Form it 250 Claim for Credit for Purchase of an Automated External Defribrillator Tax Year 2023

Understanding the IT 250 Form for AED Purchase Credit

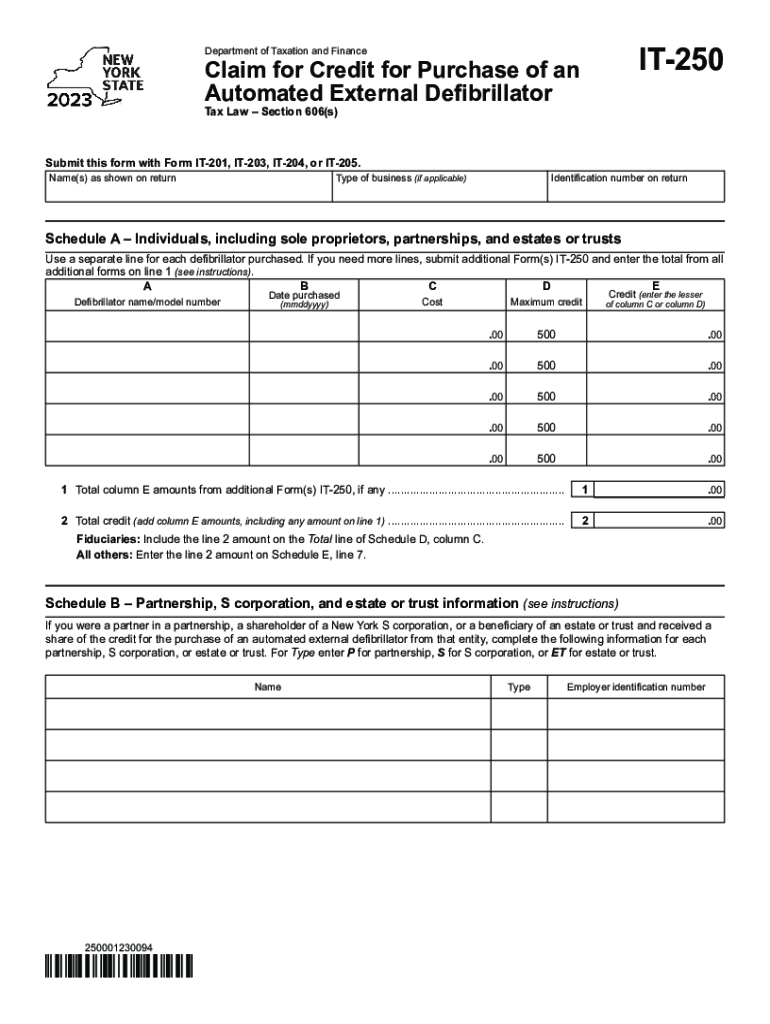

The IT 250 form, officially known as the Claim for Credit for Purchase of an Automated External Defibrillator, is designed for taxpayers in the United States who have purchased an AED. This form allows eligible individuals and businesses to claim a tax credit for their investment in this life-saving device. The credit aims to encourage the acquisition of AEDs, enhancing public safety and preparedness in emergencies.

Steps to Complete the IT 250 Form

Completing the IT 250 form involves several key steps:

- Gather necessary documentation, including proof of purchase for the AED.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Indicate the amount spent on the AED and any applicable credit calculations.

- Review the form for accuracy before submission.

Ensure that all required fields are completed to avoid delays in processing your claim.

Eligibility Criteria for the IT 250 Form

To qualify for the credit claimed on the IT 250 form, certain eligibility criteria must be met:

- The AED must be purchased for use in a location accessible to the public.

- Purchasers must be individuals or businesses that meet specific tax requirements.

- The purchase must be made within the tax year for which the credit is claimed.

Reviewing these criteria is essential before proceeding with your claim to ensure compliance with state and federal regulations.

Obtaining the IT 250 Form

The IT 250 form can be obtained through the official state revenue department website or by contacting their office directly. It is available in both digital and paper formats, allowing taxpayers to choose the method that best suits their needs. Ensure you have the most current version of the form to avoid any issues during submission.

Filing Deadlines for the IT 250 Form

Timely submission of the IT 250 form is crucial to ensure you receive your credit. The filing deadline typically aligns with the general tax return due date, which is usually April 15 for most taxpayers. However, it is important to verify specific deadlines for your state, as they may vary. Late submissions may result in the forfeiture of the credit.

Form Submission Methods

The IT 250 form can be submitted through various methods:

- Online submission through the state revenue department’s e-filing system.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices, if available.

Selecting the appropriate submission method can expedite the processing of your claim.

Quick guide on how to complete form it 250 claim for credit for purchase of an automated external defribrillator tax year

Effortlessly Prepare Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to Modify and Electronically Sign Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year with Ease

- Find Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year and click on Get Form to commence.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from your preferred device. Modify and electronically sign Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year and ensure strong communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 250 claim for credit for purchase of an automated external defribrillator tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 250 claim for credit for purchase of an automated external defribrillator tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it250 plan offered by airSlate SignNow?

The it250 plan is a tailored subscription designed for businesses looking to streamline their document signing process. With this plan, users can leverage airSlate SignNow's user-friendly interface to enhance productivity while ensuring secure eSigning. This cost-effective solution is perfect for teams seeking efficient management of legal documents.

-

What features can I expect with the it250 plan?

The it250 plan includes features such as unlimited signature requests, customizable templates, and complete document tracking. Users also gain access to integration options that connect seamlessly with popular applications, enhancing workflow efficiency. This allows businesses to optimize their document handling capabilities effortlessly.

-

How does the it250 plan benefit small businesses?

Small businesses benefit from the it250 plan by enjoying a cost-effective solution that simplifies document management. By utilizing airSlate SignNow’s eSigning capabilities, teams can save time and eliminate paper-based processes, fostering a more efficient operational workflow. This empowers businesses to focus on growth while reducing overhead costs.

-

Is there a free trial available for the it250 plan?

Yes, airSlate SignNow offers a free trial for the it250 plan, allowing prospective users to explore its features without commitment. This trial period is a great opportunity to evaluate how the platform can enhance your eSignature process. Simply sign up on the website to start experiencing the benefits firsthand.

-

Can the it250 plan integrate with other software?

Absolutely! The it250 plan supports integrations with multiple applications, including CRM, project management, and cloud storage systems. This flexibility enables businesses to create a seamless workflow, enhancing overall productivity. You can connect airSlate SignNow with your favorite tools to simplify document handling.

-

What are the pricing options for the it250 plan?

The it250 plan is competitively priced, catering to businesses of various sizes. Pricing options include monthly and annual subscriptions, allowing customers to choose a plan that best fits their budget. For detailed pricing information, visit the airSlate SignNow website and select the it250 plan to see what suits your needs.

-

How secure are documents signed with the it250 plan?

Documents signed using the it250 plan are highly secure, thanks to advanced encryption and compliance with industry standards. airSlate SignNow prioritizes the safety of your legal documents, ensuring they are protected throughout the signing process. This gives businesses peace of mind while managing sensitive paperwork.

Get more for Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year

Find out other Form IT 250 Claim For Credit For Purchase Of An Automated External Defribrillator Tax Year

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free