Form it 203 GR ATT a Schedule a New York State Group Return for Nonresident Partners Tax Year 2023

What is the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

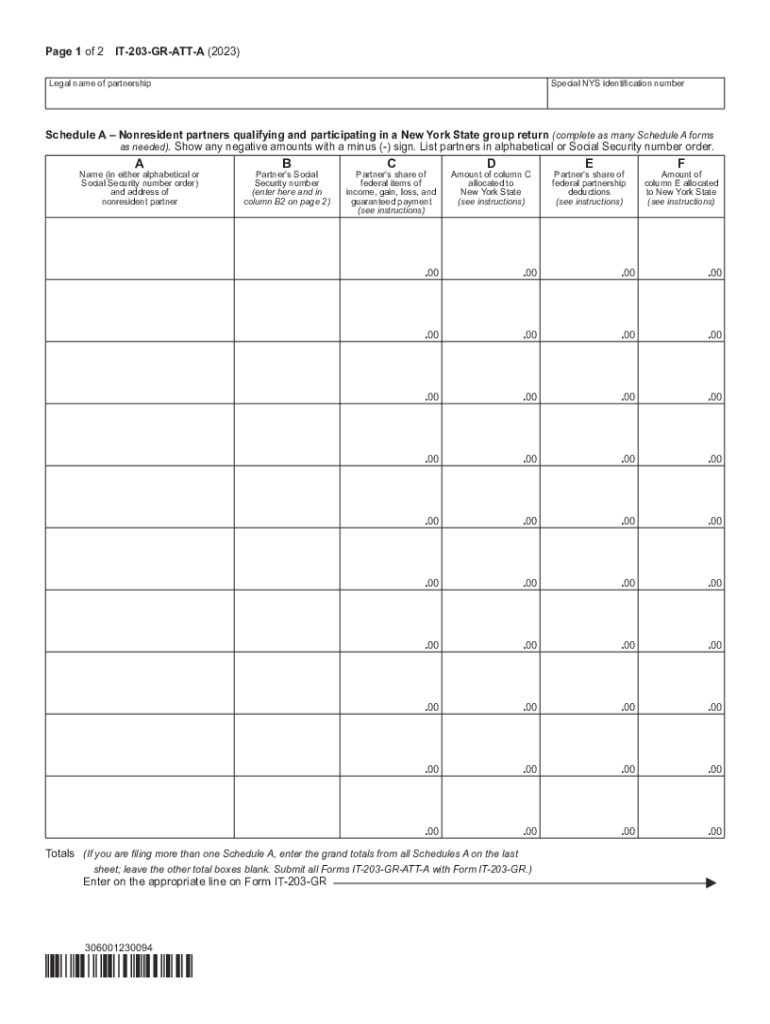

The Form IT 203 GR ATT A is a specific tax form used in New York State for filing group returns on behalf of nonresident partners. This form is essential for partnerships that include nonresident partners who earn income in New York. By utilizing this form, partnerships can report the income, deductions, and credits of their nonresident partners collectively, simplifying the tax filing process for all involved. It is particularly relevant for the tax year in which the income was earned, ensuring compliance with state tax regulations.

Key Elements of the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

The key elements of the Form IT 203 GR ATT A include various sections that require detailed information about the partnership and its nonresident partners. This includes:

- Partnership Information: Basic details about the partnership, including its name, address, and federal employer identification number (EIN).

- Partner Information: Information about each nonresident partner, including their share of income and deductions.

- Income and Deductions: A breakdown of the income earned in New York and any applicable deductions that can be claimed by the partners.

- Tax Calculation: The method for calculating the tax owed based on the income reported.

Steps to Complete the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

Completing the Form IT 203 GR ATT A involves several important steps:

- Gather necessary documentation, including income statements and records of deductions for each nonresident partner.

- Fill out the partnership information section with accurate details about the partnership.

- Provide detailed information for each nonresident partner, ensuring that income shares and deductions are correctly reported.

- Calculate the total income and deductions, then determine the tax owed based on the provided information.

- Review the completed form for accuracy before submission.

Legal Use of the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

The legal use of the Form IT 203 GR ATT A is crucial for compliance with New York State tax laws. This form allows partnerships to report the income of nonresident partners correctly, thereby fulfilling their tax obligations. Failure to use this form appropriately can lead to penalties and interest on unpaid taxes. It is recommended that partnerships consult with a tax professional to ensure all legal requirements are met when filing this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 GR ATT A align with the general tax filing deadlines set by New York State. Typically, partnerships must file this form by the fifteenth day of the fourth month following the end of the tax year. For partnerships operating on a calendar year, this usually means an April deadline. It is important to stay informed about any changes in deadlines, as extensions may be available under certain circumstances.

Eligibility Criteria

Eligibility to use the Form IT 203 GR ATT A is generally limited to partnerships that have nonresident partners earning income in New York. To qualify, the partnership must be registered in New York and must have a valid EIN. Additionally, each nonresident partner must meet specific income thresholds and other requirements as defined by New York State tax regulations. Understanding these criteria is essential for ensuring compliance and avoiding issues during the filing process.

Quick guide on how to complete form it 203 gr att a schedule a new york state group return for nonresident partners tax year

Effortlessly Prepare Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year with Ease

- Obtain Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks, accessible from any device you choose. Modify and eSign Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year while ensuring seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr att a schedule a new york state group return for nonresident partners tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att a schedule a new york state group return for nonresident partners tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny gr nonresident form and how does airSlate SignNow help with it?

The ny gr nonresident form is essential for nonresidents filing their tax obligations in New York. airSlate SignNow streamlines the process of completing and submitting this form by providing an easy-to-use electronic signature solution, allowing users to fill out and sign documents securely from anywhere.

-

How much does airSlate SignNow cost for handling ny gr nonresident documents?

airSlate SignNow offers competitive pricing plans that cater to businesses dealing with ny gr nonresident documents. Pricing varies depending on the features you need, but the plans are designed to be cost-effective, ensuring you get value for your investment in document management and electronic signing.

-

What features should I look for in an airSlate SignNow plan for ny gr nonresident filings?

When selecting an airSlate SignNow plan for ny gr nonresident filings, consider features such as document templates, bulk sending, and advanced security options. These tools help ensure that your tax documents are filled out correctly and signed securely, optimizing the filing process for better compliance.

-

Can I integrate airSlate SignNow with other tools for handling ny gr nonresident forms?

Yes, airSlate SignNow offers various integrations that allow you to link with popular applications, enhancing your workflow for ny gr nonresident forms. By integrating with tools such as CRM and document management systems, you can streamline document handling and improve overall efficiency.

-

How secure is airSlate SignNow for signing ny gr nonresident documents?

Security is a priority at airSlate SignNow, especially when dealing with sensitive information like ny gr nonresident documents. The platform employs military-grade encryption, secure cloud storage, and comprehensive compliance with industry standards to safeguard your documents and data.

-

Is airSlate SignNow user-friendly for those unfamiliar with ny gr nonresident procedures?

Absolutely! airSlate SignNow is designed for ease of use, making it accessible for individuals unfamiliar with ny gr nonresident procedures. The intuitive interface guides users through the process of creating, signing, and sending documents without requiring extensive technical knowledge.

-

How can airSlate SignNow improve efficiency for businesses managing ny gr nonresident forms?

By using airSlate SignNow, businesses can signNowly improve efficiency when managing ny gr nonresident forms. The platform automates workflows, reduces paper use, and accelerates the signing process, enabling companies to focus more on their core operations while ensuring compliance with tax regulations.

Get more for Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

Find out other Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy