Form it 203 GR ATT a Schedule a Tax NY Gov 2022

What is the Form IT 203 GR ATT A Schedule A?

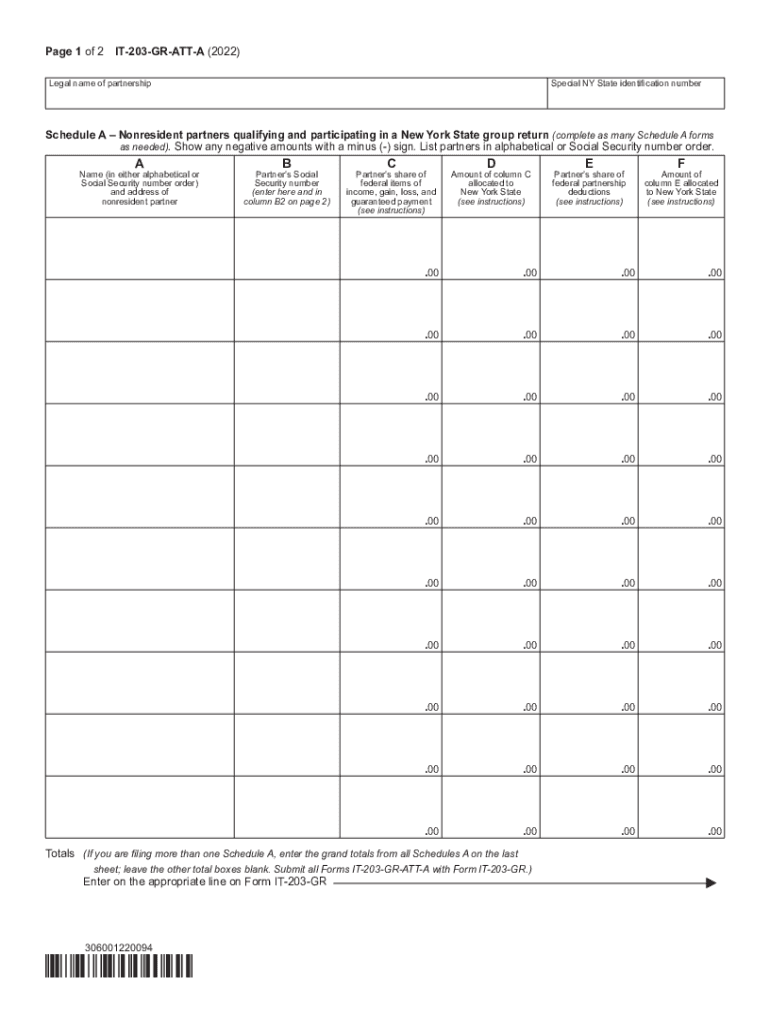

The Form IT 203 GR ATT A, commonly referred to as the NY IT 203 GR ATT A Schedule A, is a tax document used by certain groups in New York State to report income and calculate tax liabilities. This form is specifically designed for partnerships, LLCs, and other entities that elect to file a group return. It allows these entities to report their income collectively, simplifying the tax process for multiple members. Understanding the purpose and requirements of this form is crucial for compliance and accurate tax reporting.

Steps to Complete the Form IT 203 GR ATT A

Completing the Form IT 203 GR ATT A involves several key steps. First, gather all necessary financial documents, including income statements and expense records for each member of the group. Next, ensure that you have the correct form version for the tax year you are filing. Fill out the form by entering the required information, such as total income, deductions, and credits. It is important to double-check all entries for accuracy. Once completed, the form must be signed by an authorized representative of the group before submission.

Key Elements of the Form IT 203 GR ATT A

Several key elements are essential to the Form IT 203 GR ATT A. These include:

- Identification Information: This section requires the name, address, and taxpayer identification number of the group.

- Income Reporting: Total income earned by the group must be reported accurately.

- Deductions and Credits: Any applicable deductions and credits should be clearly listed to reduce the overall tax liability.

- Signatures: The form must be signed by an authorized member of the group to validate the submission.

Legal Use of the Form IT 203 GR ATT A

The Form IT 203 GR ATT A is legally binding when filled out and submitted in accordance with New York State tax laws. To ensure its legal validity, it must meet specific requirements, including proper signatures and compliance with filing deadlines. Utilizing a trusted electronic signature solution can enhance the legal standing of the document, as it provides a digital certificate that verifies the identity of the signers. Compliance with regulations such as the ESIGN Act and UETA is also essential for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 GR ATT A are crucial for compliance. Typically, the form must be submitted by the due date of the group’s tax return, which aligns with the standard tax filing deadlines for partnerships and LLCs. It is important to check for any specific extensions or changes to deadlines that may apply in a given tax year. Staying informed about these dates can help avoid penalties and ensure timely processing of the return.

Form Submission Methods

The Form IT 203 GR ATT A can be submitted through various methods, including:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail: The form can be printed and sent via postal service to the appropriate tax authority.

- In-Person: Some taxpayers may choose to deliver the form directly to a local tax office.

Choosing the right submission method can depend on personal preference and the specific circumstances of the group.

Quick guide on how to complete form it 203 gr att a schedule a taxnygov

Prepare Form IT 203 GR ATT A Schedule A Tax NY gov effortlessly on any device

Online document organization has gained traction among enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form IT 203 GR ATT A Schedule A Tax NY gov on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Form IT 203 GR ATT A Schedule A Tax NY gov with ease

- Obtain Form IT 203 GR ATT A Schedule A Tax NY gov and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, an invitation link, or download it directly to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that require reprinting. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Form IT 203 GR ATT A Schedule A Tax NY gov and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr att a schedule a taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att a schedule a taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny it203gratta form used for?

The ny it203gratta form is used for reporting and paying your New York State taxes. This form allows you to file for various tax deductions and credits as a non-resident or part-year resident. Using airSlate SignNow, you can easily complete and eSign your ny it203gratta form for a hassle-free filing experience.

-

How can airSlate SignNow help with the ny it203gratta form?

AirSlate SignNow simplifies the process of completing the ny it203gratta form by providing an intuitive and user-friendly platform. You can upload, fill out, and electronically sign the form in just a few clicks. This streamlines your tax filing process and ensures you submit your ny it203gratta form correctly and on time.

-

Is there a cost associated with using airSlate SignNow for the ny it203gratta form?

Yes, airSlate SignNow offers various pricing plans that are both affordable and flexible, depending on your needs. The investment in using airSlate SignNow for your ny it203gratta form is minimal compared to the time and hassle saved in filing your taxes. Plus, you can find a plan that suits both individual and business needs.

-

Can I save my ny it203gratta form for later use?

Absolutely! With airSlate SignNow, you can save your completed ny it203gratta form and return to it whenever you need. This feature allows you to make edits and updates, ensuring that your information is always accurate before submission.

-

What features does airSlate SignNow offer for the ny it203gratta form?

AirSlate SignNow offers a variety of features to enhance your experience with the ny it203gratta form, including templates, team collaboration tools, and secure cloud storage. These features ensure that you can efficiently manage your documents while maintaining confidentiality and compliance.

-

Is airSlate SignNow compliant with New York State tax regulations?

Yes, airSlate SignNow complies with New York State tax regulations, making it a reliable choice for electronically signing and submitting your ny it203gratta form. The platform adheres to legal standards for electronic signatures, ensuring that your submissions are valid and recognized by tax authorities.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Yes, airSlate SignNow offers integrations with various tax preparation tools and software, allowing you to streamline your workflow when completing the ny it203gratta form. This integration capability helps keep your financial documents organized and ensures a smooth transition between platforms.

Get more for Form IT 203 GR ATT A Schedule A Tax NY gov

- Discovery interrogatories from plaintiff to defendant with production requests south dakota form

- Discovery interrogatories from defendant to plaintiff with production requests south dakota form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant south dakota form

- Heirship affidavit descent south dakota form

- South dakota form 497326128

- Quitclaim deed from individual to two individuals in joint tenancy south dakota form

- Renunciation and disclaimer of joint tenant or tenancy interest south dakota form

- Statement of account individual south dakota form

Find out other Form IT 203 GR ATT A Schedule A Tax NY gov

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later