , Individual Income Tax Return Resident Forms while ensuring outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n 11 rev individual income tax return resident forms

Create this form in 5 minutes!

How to create an eSignature for the n 11 rev individual income tax return resident forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2009 hi n11 and how does it work?

The 2009 hi n11 is a versatile tool designed for digital document management. It allows users to create, send, and eSign documents seamlessly, streamlining the workflow. With features tailored for efficiency, the 2009 hi n11 transforms how businesses handle their paperwork.

-

What pricing options are available for the 2009 hi n11?

The 2009 hi n11 offers various pricing tiers to fit different business needs. You can choose from monthly or annual subscriptions based on your usage requirements. Each plan is designed to be cost-effective, ensuring you get maximum value from the 2009 hi n11.

-

What are the key features of the 2009 hi n11?

The 2009 hi n11 boasts a range of features including customizable templates, real-time tracking, and secure eSignature capabilities. These features enhance collaboration and ensure compliance, making it easier for businesses to manage their documents efficiently. The intuitive interface of the 2009 hi n11 also allows for a smooth user experience.

-

How can the 2009 hi n11 benefit my business?

Utilizing the 2009 hi n11 can signNowly elevate your business operations by reducing paperwork and administrative delays. This solution enhances productivity through faster document turnaround times and improved tracking. Additionally, the 2009 hi n11 fosters better communication within teams and with clients.

-

Does the 2009 hi n11 integrate with other software?

Yes, the 2009 hi n11 offers seamless integrations with various business applications including CRM and project management tools. This compatibility allows for a more streamlined workflow as data flows effortlessly between systems. Additionally, integrating the 2009 hi n11 enhances overall efficiency for your team.

-

Is the 2009 hi n11 secure for sensitive documents?

Absolutely, the 2009 hi n11 prioritizes security with robust features such as encrypted document storage and secure eSignatures. Compliance with industry standards ensures that your sensitive documents are protected. Trusting the 2009 hi n11 guarantees peace of mind when handling confidential information.

-

Can I try the 2009 hi n11 before committing?

Yes, the 2009 hi n11 offers a free trial allowing prospective users to explore its features and benefits. This trial period provides a risk-free opportunity to see how the 2009 hi n11 can fit into your business processes before making a commitment. We encourage you to experience the ease of use firsthand.

Get more for N 11, Rev , Individual Income Tax Return Resident Forms

Find out other N 11, Rev , Individual Income Tax Return Resident Forms

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template