Form it 203 GR ATT a Schedule a New York State Group Return for Nonresident Partners Tax Year 2024-2026

Understanding the IT 203 GR ATT A Schedule A for Nonresident Partners

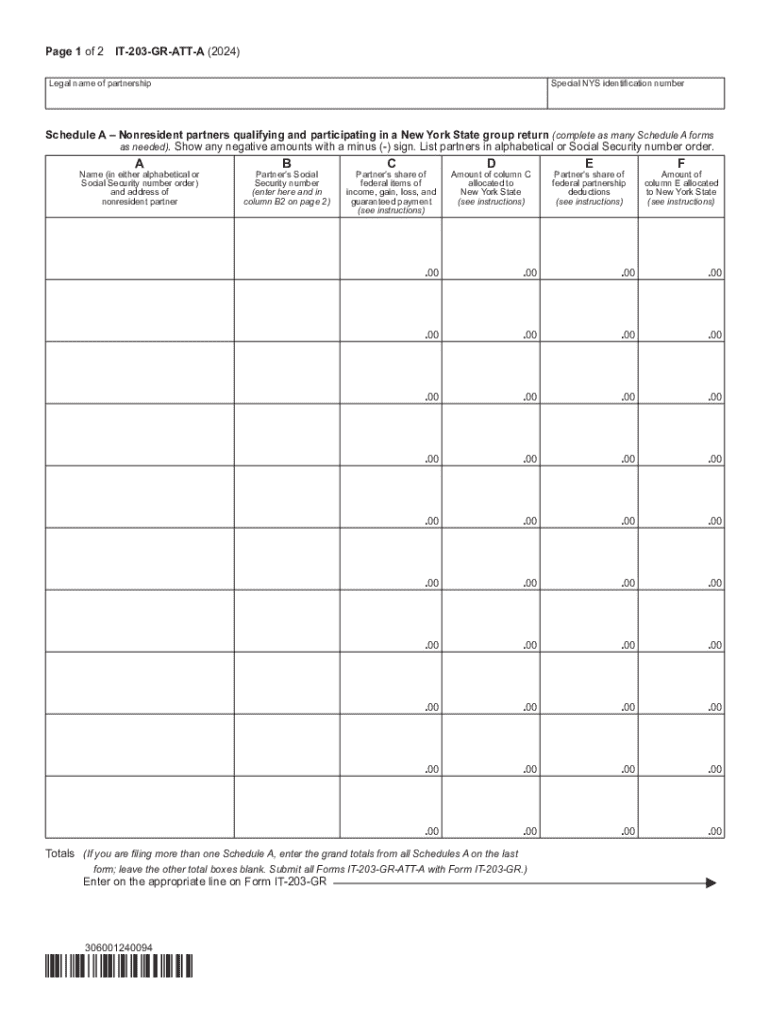

The IT 203 GR ATT A Schedule A is a specific form used in New York State for filing group returns for nonresident partners. This form allows partnerships to report income earned by nonresident partners in a consolidated manner. It is particularly useful for partnerships that have multiple nonresident partners, simplifying the filing process and ensuring compliance with state tax regulations. Each partner's share of income, deductions, and credits is reported collectively, which can streamline tax obligations for both the partnership and the individual partners.

Steps to Complete the IT 203 GR ATT A Schedule A

Completing the IT 203 GR ATT A Schedule A involves several key steps:

- Gather Required Information: Collect all necessary financial documents, including partnership income statements, individual partner information, and any relevant tax documents.

- Fill Out the Form: Enter the partnership's information, including the name, address, and Employer Identification Number (EIN). Report the total income and deductions as applicable.

- Allocate Income to Partners: Distribute the income and deductions among the nonresident partners based on their ownership percentages.

- Review and Verify: Double-check all entries for accuracy and completeness to avoid errors that could lead to penalties.

- Submit the Form: File the completed form by the due date, ensuring that all partners receive a copy for their records.

Eligibility Criteria for Using the IT 203 GR ATT A Schedule A

To utilize the IT 203 GR ATT A Schedule A, certain eligibility criteria must be met:

- The partnership must have nonresident partners who earn income from New York sources.

- The partnership must choose to file a group return rather than individual returns for each nonresident partner.

- All partners included in the group return must consent to the filing of the IT 203 GR ATT A Schedule A.

Key Elements of the IT 203 GR ATT A Schedule A

Several key elements are essential for understanding the IT 203 GR ATT A Schedule A:

- Partnership Information: This section requires details about the partnership, including its legal name and EIN.

- Income Reporting: Partners must report their share of income, which includes any gains or losses from New York sources.

- Deductions and Credits: Partners can claim deductions and credits based on their share of the partnership's income and expenses.

- Signature Section: All partners must sign the form to validate the information provided and confirm their agreement to the group filing.

Filing Deadlines for the IT 203 GR ATT A Schedule A

It is crucial to adhere to filing deadlines to avoid penalties. The IT 203 GR ATT A Schedule A typically must be filed by the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day.

Obtaining the IT 203 GR ATT A Schedule A

The IT 203 GR ATT A Schedule A can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, partnerships may consult with tax professionals or accountants who can provide guidance on obtaining and completing the form accurately.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr att a schedule a new york state group return for nonresident partners tax year 772080701

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att a schedule a new york state group return for nonresident partners tax year 772080701

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for ny gr nonresident?

airSlate SignNow provides a seamless platform for ny gr nonresident individuals to send and eSign documents efficiently. This solution is designed to simplify the signing process, ensuring that nonresidents can manage their paperwork without hassle.

-

How does airSlate SignNow handle pricing for ny gr nonresident users?

Our pricing for ny gr nonresident users is competitive and transparent, offering various plans to suit different needs. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need while enjoying full access to our features.

-

What features does airSlate SignNow offer for ny gr nonresident customers?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure cloud storage, all tailored for ny gr nonresident users. These features enhance productivity and ensure that your documents are handled securely and efficiently.

-

Can ny gr nonresident users integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, making it easy for ny gr nonresident users to streamline their workflows. This connectivity allows for a more cohesive experience when managing documents across different platforms.

-

What are the benefits of using airSlate SignNow for ny gr nonresident individuals?

Using airSlate SignNow provides ny gr nonresident individuals with a cost-effective and user-friendly solution for document management. The platform enhances efficiency, reduces turnaround times, and ensures compliance with legal standards, making it an ideal choice for nonresidents.

-

Is airSlate SignNow secure for ny gr nonresident users?

Absolutely! airSlate SignNow prioritizes security for all users, including ny gr nonresident individuals. We utilize advanced encryption and compliance measures to protect your sensitive information throughout the signing process.

-

How can ny gr nonresident users get started with airSlate SignNow?

Getting started with airSlate SignNow is simple for ny gr nonresident users. You can sign up for a free trial on our website, allowing you to explore our features and see how they can benefit your document management needs.

Get more for Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

- Inverse functions worksheet with answers pdf form

- Pw2help ford com form

- Pcrdp punjab form

- Georgia school report card form

- Anmac skill assessment professional reference form

- Davinci resolve cheat sheet pdf form

- Peace dollar checklist form

- Tr 13a application for salvage vehicle inspection vehicle dealer form

Find out other Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors