Form it 203 GR ATT a Schedule a New York State Group Return for Nonresident Partners Tax Year 2020

What is the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

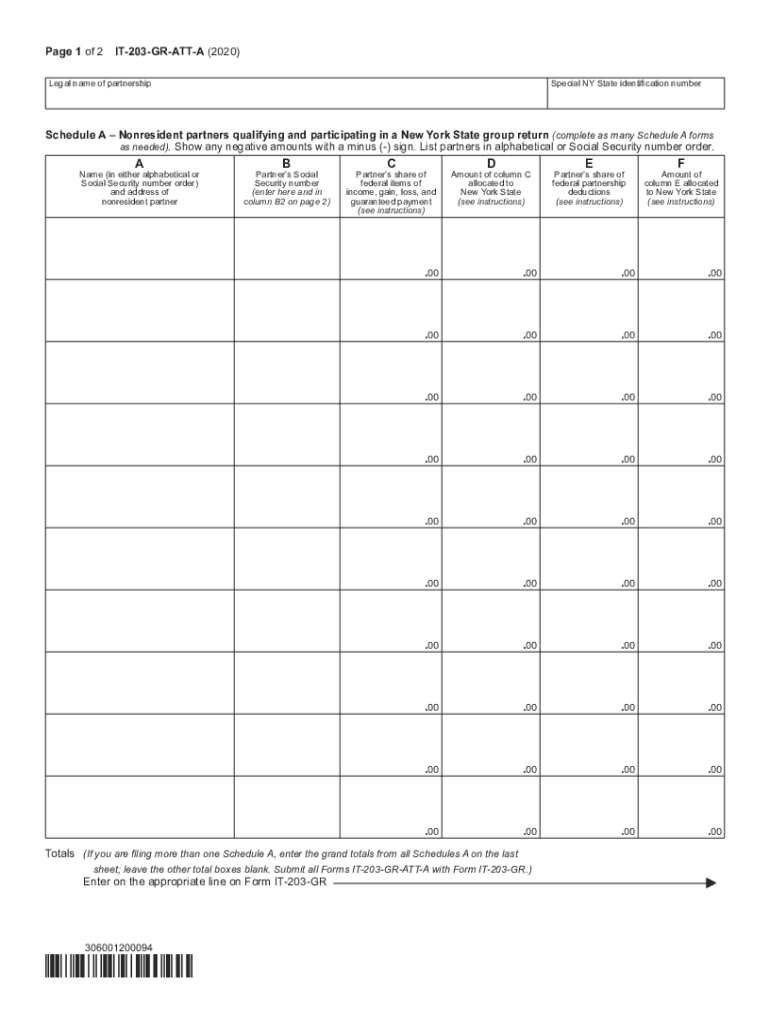

The IT 203 GR ATT A is a specific form used in New York State for filing a group return for nonresident partners. This form is essential for partnerships that have nonresident partners who need to report their New York source income. It consolidates the tax obligations of these partners into a single return, simplifying the filing process for both the partnership and the state tax authorities. The form must be completed accurately to ensure compliance with New York tax laws and to avoid potential penalties.

How to use the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

To effectively use the IT 203 GR ATT A, partnerships should first gather all necessary financial information related to the nonresident partners. This includes income earned in New York, deductions, and any applicable credits. The form allows partnerships to report this information collectively, which can streamline the tax filing process. It is crucial to ensure that all data is accurate and complete to facilitate a smooth submission and to minimize the risk of audits or additional inquiries from tax authorities.

Steps to complete the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

Completing the IT 203 GR ATT A involves several key steps:

- Gather all necessary documentation, including income statements and prior tax returns for nonresident partners.

- Fill out the form with accurate financial data, ensuring that all income earned in New York is reported.

- Calculate any deductions and credits that apply to the nonresident partners.

- Review the completed form for accuracy, checking all figures and ensuring compliance with New York tax regulations.

- Submit the form by the designated deadline, either electronically or via mail, as per the guidelines provided by the New York State Department of Taxation and Finance.

Legal use of the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

The IT 203 GR ATT A is legally recognized as a valid method for nonresident partners to report their New York income. To be considered legally binding, the form must be completed in accordance with New York State tax laws and regulations. This includes providing accurate information and ensuring that all signatures are obtained where necessary. Using an electronic signature solution, like airSlate SignNow, can enhance the legal validity of the document by providing a secure and compliant way to sign and submit the form.

Key elements of the Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

Several key elements are essential for the IT 203 GR ATT A:

- Identification of Partners: Clearly list all nonresident partners included in the group return.

- Income Reporting: Accurately report all income derived from New York sources for each partner.

- Deductions and Credits: Include any applicable deductions or credits that can reduce the overall tax liability.

- Signatures: Ensure that all required signatures are obtained to validate the submission.

Filing Deadlines / Important Dates

Timely filing of the IT 203 GR ATT A is critical to avoid penalties. The deadline for submitting this form typically aligns with the due date for the partnership’s federal tax return. It is important to stay informed about any changes to filing deadlines, as these can vary from year to year. Partners should also be aware of any extensions that may be available and the procedures for requesting them.

Quick guide on how to complete form it 203 gr att a schedule a new york state group return for nonresident partners tax year 2020

Complete Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year seamlessly

- Find Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr att a schedule a new york state group return for nonresident partners tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att a schedule a new york state group return for nonresident partners tax year 2020

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the it 203 gr. offered by airSlate SignNow?

The it 203 gr. is a specialized eSignature solution designed to streamline document signing processes for businesses. With its intuitive interface, users can quickly send, sign, and store documents securely. It combines convenience and security, making it ideal for companies looking for an effective way to manage signatures.

-

How much does the it 203 gr. cost?

Pricing for the it 203 gr. varies based on your company's needs and the number of users. AirSlate SignNow offers flexible subscription plans, ensuring cost-effectiveness while providing robust features. For detailed pricing, visit our website or contact our sales team for a personalized quote.

-

What features are included in the it 203 gr. package?

The it 203 gr. package includes core features such as unlimited document signing, templates, audit trails, and secure cloud storage. Additionally, users benefit from mobile access and API integration. These features empower teams to optimize their document workflows efficiently.

-

Can I integrate the it 203 gr. with other software applications?

Yes, the it 203 gr. seamlessly integrates with various applications, including CRM systems, document management platforms, and cloud storage solutions. This flexibility enhances your existing workflow and simplifies document management. Explore our integration options on the airSlate SignNow website.

-

What are the benefits of using it 203 gr. for businesses?

Using the it 203 gr. enhances efficiency by reducing paperwork and speeding up the signing process. Businesses can save time and costs by implementing a digital solution that ensures security and compliance. Ultimately, it leads to improved productivity and customer satisfaction.

-

Is the it 203 gr. compliant with eSignature laws?

Absolutely! The it 203 gr. complies with major eSignature laws such as eIDAS and ESIGN Act. This compliance guarantees that your digitally signed documents are legally valid and enforceable, offering peace of mind for businesses concerned about legal integrity.

-

What types of documents can I send with the it 203 gr.?

With the it 203 gr., you can send various document types, including contracts, agreements, invoices, and forms. The flexibility of the platform accommodates any document requiring signatures. This capability is essential for businesses across different industries.

Get more for Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

- Ui340 form

- Individual forms and publications ides home

- Work permit ma form

- You can download a copy of the waiver form here michigan

- Instructions for completing liquid industrial by product uniform program fee worksheet attachment a to eqp5122

- Deqs transporter form eqp5122a

- Certificate of compliance minnesota workers compensation law form

- Mississippi workers compensation forms

Find out other Form IT 203 GR ATT A Schedule A New York State Group Return For Nonresident Partners Tax Year

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms