New York Form it 212 Investment Credit 2023

What is the New York Form IT 212 Investment Credit

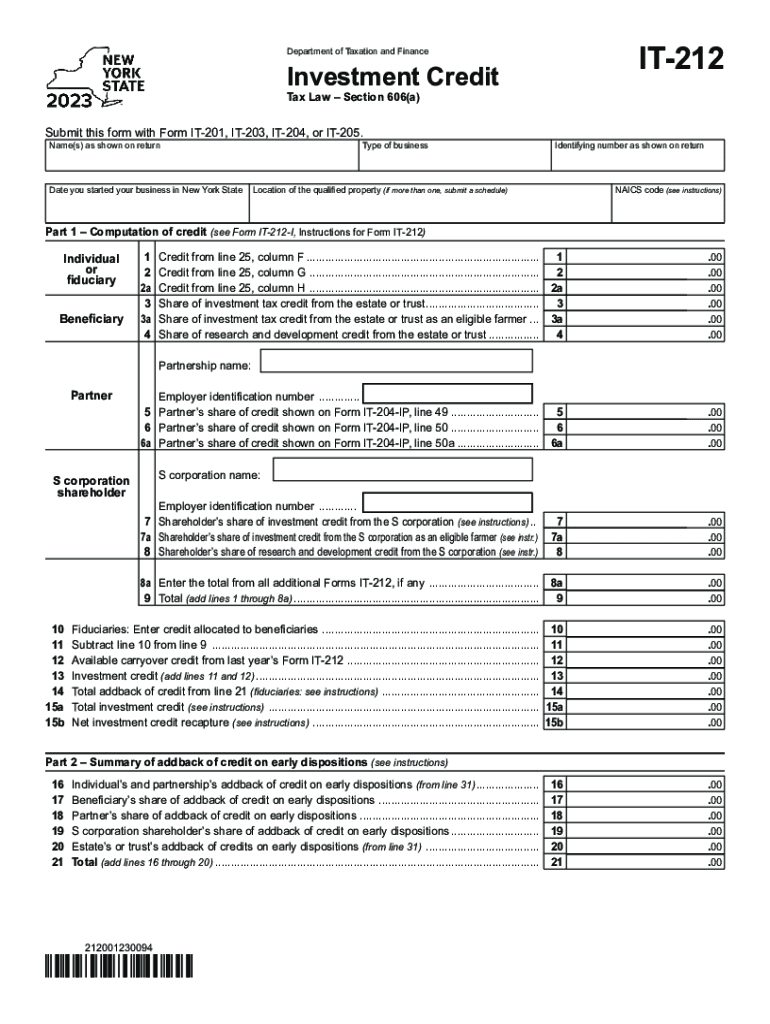

The New York Form IT 212 is a tax form used to claim the Investment Credit for certain investments made in qualified property in New York State. This form allows taxpayers to receive a credit against their state income tax for eligible investments, which can include machinery, equipment, and other tangible assets used in business operations. The purpose of the IT 212 is to encourage businesses to invest in New York by providing a financial incentive that can reduce their overall tax liability.

How to use the New York Form IT 212 Investment Credit

To utilize the New York Form IT 212, taxpayers must first determine their eligibility based on the type of investments made and the corresponding credit amounts. After confirming eligibility, the form must be filled out accurately, detailing the investments and calculating the credit. It is essential to keep records of all qualifying purchases, as these may be required for verification during the tax filing process. Once completed, the form should be submitted along with the taxpayer's annual income tax return.

Steps to complete the New York Form IT 212 Investment Credit

Completing the New York Form IT 212 involves several key steps:

- Gather necessary documentation, including receipts and proof of purchase for qualifying property.

- Fill out personal and business information on the form, ensuring all details are accurate.

- Detail the investments made, including descriptions and costs associated with each item.

- Calculate the credit based on the guidelines provided for eligible investments.

- Review the completed form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the New York Form IT 212 Investment Credit, taxpayers must meet specific criteria. Eligible investments typically include tangible property such as machinery and equipment used in a trade or business within New York State. The property must be new or, in some cases, used but must meet certain conditions. Additionally, the taxpayer must be subject to New York State income tax and must not have claimed the same credit on a different form. It is essential to review the detailed eligibility requirements outlined by the New York State Department of Taxation and Finance.

Required Documents

When filing the New York Form IT 212, taxpayers should prepare to submit several important documents to support their claim for the Investment Credit. Required documents may include:

- Receipts or invoices for the purchase of qualifying property.

- Proof of payment for the investments made.

- Any prior tax returns that may be relevant to the current claim.

- Documentation proving the use of the property in a trade or business.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the New York Form IT 212. Generally, the form must be submitted by the same deadline as the taxpayer's annual income tax return. For most individuals, this date is April fifteenth. However, if the taxpayer has received an extension for their income tax return, the IT 212 must also be filed by the extended deadline. Keeping track of these dates ensures compliance and avoids potential penalties.

Quick guide on how to complete new york form it 212 investment credit

Effortlessly Prepare New York Form IT 212 Investment Credit on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage New York Form IT 212 Investment Credit on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The simplest method to edit and electronically sign New York Form IT 212 Investment Credit with ease

- Obtain New York Form IT 212 Investment Credit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, either via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, lengthy form searches, or errors that necessitate printing new document copies. airSlate SignNow resolves all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign New York Form IT 212 Investment Credit while ensuring outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 212 investment credit

Create this form in 5 minutes!

How to create an eSignature for the new york form it 212 investment credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the it 212 instructions for signing documents with airSlate SignNow?

The it 212 instructions for airSlate SignNow guide users through the process of electronically signing documents. This user-friendly solution streamlines the signing process, making it simple to upload, sign, and send documents securely. With clear steps outlined in the it 212 instructions, users can complete their tasks efficiently and effectively.

-

How much does airSlate SignNow cost based on the it 212 instructions?

Pricing for airSlate SignNow varies depending on the plan you choose, which is detailed in the it 212 instructions. The service offers several tiers, including a free trial, so you can explore features before committing. The it 212 instructions include specific pricing for businesses, ensuring that you find the right solution for your needs.

-

What features are highlighted in the it 212 instructions for airSlate SignNow?

The it 212 instructions detail key features of airSlate SignNow, such as customizable templates, real-time tracking, and seamless integration options. These features enhance productivity and collaborative efforts, making document management easier than ever. Understanding these features through the it 212 instructions can help you leverage the tool effectively.

-

Are there benefits to following the it 212 instructions for airSlate SignNow?

Yes, following the it 212 instructions offers numerous benefits including improved efficiency and reduced turnaround times for document signing. It ensures that users are aware of best practices to maximize their use of the platform. By adhering to these instructions, businesses can streamline their operations and enhance customer satisfaction.

-

Can airSlate SignNow integrate with other tools as per the it 212 instructions?

Absolutely! The it 212 instructions outline various integrations available for airSlate SignNow, including popular CRM systems and cloud storage solutions. These integrations make it easy to incorporate eSigning into your existing workflows, which enhances overall productivity and effectiveness.

-

What types of documents can I manage using airSlate SignNow according to the it 212 instructions?

The it 212 instructions indicate that airSlate SignNow supports a wide range of documents, including contracts, NDAs, and forms. This versatility allows businesses to manage all necessary paperwork efficiently without worrying about compatibility issues. Users can confidently handle any document type with airSlate SignNow.

-

Is there a mobile app for airSlate SignNow mentioned in the it 212 instructions?

Yes, the it 212 instructions highlight that airSlate SignNow offers a mobile app for both iOS and Android devices. This functionality allows users to sign documents on the go and manage their documents anytime, anywhere. The mobile experience ensures that you remain productive even outside of the office.

Get more for New York Form IT 212 Investment Credit

Find out other New York Form IT 212 Investment Credit

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form