Form it 250 Claim for Credit for Purchase of an Automated External Defribrillator Tax Year 2024-2026

Understanding the IT 250 Claim for Credit for Purchase of an Automated External Defibrillator

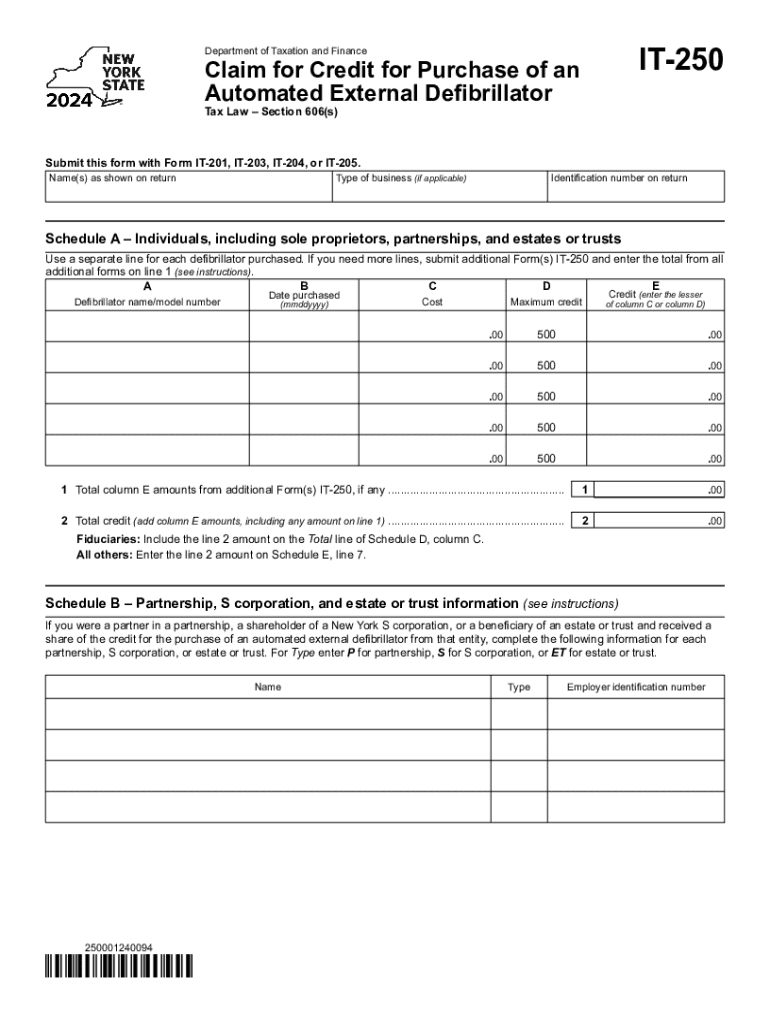

The IT 250 form is designed for individuals and businesses seeking to claim a tax credit for the purchase of an Automated External Defibrillator (AED). This form is particularly relevant for those who have invested in an AED, as it allows them to recoup a portion of their expenses through tax benefits. The credit is intended to encourage the acquisition of AEDs, which can save lives in emergency situations.

Steps to Complete the IT 250 Form

Completing the IT 250 form involves several key steps:

- Gather necessary documentation, including proof of purchase for the AED.

- Fill out your personal information accurately, ensuring that your name and address match your tax records.

- Provide details about the AED, including the model and purchase date.

- Calculate the credit amount based on the cost of the AED and any applicable limits.

- Review the form for accuracy before submission.

Eligibility Criteria for the IT 250 Credit

To qualify for the IT 250 credit, applicants must meet specific eligibility criteria:

- The AED must be purchased for use in a location accessible to the public or for personal use.

- The purchase must be made during the tax year for which the credit is being claimed.

- Documentation proving the purchase must be provided with the form.

- Individuals and businesses must be subject to U.S. tax laws to qualify for this credit.

Obtaining the IT 250 Form

The IT 250 form can be obtained through various channels:

- Visit the official state tax website, where the form is typically available for download.

- Contact your local tax office to request a physical copy of the form.

- Consult with a tax professional who can provide the form and assist with completion.

Filing Deadlines for the IT 250 Form

It is essential to be aware of the filing deadlines associated with the IT 250 form:

- The form must be submitted along with your annual tax return by the standard tax filing deadline, typically April 15.

- Extensions for filing your tax return do not extend the deadline for claiming the credit.

Common Scenarios for Using the IT 250 Form

Understanding when to use the IT 250 form can help taxpayers maximize their benefits:

- Businesses purchasing AEDs for employee safety or public access can claim the credit.

- Individuals who purchase an AED for home use may also qualify for the credit.

- Organizations, such as schools or non-profits, that invest in AEDs for community safety can benefit from this tax credit.

Create this form in 5 minutes or less

Find and fill out the correct form it 250 claim for credit for purchase of an automated external defribrillator tax year 772088716

Create this form in 5 minutes!

How to create an eSignature for the form it 250 claim for credit for purchase of an automated external defribrillator tax year 772088716

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it250 feature in airSlate SignNow?

The it250 feature in airSlate SignNow allows users to streamline their document signing process. It provides an intuitive interface for sending and eSigning documents, making it easier for businesses to manage their workflows efficiently.

-

How much does airSlate SignNow cost with the it250 plan?

The it250 plan offers competitive pricing tailored for businesses looking for an affordable eSigning solution. You can choose from various subscription options that fit your budget while enjoying all the essential features of airSlate SignNow.

-

What are the key benefits of using the it250 plan?

The it250 plan provides numerous benefits, including enhanced document security, faster turnaround times, and improved collaboration among team members. By using airSlate SignNow, businesses can increase productivity and reduce the time spent on manual paperwork.

-

Can I integrate airSlate SignNow with other tools using the it250 plan?

Yes, the it250 plan supports integrations with various third-party applications, allowing you to connect airSlate SignNow with your existing tools. This flexibility helps streamline your processes and enhances overall efficiency.

-

Is it easy to use airSlate SignNow with the it250 feature?

Absolutely! The it250 feature is designed with user-friendliness in mind, ensuring that even those with minimal technical skills can navigate the platform effortlessly. The straightforward interface allows users to send and eSign documents quickly.

-

What types of documents can I send using the it250 feature?

With the it250 feature, you can send a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, making it versatile for different business needs.

-

How does airSlate SignNow ensure the security of documents in the it250 plan?

Security is a top priority for airSlate SignNow. The it250 plan includes advanced encryption and authentication measures to protect your documents and ensure that only authorized users can access them.

Get more for Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year

- Can i stop the appointment reminders northern valley form

- Conyers pediatrics patient forms

- Vascular expertise form

- 40 petty cash log templates ampamp forms excel pdf word

- Microneedling consent form

- Fiche patient pdf form

- Consious sedationn records sheet form

- Dr joan g calkins md reviewshamburg nyvitalscom form

Find out other Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free