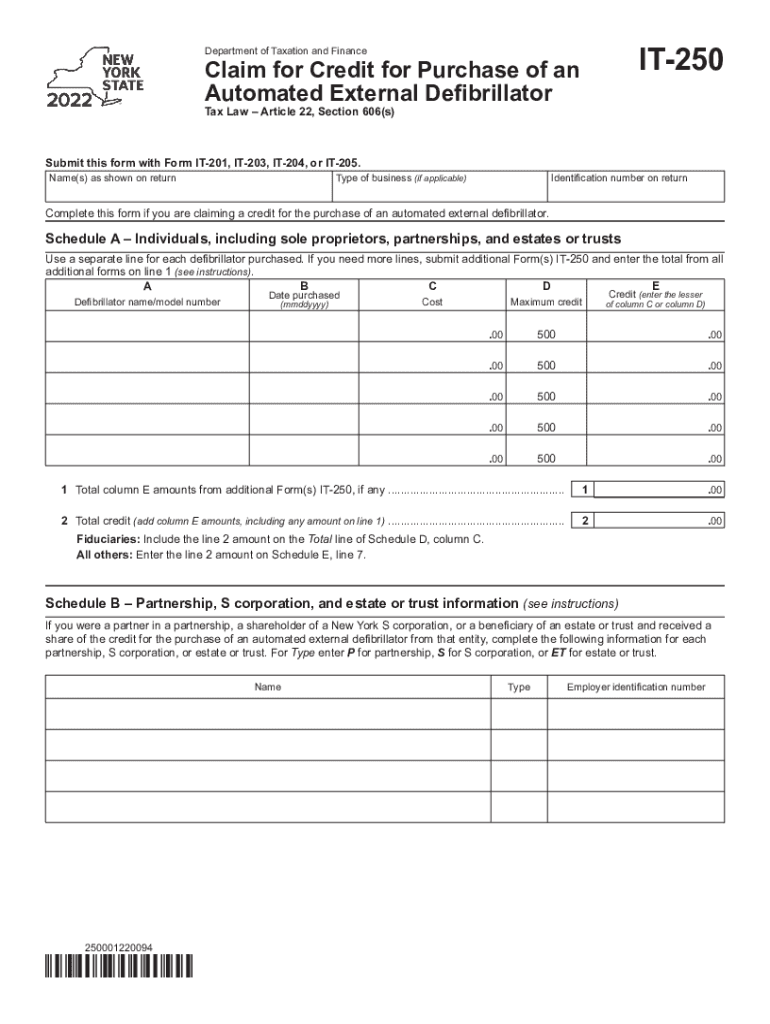

Form it 250 Claim for Credit for Purchase of an Automated 2022

What is the Form IT 250 Claim For Credit For Purchase Of An Automated

The Form IT 250 Claim For Credit For Purchase Of An Automated is a tax form used in the United States to claim a credit for the purchase of automated equipment. This form is particularly relevant for businesses that invest in technology to enhance their operations. The credit aims to encourage the adoption of automated systems that can improve efficiency and productivity.

How to use the Form IT 250 Claim For Credit For Purchase Of An Automated

To effectively use the Form IT 250, begin by gathering all necessary documentation related to your purchase of automated equipment. This includes invoices, receipts, and any relevant contracts. Fill out the form accurately, ensuring that all information matches your records. Once completed, submit the form according to the guidelines provided by the IRS, either electronically or via mail, depending on your preference and the requirements for your specific situation.

Steps to complete the Form IT 250 Claim For Credit For Purchase Of An Automated

Completing the Form IT 250 involves several key steps:

- Gather all necessary documentation, including proof of purchase and details about the automated equipment.

- Fill out the form with accurate information, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the IRS e-file system or mail it to the appropriate address.

Eligibility Criteria

Eligibility for claiming the credit using Form IT 250 typically includes businesses that have purchased automated equipment for operational purposes. The equipment must meet specific criteria set by the IRS, including being new and used primarily for business activities. It is essential to review the detailed eligibility requirements to ensure compliance and maximize your potential credit.

Required Documents

When filing the Form IT 250, certain documents are required to substantiate your claim. These include:

- Invoices or receipts for the purchase of automated equipment.

- Documentation proving the equipment is new and used for business purposes.

- Any contracts or agreements related to the purchase.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 250 can be submitted through various methods. Businesses may choose to file electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the designated IRS address. In-person submissions are generally not available for this form; however, consulting with a tax professional can provide additional guidance on the best submission method for your situation.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form IT 250. It is crucial to adhere to these guidelines to ensure that your claim is processed smoothly. This includes following the instructions for filling out each section of the form, understanding the eligibility criteria, and being aware of any deadlines for submission. Regularly checking the IRS website for updates is also advisable, as tax regulations can change.

Quick guide on how to complete form it 250 claim for credit for purchase of an automated

Effortlessly Prepare Form IT 250 Claim For Credit For Purchase Of An Automated on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without interruptions. Manage Form IT 250 Claim For Credit For Purchase Of An Automated on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Form IT 250 Claim For Credit For Purchase Of An Automated with Ease

- Find Form IT 250 Claim For Credit For Purchase Of An Automated and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Select your preferred delivery method for your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and electronically sign Form IT 250 Claim For Credit For Purchase Of An Automated to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 250 claim for credit for purchase of an automated

Create this form in 5 minutes!

How to create an eSignature for the form it 250 claim for credit for purchase of an automated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 250 Claim For Credit For Purchase Of An Automated?

The Form IT 250 Claim For Credit For Purchase Of An Automated is a tax form that allows businesses to claim a credit for purchasing automated equipment. By using this form, businesses can offset some of their equipment purchase expenses, enhancing their overall cash flow. Understanding how to fill out this form accurately is essential for maximizing your tax benefits.

-

How can airSlate SignNow assist with filling out the Form IT 250 Claim For Credit For Purchase Of An Automated?

airSlate SignNow offers tools that simplify document preparation, making it easier to fill out the Form IT 250 Claim For Credit For Purchase Of An Automated. Our platform allows you to input information digitally, ensuring accuracy and efficiency. With electronic signatures, you can expedite the submission process.

-

Is there a cost associated with using airSlate SignNow for the Form IT 250 Claim For Credit For Purchase Of An Automated?

Yes, airSlate SignNow offers a subscription model with various pricing tiers depending on your business needs. We provide a cost-effective solution that streamlines document management and eSigning, including for forms like the Form IT 250 Claim For Credit For Purchase Of An Automated. Consider exploring our plans to find one that fits your budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a wide range of features, including template creation, automated workflows, and cloud storage. These features are particularly beneficial when preparing documents like the Form IT 250 Claim For Credit For Purchase Of An Automated. You'll be able to manage multiple documents efficiently, improving your operational workflow.

-

Can I integrate airSlate SignNow with other tools for filing the Form IT 250 Claim For Credit For Purchase Of An Automated?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and productivity tools. This integration allows you to streamline your operations, making it easier to gather necessary information for the Form IT 250 Claim For Credit For Purchase Of An Automated using data from your existing systems.

-

What are the benefits of using airSlate SignNow for the Form IT 250 Claim For Credit For Purchase Of An Automated?

Using airSlate SignNow for the Form IT 250 Claim For Credit For Purchase Of An Automated provides several benefits, including increased efficiency in document handling and reduced time spent on paperwork. The platform also enhances accuracy, minimizing the risk of errors that could delay your claims. Additionally, electronic signatures expedite the approval process, ensuring you receive credits faster.

-

How secure is my information when using airSlate SignNow for the Form IT 250 Claim For Credit For Purchase Of An Automated?

Security is a top priority at airSlate SignNow. We employ strong encryption and security protocols to protect your information when filling out the Form IT 250 Claim For Credit For Purchase Of An Automated. You can confidently manage sensitive documents knowing that your data is safeguarded against unauthorized access.

Get more for Form IT 250 Claim For Credit For Purchase Of An Automated

- Sc partnership form

- Sc llc company form

- Quitclaim deed for three individuals to one individual south carolina form

- South carolina deed 497325988 form

- Warranty deed for three individuals to one individual south carolina form

- Sc deed life form

- South carolina ucc1 financing statement south carolina form

- Sc addendum form

Find out other Form IT 250 Claim For Credit For Purchase Of An Automated

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document