Form it 212 Investment Credit Tax Year 2022

What is the Form IT 212 Investment Credit Tax Year

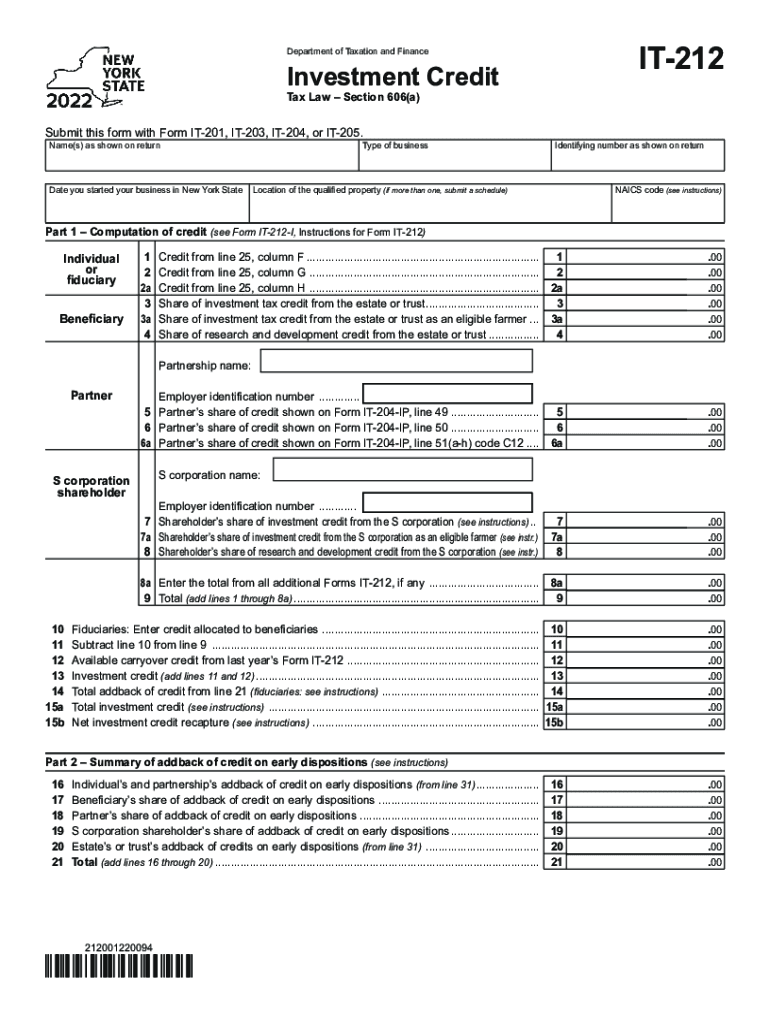

The Form IT 212 is utilized for claiming the Investment Credit in New York State. This form allows taxpayers to receive a credit for investments made in qualified property. The tax year for which the form is applicable is crucial, as it determines the specific investments and eligibility criteria. For the 2022 taxation year, the form must be completed accurately to ensure that the taxpayer receives the appropriate credit based on their investments during that year.

Steps to complete the Form IT 212 Investment Credit Tax Year

Completing the Form IT 212 requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including receipts and records of qualified investments.

- Fill out personal information, including your name, address, and Social Security number.

- Detail the qualified property and the amount of investment made.

- Calculate the credit amount based on the investment and any applicable rates.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the Investment Credit using the Form IT 212, certain criteria must be met. Taxpayers must have made investments in qualified property during the tax year. This includes tangible personal property used in a trade or business. Additionally, the property must be located in New York State. Taxpayers should also ensure they meet any income limitations or other specific requirements set forth by the New York State Department of Taxation and Finance.

How to obtain the Form IT 212 Investment Credit Tax Year

The Form IT 212 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a printable format, ensuring that taxpayers can easily access the form. Additionally, physical copies may be available at local tax offices or through tax preparation services. It is essential to ensure that you are using the correct version of the form for the applicable tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 212 align with the general tax return deadlines set by the IRS. For the 2022 tax year, the deadline for submission is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply if they are unable to file by the standard deadline.

Legal use of the Form IT 212 Investment Credit Tax Year

The Form IT 212 must be used in accordance with New York State tax laws. It is essential that all information provided is accurate and truthful to avoid penalties or legal issues. The form serves as a declaration of the taxpayer's eligibility for the investment credit, and any discrepancies may lead to audits or further scrutiny by tax authorities. Compliance with all applicable regulations ensures that the credit is legally recognized.

Quick guide on how to complete form it 212 investment credit tax year 2022

Prepare Form IT 212 Investment Credit Tax Year effortlessly on any device

Online document management has surged in popularity among businesses and individuals alike. It offers a superb environmentally-friendly option to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form IT 212 Investment Credit Tax Year on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form IT 212 Investment Credit Tax Year with ease

- Find Form IT 212 Investment Credit Tax Year and click on Get Form to begin.

- Utilize the resources we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive details using tools that airSlate SignNow specifically offers for such tasks.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 212 Investment Credit Tax Year and guarantee outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 212 investment credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 212 investment credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to IT 212 instructions?

airSlate SignNow offers streamlined document management with advanced electronic signature capabilities, which simplify the process of complying with IT 212 instructions. Users can easily send, sign, and store documents securely while tracking their status in real time.

-

How does airSlate SignNow ensure compliance with IT 212 instructions?

airSlate SignNow adheres to strict security protocols and provides audit trails to ensure compliance with IT 212 instructions. All signed documents are legally binding and stored securely, making it easy to demonstrate adherence to regulations.

-

What pricing plans does airSlate SignNow offer for users needing IT 212 instructions?

airSlate SignNow offers various pricing plans tailored to fit the needs of businesses seeking to comply with IT 212 instructions. These plans are designed to be budget-friendly while providing all the necessary features to facilitate efficient document signing.

-

Can airSlate SignNow integrate with my existing systems to help with IT 212 instructions?

Yes, airSlate SignNow offers integrations with various applications and CRM systems to enhance workflow efficiency related to IT 212 instructions. This allows users to seamlessly manage their document signing processes without disruptions.

-

What are the benefits of using airSlate SignNow for IT 212 instructions?

Using airSlate SignNow for IT 212 instructions streamlines your document workflows, reduces paper usage, and enhances collaboration. It enables faster turnaround times and ensures that all parties can access the required documentation easily.

-

Is there a mobile app for airSlate SignNow available for IT 212 instructions?

Yes, airSlate SignNow offers a mobile application that allows users to manage their IT 212 instructions on the go. This mobile access ensures flexibility and convenience, helping you stay on top of your document signing tasks from anywhere.

-

How does airSlate SignNow handle security for documents related to IT 212 instructions?

AirSlate SignNow employs advanced encryption and secure data storage practices to protect documents related to IT 212 instructions. This high level of security ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form IT 212 Investment Credit Tax Year

- Sc lien form

- Storage business package south carolina form

- Child care services package south carolina form

- Special or limited power of attorney for real estate sales transaction by seller south carolina form

- Sc closing real estate form

- Limited power of attorney where you specify powers with sample powers included south carolina form

- Limited power of attorney for stock transactions and corporate powers south carolina form

- Special durable power of attorney for bank account matters south carolina form

Find out other Form IT 212 Investment Credit Tax Year

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later